How Do Chime Credit Cards Work?

Contents

If you’re wondering how Do Chime credit cards work, you’re in the right place. In this blog post, we’ll explain everything you need to know about using a Chime credit card , from how to get one to how to use it.

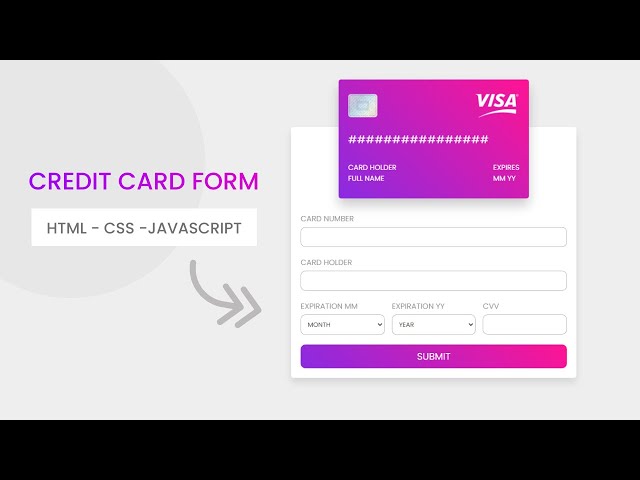

Credit Cards Work?’ style=”display:none”>Checkout this video:

What is a Chime Credit Card?

A Chime Credit Card is a MasterCard that is linked to your Chime Spending account. This means that you can use your Chime Credit Card anywhere that MasterCard is accepted.

Your Chime Credit Card also comes with a few great features:

-No fees: There are no fees associated with using or having a Chime Credit Card, including no annual fee, foreign transaction fee, late payment fee, or returned payment fee.

-Security features: Your Chime Credit Card comes with EMV chip technology and fraud monitoring to help keep your account safe.

-Cash back rewards: You’ll earn 1% cash back on all purchases made with your Chime Credit Card.

How Does a Chime Credit Card Work?

A Chime credit card works just like any other credit card. You can use it to make purchases, pay bills, and withdraw cash from ATMs. The only difference is that Chime is a mobile-first bank, which means you manage your account via a smartphone app instead of through a traditional brick-and-mortar bank branch or online banking website.

To get started, you’ll need to download the Chime app and sign up for an account. Once you’re approved for a credit card, you’ll receive a physical card in the mail. You can then activate your card and start using it right away.

One of the great things about Chime is that it doesn’t have any fees associated with its credit cards. That means no annual fee, no foreign transaction fee, and no balance transfer fee. Plus, there’s no minimum purchase required in order to earn rewards. You’ll earn 1% cash back on all your purchases, which will be deposited into your Chime spending account each month.

If you’re ever in need of customer service, you can reach out to Chime’s team via the app or by emailing [email protected]. They’re available 24/7 and will be happy to help resolve any issues you’re having with your account or card.

What are the Benefits of a Chime Credit Card?

A Chime credit card is a reloadable prepaid Visa card that can be used anywhere Visa cards are accepted. The card is linked to your Chime Spending account, so you can easily track your expenses and see where you are spending your money. There is no credit check required to get a Chime card, so it is a great option for people with bad credit or no credit history.

There are many benefits of using a Chime credit card, including:

-No Credit Check Required: Because Chime does not do a credit check when you apply for the card, it is a great option for people with bad credit or no credit history.

-Builds Credit History: Using your Chime card and making on-time payments can help you build a positive credit history, which can improve your chances of getting approved for loans and other lines of credit in the future.

-Access to Your spending Account: Linking your Chime credit card to your Spending account gives you easy access to all of your account information in one place. You can view your transactions, track your expenses, and monitor your spending easily.

-Reloadable: You can reload your Chime card with money as often as you need to, so you never have to worry about running out of funds.

-Accepted Everywhere: Because the Chime credit card is a Visa card, it can be used anywhere that Visa cards are accepted. This makes it a convenient way to make purchases both in person and online.

How to Use a Chime Credit Card?

Getting a Chime credit card is easy. You can either sign up for a new account online or transfer your existing balance from another credit card provider. Once your account is open, you can start using your Chime credit card right away.

There are no annual fees, foreign transaction fees, or late payment fees with a Chime credit card. You will also get free access to your FICO score so that you can keep track of your credit health.

When you use your Chime credit card, the funds are automatically deposited into your Chime spending account. From there, you can either use the funds to make purchases or withdraw cash from ATMs. If you have any questions about how to use your Chime credit card, you can contact customer service for help.

Chime Credit Card Fees

The Chime Credit Card has no annual fee, no foreign transaction fees, and no fees for cash advances. You will pay a 3% fee for balance transfers.

Chime Credit Card Limits

Chime credit cards have a limit of $1,000. This is the maximum amount that you can spend in a day. If you attempt to spend more than this, your card will be declined.

Chime Credit Card Reviews

Chime Credit Cards is a credit card company that offers three different types of credit cards: the Chime Visa Platinum Card, the Chime World MasterCard, and the Chime American Express Card. All three of these credit cards have different features, but all three work in essentially the same way.

When you use a Chime Credit Card, you will be asked to choose a primary account and a backup account. Your primary account is the account that you will use most often, and it will be the account that is used to pay your monthly bill. Your backup account is an account that you can use if you find yourself in a situation where you cannot pay your monthly bill with your primary account.

If you make a purchase with your Chime Credit Card, the purchase will be charged to your primary account. If you do not have enough money in your primary account to cover the purchase, the purchase will be charged to your backup account. If you do not have enough money in your backup account to cover the purchase, the purchase will be declined.

If you want to transfer money from one account to another, you can do so by loggin into your Online Account Center. From there, you will be able to see all of your accounts and transfer money between them. You can also use this feature to set up automatic payments from one account to another.

The bottom line is that Chime Credit Cards work just like any other credit card. You charge purchases to your card and then pay off the balance each month. If you don’t have enough money in your accounts to cover a purchase, the purchase will be declined. You can transfer money between accounts at any time, and you can set up automatic payments if you want to make sure that your bills are always paid on time.