How to Accept Credit Card Payments for Your Business

Contents

If you’re looking to accept credit card payments for your business, you’ll need to choose a payment processor. In this blog post, we’ll walk you through the steps of choosing a payment processor and setting up credit card payments for your business.

Checkout this video:

Introduction

As a small business owner, you may be wondering how to accept credit card payments. After all, credit cards are one of the most popular methods of payment today. Fortunately, there are a number of ways to accept credit card payments, whether you’re selling online, in-person, or over the phone. In this article, we’ll cover the different ways to accept credit card payments and what you need to know to get started.

Finding the right credit card processor

When you’re ready to start accepting credit card payments, there are a lot of things to consider. One of the most important is finding the right credit card processor. Not all processors are created equal, and fees can vary widely. You’ll want to shop around and compare features and prices before you decide which one is right for your business.

Here are a few things to keep in mind when you’re looking for a credit card processor:

-Processing fees: You’ll be charged a fee every time you process a credit card transaction. Processing fees typically range from 1% to 3%, but they can be higher for certain types of businesses.

-Transaction limits: Some processors limit the number of transactions you can process in a day or month. If your business processes a lot of credit card transactions, you’ll want to make sure your processor can handle the volume.

-Contract terms: Most processors require you to sign a contract that obligates you to use their service for a certain period of time. Be sure to read the contract carefully before you sign it so you understand all the terms and conditions.

-Customer service: When something goes wrong with your credit card processor, you want to be able to reach customer service quickly and get help resolving the problem. Find out what kind of customer service options are available before you sign up for a service.

By doing your homework and taking the time to find the right credit card processor, you can save yourself a lot of headaches down the road.

Setting up a merchant account

If you want to accept credit card payments from your customers, you will need to set up a merchant account with a bank or other financial institution. This is different from a regular business bank account, and there are some important things to consider before you sign up for one.

First, you need to make sure that the merchant account provider is reputable and has a good reputation with its customers. There are many providers out there, so take your time and do your research. You can read online reviews or ask other businesses that accept credit cards for their recommendations.

Second, you need to make sure that the merchant account provider offers competitive rates and fees. Some providers charge higher fees for certain types of businesses, so it’s important to shop around and compare rates before you choose one.

Third, you need to make sure that the merchant account provider offers good customer service. This is important because if you have any questions or problems with your account, you want to be able to contact someone who can help you resolve them.

Once you’ve found a good merchant account provider, the next step is to set up your account and start accepting credit card payments from your customers!

Accepting credit card payments

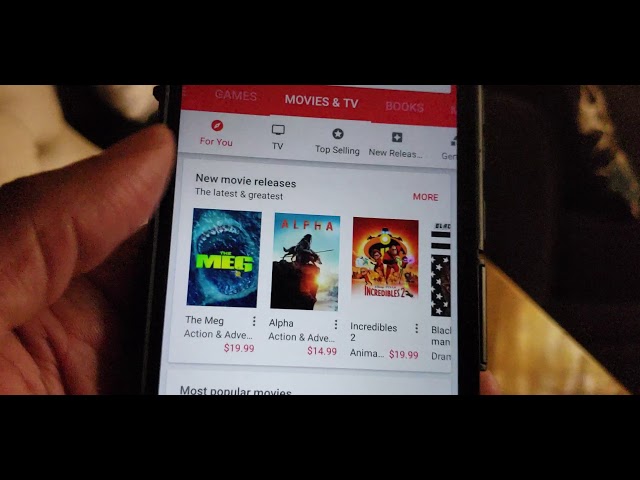

There are a few different ways you can accept credit card payments for your business. The most common way is to use a physical credit card reader that plugs into your phone or tablet. You can also use an online payment processor like PayPal or Stripe, or you can use a point of sale (POS) system that includes a credit card reader.

If you decide to use a physical credit card reader, you’ll need to purchase one that’s compatible with your phone or tablet. The two most popular types of readers are EMV (Chip) and magstripe (Swipe). EMV readers are more secure because they encrypt your customer’s credit card information, but they’re also more expensive. Magstripe readers are less secure, but they’re more affordable.

Once you have a credit card reader, you’ll need to sign up for an account with a payment processor like PayPal or Stripe. These companies will handle the transactions between you and your customers, and they’ll also deposit the funds into your account. You’ll typically pay a small fee for each transaction, but these fees are generally much lower than what you’d pay for traditional merchant services.

If you decide to use a POS system, you’ll need to purchase one that includes a built-in credit card reader. POS systems come in all shapes and sizes, so it’s important to choose one that’s right for your business. Typically,POS systems come with features like inventory management and customer loyalty programs. They’re more expensive than standalone credit card readers, but they offer a lot more functionality.

Fraud prevention

Fraud prevention is a key concern whenAccepting credit card payments for your business. There are a few things you can do to reduce the risk of fraud, such as verifying the customer’s identity and making sure the billing address matches the one on file with the credit card company. You can also require a signature for all transactions. If you suspect fraud, you can contact the credit card company or the police to investigate.

Chargebacks

What is a chargeback?

A chargeback is when a cardholder disputes a charge with their credit card issuer. The card issuer then initiates an investigation to determine whether or not the cardholder should be reimbursed for the disputed amount. If the card issuer finds in favor of the cardholder, the merchant will be charged back for the amount of the transaction, plus any associated fees.

How can I avoid chargebacks?

There are a few things you can do to avoid chargebacks:

1. Clearly display your refund policy on your website and on your invoices.

2. Get authorization for every credit card transaction.

3. Make sure you capture and store the customer’s signature for each transaction.

4. Keep track of all customer communications, including emails and phone calls.

5. Respond to all customer inquiries in a timely manner.

Security

When you’re accepting credit card payments for your business, it’s important to keep security in mind. There are a few different ways to process credit card payments, and each has its own advantages and disadvantages. You’ll need to decide which option is best for your business, taking into account factors like cost, convenience, and security.

One option is to use a payment processor like PayPal or Square. These companies will provide you with a card reader that you can use to swipe credit cards. They will also process the payments for you, taking a small percentage of each sale. Payment processors are convenient because they’re easy to set up and use, but they can be more expensive than other options. And because you’re using a third-party service, there’s always the possibility that your customer data could be compromised.

Another option is to use a merchant account. This is an account with a bank or other financial institution that allows you to accept credit card payments. Merchant accounts usually have lower fees than payment processors, but they can be more complicated to set up. And like payment processors, there’s always the possibility that your customer data could be compromised if you’re using a third-party service.

The most secure way to accept credit card payments is to use an integrated point-of-sale (POS) system. With this system, your customer’s credit card information is stored on your own servers, not on a third-party service. This means that there’s no risk of data breaches or other security threats. POS systems can be more expensive than other options, but they offer the best protection for your customers’ data.

Fees

There are four main types of fees you’ll pay when you accept credit cards: interchange, assessment, processor, and gateway.

Interchange fees, which are set by the card brands (Visa, Mastercard, Discover, and American Express), are the largest fees you’ll pay. They’re generally around 1.5% to 2.5% of each transaction and go to the card issuer — the bank that lent the customer the money to make the purchase. On top of that fee, you’ll also pay an assessment fee of usually around 0.05%, which goes to the card brands to fund things like fraud prevention initiatives.

Processor fees are charged by your credit card processor — the company that helps facilitate credit card transactions by sending them through the right channels and ensuring they comply with all applicable laws. These fees usually run around 1% to 3% per transaction, but they can be even higher for high-risk businesses like adult entertainment or short-term rentals. You may also be charged a monthly statement fee or a per-transaction fee on top of your processor’s base rate.

Gateway fees are charged by companies that provide software to help businesses accept credit card payments online or via mobile devices. If you take payments through a physical point of sale terminal, you probably won’t have to pay any gateway fees. Gateway companies typically charge a monthly fee plus a per-transaction fee, which is generally around 2.5% + $0.10 for most businesses.

Conclusion

There are a number of different ways to accept credit card payments for your business. The best method for you will depend on a number of factors, including the type of business you run, your sales volume, and your available resources.

Whichever method you choose, it’s important to make sure that you are getting the best possible deal on credit card processing fees. By shopping around and comparing rates, you can ensure that you are paying as little as possible in fees and maximizing your profits.