How You Can Reduce Your Total Loan Cost

Contents

By knowing how to reduce your total loan cost, you can save money on your home loan. Here are a few tips to help you get started.

Checkout this video:

Introduction

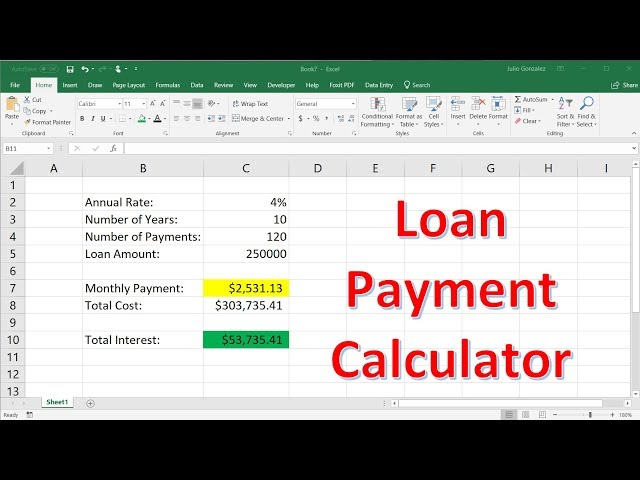

Today, we’re going to talk about how you can reduce your total loan cost. We’ll cover the importance of paying down your principal, refinancing to a lower interest rate, and making extra payments on your loan.

Paying down your principal is the best way to reduce your total loan cost. Every payment you make goes towards both the interest and the principal of your loan. The sooner you pay off your principal, the less interest you will accrue and the lower your total loan cost will be.

Refinancing to a lower interest rate can also help reduce your total loan cost. When you refinance, you take out a new loan with a lower interest rate and use it to pay off your existing loan. This lowers the amount of interest you accrue on your loan, which reduces your total loan cost.

Finally, making extra payments on your loan can also help reduce your total loan cost. Every payment you make goes towards both the interest and the principal of your loan. by making extra payments, you can pay off your loan sooner and save money on interest.

Follow these tips and you can save money on your total loan cost!

How to Reduce the Principal Balance of Your Loan

If you have a loan with a high interest rate, you may be able to reduce your monthly payments by refinancing to a new loan with a lower interest rate. But if you have a loan with a low interest rate, you might be better off keeping that loan and using the money you would have spent on the refinance to pay down the principal balance of your loan.

There are a couple of ways to do this:

1. Make an extra payment each month. This will help you pay off the principal balance of your loan faster and reduce the total amount of interest you will pay over the life of the loan.

2. Refinance to a shorter-term loan. This will also help you pay off the principal balance of your loan faster and reduce the total amount of interest you will pay over the life of the loan.

How to Reduce the Interest Rate on Your Loan

If you’re like most people, you probably don’t know all that much about how interest rates work. Here’s a quick rundown: When you get a loan, the interest rate is the percentage of your loan amount that you’ll have to pay back in addition to the principal. The higher your interest rate, the more you’ll end up paying over the life of the loan.

There are a few things that can affect your interest rate, but one of the most important is your credit score. Your credit score is a number that lenders use to assess your riskiness as a borrower. The higher your score, the lower your interest rate will be.

If you’re interested in reducing your total loan cost, there are a few things you can do to improve your credit score and thus lower your interest rate. Here are a few suggestions:

-Pay all of your bills on time. This includes not only credit cards and loans, but also utility bills, rent, and other expenses.

-Keep balances low on your credit cards. Your credit utilization ratio – which is the percentage of your credit limit that you’re using – should be below 30%.

-Don’t open new lines of credit unnecessarily. Every time you open a new account, it results in a hard inquiry on your credit report, which can temporarily ding your score.

-Check for errors on your credit report and dispute them if necessary. You’re entitled to one free copy of your report from each major credit bureau every year, so take advantage of it!

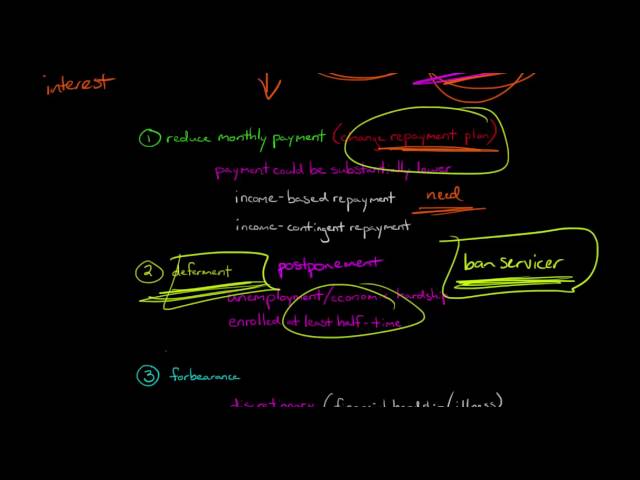

How to Get a Lower Monthly Payment

If you’re looking for ways to lower your monthly payment, there are a few things you can do. You may be able to refinance your loan to get a lower interest rate, which would lower your monthly payment. You could also extend the term of your loan, which would also lower your monthly payment, but you’d end up paying more in interest over the life of the loan. Another option might be to make extra payments on your loan each month, which would reduce the amount of interest you accrue and, as a result, lower your monthly payment.

How to Save on Loan Origination Fees

Loan origination fees are charged by lenders in order to cover the cost of processing a loan application. These fees can vary widely, depending on the lender and the type of loan being applied for.Origination fees are typically a percentage of the total loan amount, and they are paid at closing.

There are a few ways to reduce the amount you pay in origination fees:

-Shop around. Some lenders charge higher origination fees than others. By shopping around, you can compare rates and fees to find a lender that offers a competitive Origination Fee.

-Ask about waive-able or refundable origination fees. Some lenders may be willing to waive or refund all or part of your origination fee if you agree to certain conditions, such as making automatic payments from a linked checking account.

-Look for loans with no origination fee. A number of lenders, including online lenders, credit unions, and community banks, offer loans with no Origination Fee.

How to Save on Mortgage Insurance

Many people choose to take out a mortgage to purchase their home. A mortgage is a loan that is secured by the home as collateral. The lender will hold the deed to the property until the loan is paid in full. The borrower makes monthly payments to the lender, and the loan is typically paid off over a period of 15 or 30 years.

One of the costs associated with a mortgage is mortgage insurance. Mortgage insurance is a type of insurance that protects the lender in case the borrower defaults on the loan. Mortgage insurance is usually required if the borrower has a down payment of less than 20% of the purchase price of the home.

Mortgage insurance can be expensive, so it’s important to understand how it works and how you can save on this cost. Here are 3 tips for saving on mortgage insurance:

1) Make a larger down payment. If you can afford to make a larger down payment, you will reduce your loan balance and may not be required to pay for mortgage insurance at all.

2) Shop around for mortgage insurance. Not all lenders offer the same rates for mortgage insurance, so it’s important to compare rates from different lenders before you choose a home loan.

3) Choose a shorter loan term. A shorter loan term will result in a lower interest rate and may also help you avoid paying for mortgage insurance altogether.

How to Refinance Your Loan

If you’re looking to save money on your monthly loan payments, refinancing may be a good option for you. Loan refinancing involves taking out a new loan with a lower interest rate in order to pay off your existing loan. This can help you save money on interest over the life of your loan.

In order to qualify for refinancing, you will need to have a good credit score and a steady income. You will also need to demonstrate that you have the ability to make your new monthly payments.

If you’re interested in refinancing your loan, there are a few things you should keep in mind. First, make sure to shop around for the best rates and terms. Second, be aware that you may have to pay some fees in order to refinance your loan. Finally, make sure that you understand all of the terms and conditions of your new loan before signing anything.