How to Get Pre-Approved for a FHA Loan

Contents

Find out how to get pre-approved for a FHA loan and start the process of buying a home with confidence. We’ve gathered the most important information you need to know in order to get pre-approved for a FHA loan.

Checkout this video:

What is a FHA Loan?

A Federal Housing Administration loan is a mortgage loan that is insured by the federal government. The program is administered by the Department of Housing and Urban Development (HUD). The FHA does not lend money directly to borrowers; instead, it insures loans that are made by private lenders. This insurance protects the lender in the event that the borrower defaults on the loan.

There are two types of FHA loans:

– Title I loans, which are intended for minor repairs and improvements; and

-Title II loans, which are for major repairs and rehabilitation.

To be eligible for a Title I or Title II loan, you must be a homeowner with good credit who meets certain income requirements. You will also need to have a property that meets the FHA’s guidelines for safety and habitability.

How to Get Pre-Approved for a FHA Loan

Many people assume that they need perfect credit and a large down payment to get approved for a FHA loan. However, this is not always the case. You can get pre-approved for a FHA loan with a 580 credit score and a 3.5% down payment.

Mortgage Pre-Qualification

Mortgage pre-qualification is an important first step for anyone who is considering buying a home and is unsure if they are financially ready. A mortgage pre-qualification can be done simply by providing your bank or mortgage lender with your annual income, your credit score, and the amount of liquid assets you have available for a down payment.

Once you are pre-qualified, you will have a better idea of how much home you can afford based on your current income and debts. You will also be in a better position to negotiate with sellers since they will know that you are a serious buyer who has been approved for financing.

If you are not sure where to start, most banks and mortgage lenders offer free mortgage pre-qualification services.

Mortgage Pre-Approval

A mortgage pre-approval is a process in which the lender reviews your financial qualifications—including your credit report, employment history, and income— and agrees to provide you with a loan up to a certain amount. With a pre-approval letter in hand, you’ll know exactly how much you can borrow when you start shopping for homes.

Getting pre-approved for a FHA loan is similar to getting approved for any other mortgage program — it requires borrowing qualifications such as credit score, employment history, and income level. But because of the guarantee that comes with a FHA loan review process is more in depth than most other mortgage programs.

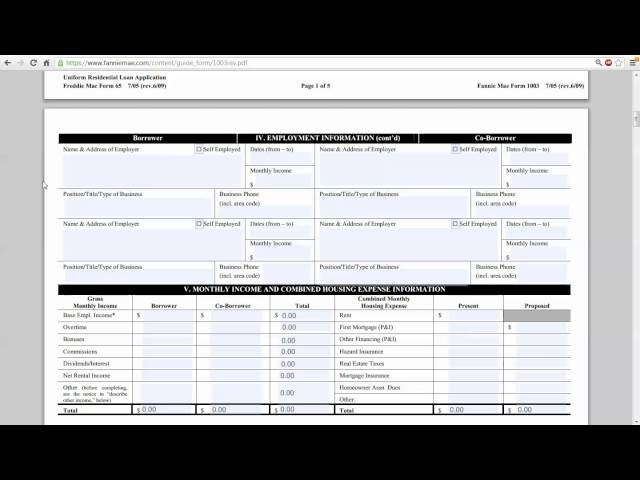

If you’re looking to get pre-approved for a FHA loan, there are a few things you can do to make the process go smoothly. First, identify the type of lender that would be the best fit for your needs (i.e., a bank, credit union, or online lender). Then, gather required documentation such as your W-2 forms or tax returns for the past two years, pay stubs covering the past 30 days, bank statements from the past three months, and information about any other debts or assets you may have. Finally, reach out to several lenders to compare offers and choose the one that best suits your needs.

How to Shop for a FHA Loan

Pre-approval for a FHA loan means that a lender has looked at your financial history and determined that you would likely be approved for a loan up to a certain amount. It’s important to have a pre-approval letter before you start shopping for a home because it will help you know how much you can afford to spend. It’s also a good idea to get pre-approved for a loan before you start shopping so that you can be sure to get the best interest rate possible.

Finding a FHA-Approved Lender

In order to get pre-approved for a FHA loan, you’ll need to work with a FHA-approved lender. The Department of Housing and Urban Development (HUD) maintains a list of approved lenders that you can use to find one in your area.

You can also work with a mortgage broker, who can help you shop around for the best deal on a FHA loan. Keep in mind that not all brokers are FHA-approved, so be sure to ask before you start working with one.

Once you’ve found an approved lender, you’ll need to fill out a loan application and provide some financial information. The lender will then pull your credit report and review your financial history. Based on this information, they’ll give you a pre-approval letter that indicates how much of a loan you qualify for and what your interest rate will be.

With a pre-approval letter in hand, you’ll be ready to start shopping for your new home.

FHA Loan Limits

Federal Housing Administration (FHA) loans are available for single-family homes as well as condominiums and townhouses. The FHA limits the amount that homebuyers are allowed to borrow. The maximum loan limit is calculated each year and announced in advance of the new calendar year. You can find the 2020 FHA loan limits here.

If you’re thinking of purchasing a home with an FHA loan, you’ll need to prove that you’re a responsible borrower who is likely to repay the loan on time. The best way to do this is by getting pre-approved for a FHA loan. A pre-approval letter from a lender shows that you’re approved for a certain loan amount, which gives you an estimate of how much house you can afford.

When shopping for a FHA loan, it’s important to compare offers from multiple lenders to make sure you’re getting the best deal. Be sure to compare interest rates, fees, and other costs associated with each loan. You can use our mortgage calculator to estimate your monthly payments and help you compare different FHA loans.

FHA Loan Requirements

To get an FHA loan, you’ll need to satisfy certaincredit, income and other requirements.

For example, to qualify for a down payment as low as 3.5%, you’ll need a credit score of at least 580. If your score is between 500 and 579, you can still get an FHA loan, but your down payment requirement will be 10%.

In addition to credit scores, lenders will also look at your employment history, current earnings and other factors to decide if you’re eligible for an FHA loan. In general, to get the best terms on an FHA loan you’ll need:

-A credit score of 580 or higher (lower scores may still qualify if you make a larger down payment)

-Employment verification

-A steady income history

-A valid Social Security number

-Proof of U.S. Citizenship or legal residency (a green card)

-No more than two 30-day late payments on major credit accounts in the last 12 months

How to Refinance a FHA Loan

You’ve probably heard that you should get pre-approved for a mortgage before you start shopping for your new home. But what does the pre-approval process entail, and how can you make sure you’re pre-approved for the best possible loan? We’ll take a look at the pre-approval process for FHA loans and how you can make sure you’re getting the best possible deal.

FHA Streamline Refinance

The FHA Streamline Refinance is a special mortgage product reserved for homeowners with existing FHA loans. refinancing with an FHA Streamline Loan can help current FHA homeowners lower their monthly payments and interest rates. And, with lenient credit standards and documentation requirements it can be the fastest and most cost effective options to refinance an fha loan.

To be eligible for an FHA Streamline Refinance Loan, your mortgage must:

-Be currently insured by the FHA

-Be owned by you (not leased or owned by a bank or other financial institution)

-Have been in good standing (no 30 day late payments in last 12 months)

-Not have been already been refinanced through the FHA streamline program

FHA Cash-Out Refinance

If you have equity built up in your home, you can use this equity to finance home improvements, pay for college tuition, or consolidate debt. The Federal Housing Administration (FHA) offers two programs that allow you to cash out of your home equity — the FHA Streamline Refinance and the FHA Cash-Out Refinance. The best option for you will differ depending on your unique financial situation.

The FHA Streamline Refinance is a great option if you owe more on your mortgage than your home is currently worth, but you don’t have a lot of extra cash on hand. This program allows you to refinance your mortgage without having to get an appraisal or provide extensive documentation of your financial history.

The FHA Cash-Out Refinance is a more comprehensive program that allows you to access up to 85% of your home’s equity. With this program, you will need to provide documentation of your financial history as well as get an appraisal. This option is best if you have equity built up in your home and you need cash for a large purchase or to consolidate debt.