How to Fix Your Credit

Contents

Having bad credit can make it difficult to get approved for loans or new lines of credit . If you’re looking to improve your credit score, here are some tips on how to fix your credit.

Checkout this video:

Check your credit score

Your credit score is a three-digit number that’s derived from information in your credit report. Lenders use credit scores to evaluate your creditworthiness — the likelihood that you will repay a loan on time. A high score is an indication to lenders that you’re a low-risk borrower, which could lead to a lower interest rate on a loan. Conversely, a lower credit score indicates to lenders that you’re a higher-risk borrower, which could lead to higher interest rates and fees.

You have three FICO® scores, one for each of the three credit bureaus — Experian, TransUnion and Equifax. These scores are based on information in your credit reports, and they may vary depending on which bureau provides the score. Your score can also change over time as your credit report information changes.

You can get your free credit scores from several sources, including some financial institutions andcredit card issuers. You can also get your FICO® Score 8 for free through Experian by signing up for an Experian membership or by taking advantage of certain free offers.

Dispute any errors

The first step to fixing your credit is to dispute any errors that you find on your credit report. You can do this by contacting the credit bureau directly and asking them to remove the error. If the error is valid, they will remove it from your report.

Create a budget

A budget is an important tool that can help you get your finances in order and keep track of where your money is going. When you know where your money is going, you can make changes to spending habits that may be contributing to financial problems.

There are a number of ways to create a budget, but one of the simplest is to tracker your spending for a month and then creating categories for expenses. Once you have your categories, you can total up your monthly spending and see where you may be able to cut back.

Some common expense categories include:

-Housing

-Transportation

-Food

-Utilities

-Clothing

-Entertainment

-Debt payments

Get on a payment plan

If you have delinquent accounts, you should contact the creditor to try to work out a payment plan. You may be able to set up a payment plan for a few dollars a month that will satisfy the debt over time. Once you have made three payments on the account, the account will show as current, and your credit score will improve.

Consider credit counseling

If you have a limited budget and want to work on your own, you might consider credit counseling.

A reputable credit counseling organization can help you develop a budget and a plan to repay your debt. The catch? You must be committed to following the plan.

Before you enroll in a plan, find out how much the monthly payment will be and how long it will take to pay off your debt. Be sure you can afford the monthly payment and that the plan won’t take longer than five years to complete.

Take out a consolidation loan

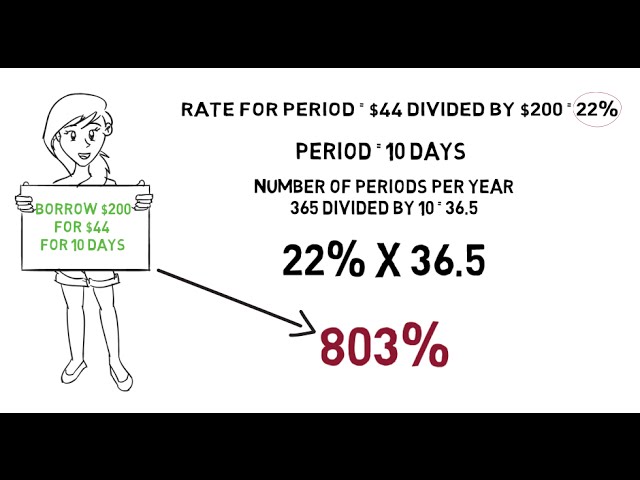

If you’re struggling to make payments on multiple high-interest loans or credit card balances, a consolidation loan might help. With a consolidation loan, you can combine all your debts into a single monthly payment at a fixed interest rate. This can help you free up some cash each month, as well as get out of debt more quickly if you’re able to find a loan with a low interest rate.

To qualify for a consolidation loan, you’ll need good credit and enough income to make the monthly payments. You can get consolidation loans from banks, credit unions, and online lenders. If you have federal student loans, you might be able to consolidate them through the Department of Education’s Direct Consolidation Loan program.

Work with a credit repair company

If your credit report contains errors or negative information that you can’t remove yourself, working with a credit repair company may be your best option. Credit repair companies use a variety of methods to help improve your credit score, including:

-Contesting negative information on your credit report

-Helping you develop a budget and financial plan

-Providing credit counseling and education

Before you work with a credit repair company, be sure to research the company carefully and avoid companies that make unrealistic promises or charge high fees.