Your Eidl Loan Has Been Approved – Now What?

Contents

You’ve finally received approval for your Eidl Loan – now what? Use these tips to make the most of your loan and ensure you’re on the path to success.

Checkout this video:

What is an EIDL Loan?

The EIDL program provides long-term, low-interest disaster loans to small businesses, agricultural cooperatives, and most private non-profit organizations of all sizes that are located in disaster declared areas.

EIDL Loans are available in declared disaster areas for working capital purposes to help small businesses, small agricultural cooperatives, and most private non-profit organizations of all sizes meet their financial obligations and pay ordinary and necessary operating expenses that have been severely impacted as a direct result of the disaster.

How to Apply for an EIDL Loan

You’ve been approved for an EIDL loan! Now what?

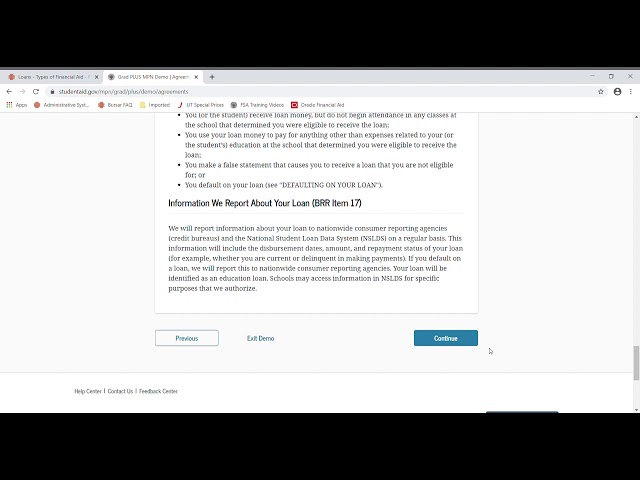

Now it’s time to apply for your loan. The first step is to fill out a loan application. You can do this online or through the mail.

The next step is to submit your supporting documentation. This includes things like your business tax return, profit and loss statement, and balance sheet.

Finally, you’ll need to sign and return your promissory note. This is a legally binding document that outlines the terms of your loan.

Once you’ve completed all of these steps, your loan will be funded and you can start using the money to grow your business!

What Happens Once You’re Approved for an EIDL Loan

The U.S. Small Business Administration (SBA) has approved your Economic Injury Disaster Loan (EIDL). Here’s what happens next.

The SBA will issue you a loan note guarantee within five days of approving your loan. At that time, the SBA will also send your loan information to the lender you selected when you applied for the loan.

The lender will then contact you to discuss disbursement of the loan proceeds and will work with you to complete the loan closing process.

Once the loan is closed, you will begin making monthly payments to the lender, and the SBA will guarantee 75% of the unpaid principal and accrued interest on your loan.

How to Use Your EIDL Loan

If your business has been impacted by COVID-19, you may be eligible for an Economic Injury Disaster Loan (EIDL) through the U.S. Small Business Administration (SBA). These loans provide working capital to small businesses and nonprofits to help them overcome the temporary loss of revenue they are experiencing.

The first step in the process is to submit an application through the SBA website. Once your application is approved, you will receive a loan authorization from the SBA. This will outline the terms and conditions of your loan, as well as how much money you are eligible to receive.

Now that you have been approved for an EIDL loan, it’s time to start thinking about how you will use the money. Here are some tips to help you make the most of your EIDL loan:

1. Use it for working capital: The most common use for EIDL loans is to cover working capital expenses like payroll, inventory, rent, utilities, and other day-to-day operating costs. This can help you keep your business afloat during a time of reduced revenue.

2. Use it for unexpected costs: If you have incurred unexpected costs due to COVID-19, such as medical expenses or additional cleaning supplies, your EIDL loan can help cover these costs.

3. Use it for debt relief: If you have outstanding debts that have become difficult to pay because of reduced revenue, you can use your EIDL loan to cover these payments. This can help ease some of the financial stress that your business is currently facing.

4. Use it for capital expenditures: If there are necessary capital expenditures that will help your business recover from the impact of COVID-19, you can use your EIDL loan to cover these costs. This could include things like new equipment or renovations to improve safety or efficiency.

5. Use it wisely: Remember that an EIDL loan is a real estate backed loan and must be repaid with interest. Be sure to use your loan funds wisely and only borrow what you need to get through this difficult time.

If you need assistance understanding how to use your EIDL loan or what expenses are eligible for coverage, please reach out to one of our SBA disaster assistance experts at (800) 659-2955 (TTY: 1-800-877-8339).