What is a Graduate Plus Loan?

Contents

A federal Direct PLUS Loan is a loan made to parents of dependent undergraduate students and to graduate or professional degree students.

Checkout this video:

What is a Graduate Plus Loan?

A Graduate Plus Loan is a federal student loan that helps graduate or professional degree students pay for their educational expenses. It has a fixed interest rate and can be used for tuition and other education-related expenses. You may borrow up to the full cost of your education minus any other financial aid you receive.

How do Graduate Plus Loans work?

Graduate Plus Loans are a type of federal student loan available to graduate and professional students. These loans can be used for educational expenses, including tuition, fees, books, and living expenses.

Unlike other federal student loans, Graduate Plus Loans are not need-based. Instead, they are credit-based loans, which means that your credit history will be taken into account when you apply for a loan. If you have a good credit history, you may be eligible for a lower interest rate.

To apply for a Graduate Plus Loan, you will need to complete the Free Application for Federal Student Aid (FAFSA). You will then need to submit additional documentation to your school’s financial aid office. Once your school has certified your loan, the funds will be disbursed to your school account.

What are the benefits of a Graduate Plus Loan?

The Graduate Plus Loan program offers a number of benefits for graduate and professional students, including:

-Deferred repayment: You don’t have to start repaying your loan until six months after you graduate, leave school, or drop below half-time enrollment.

-Fixed interest rates: The interest rate on your loan will be fixed for the life of the loan, so you’ll always know what your monthly payments will be.

-No prepayment penalty: You can make extra payments on your loan at any time without penalty, so you can pay off your loan early if you want to.

-Loan consolidation: If you have multiple student loans, you can consolidate them into a single loan with one monthly payment. This can often lower your interest rate and help you get out of debt faster.

How to apply for a Graduate Plus Loan?

Assuming you’re a US citizen or eligible non-citizen, you can complete the Free Application for Federal Student Aid (FAFSA) at fafsa.gov. You’ll need to provide information about your financial situation, including your family’s income and assets.

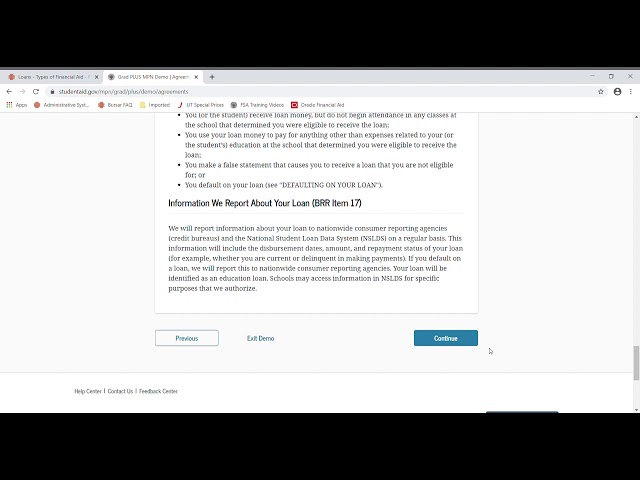

The FAFSA will generate a Student Aid Report (SAR), which will tell you how much money you’re eligible to receive in federal aid, including Direct PLUS Loans. If you’re eligible for a PLUS Loan, the next step is to complete a PLUS Loan Application and Master Promissory Note (MPN) at studentaid.gov.

What are the repayment terms for a Graduate Plus Loan?

The repayment terms for a Graduate Plus Loan are as follows: Your first payment will be due 60 days after the final disbursement of the loan. You will have 10 years to repay the loan in full. You can make payments while you are in school, but it is not required. If you choose to make payments while you are in school, you can do so monthly, quarterly, or semi-annually.