Does Your Credit Score Drop When You Check It?

Contents

If you’re like most people, you probably check your credit score from time to time. But did you know that every time you do, your score may drop a little bit?

It’s true! Checking your credit score can cause a small dip, but it’s nothing to worry about. In fact, checking your score is one of the best things you can do to keep track of your credit health.

So, if you’re worried about your credit score dropping when you

Credit Score Drop When You Check It?’ style=”display:none”>Checkout this video:

What is a credit score?

A credit score is a number that represents the risk a lender takes when lending you money. The higher your credit score, the lower the risk to the lender, and the more likely you are to be approved for a loan or line of credit.

Your credit score is determined by a number of factors, including your payment history, the amount of debt you have, the length of your credit history, and whether you have any late payments or collections.

How is a credit score calculated?

There are a few different ways that your credit score can drop when you check it. One of the most common is if you have a lot of hard inquiries on your report. Hard inquiries are when lenders pull your credit report in order to decide whether or not to approve you for a loan or credit card. Too many hard inquiries can signal to lenders that you’re in financial distress, and this can lead to a lower credit score.

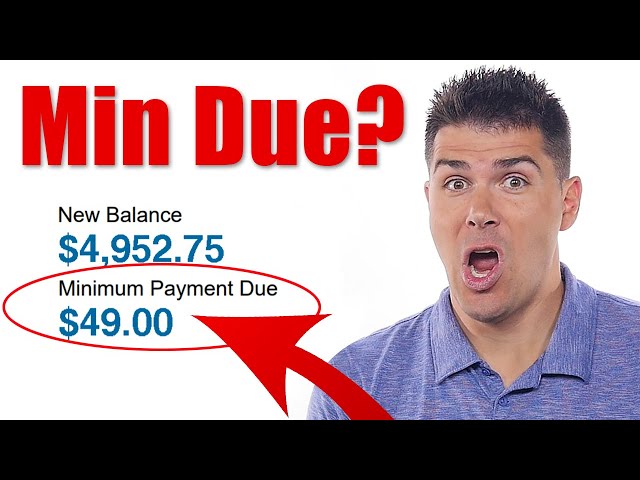

Another way that your credit score can drop when you check it is if you have missed payments or maxed out your credit cards. Missed payments can stay on your credit report for up to seven years, and they will typically result in a substantial drop in your credit score. Additionally, maxing out your credit cards can also lead to a drop in your score, as it indicates to lenders that you’re using a high percentage of your available credit.

If you’re concerned about your credit score dropping when you check it, there are a few things you can do to minimize the risk. First, make sure that you only apply for new credit when absolutely necessary, as each hard inquiry will count against you. Additionally, try to keep your balances well below your credit limits, and make sure to always make at least the minimum payment on time each month. By taking these precautions, you can help ensure that checking your credit doesn’t lead to an unwanted drop in your score.

How often is a credit score updated?

Credit scores are updated frequently, but the exact frequency depends on the scoring models and data used. The most commonly used credit scores, FICO® Scores* and VantageScore® 3.0, are updated monthly. However, older versions of VantageScore and other scoring models may update quarterly or even annually.

Your credit report, on which your credit score is based, may also be updated more frequently than your score. That’s because your credit report information can change more often than your score. For example, if you open a new credit card or close an old one, that information will be reflected on your credit report almost immediately but may not impact your score for weeks or even longer.

What factors can cause a credit score to drop?

There are a number of things that can cause your credit score to drop, including late or missed payments, maxing out your credit cards, having a high balance on your cards, opening too many new accounts at once, and closing older credit accounts. Additionally, anything that can cause negative marks on your credit report, such as a bankruptcy or foreclosure, can also cause your score to drop.

How can you check your credit score?

There are a few ways you can check your credit score. You can get a free credit report from AnnualCreditReport.com, which is the only website authorized by the federal government to provide free credit reports. You can also use a credit monitoring service such as Credit Sesame or Credit Karma. These services allow you to check your credit score for free and they will also provide you with updates if your score changes.

What can you do if your credit score drops?

If you find that your credit score has dropped, there are a few steps you can take to try to improve it.

First, check your credit report for any errors. If you find any, dispute them with the appropriate credit bureau.

Next, try to pay down your debt, especially any revolving debt such as credit cards. You can also try to increase your credit limit, which will lower your credit utilization ratio.

Finally, don’t apply for new credit cards or loans and don’t close any existing accounts. Doing either of these things could have a negative impact on your score.

If you follow these steps and still see no improvement in your score after a few months, you may want to consider talking to a professional credit counseling service.