When Does Navy Federal Report to Credit Bureaus?

Contents

Navy Federal reports to credit bureaus monthly. You can check your credit report for free once a year at AnnualCreditReport.com.

Checkout this video:

Navy Federal Credit Union reports to credit bureaus every month, typically on the same day of the month. This means that if you have a Navy Federal Credit Union account in good standing, your credit report will reflect this every month. This can help you build or maintain good credit.

Navy Federal Credit Union is a not-for-profit, member-owned financial cooperative serving over 8 million members worldwide. It is the world’s largest credit union, and one of the few remaining credit unions that Americans can join. Navy Federal offers a complete range of deposit, lending, and mortgage products and services designed to meet the unique financial needs of its members.

Navy Federal is headquartered in Vienna, Virginia, and has over 315 branches across the United States. It is regulated by the National Credit Union Administration (NCUA).

Navy Federal Credit Union reports your account information to the three major credit bureaus—Experian, TransUnion and Equifax—on a monthly basis. However, it can take up to 45 days for newly opened accounts to appear on your credit report.

Navy Federal also offers a free credit monitoring service called Credit Sense, which gives you access to your weekly Experian credit score and report. You can also set up alerts so you’ll be notified if there are any changes to your credit file.

Navy Federal Credit Union is a full-service financial institution that offers a wide range of products and services to its members. One of the most important services that Navy Federal Credit Union offers is reporting to the credit bureaus. This article will provide you with all the information you need to know about when Navy Federal Credit Union reports to the credit bureaus.

Navy Federal Credit Union reports to credit bureaus monthly. However, Navy Federal does not report to all three credit bureaus every month. In any given month, Navy Federal will report your account information to one or two of the credit bureaus. While this may vary slightly from month to month, over the course of a year, your account should be reported to all three credit bureaus at least once.

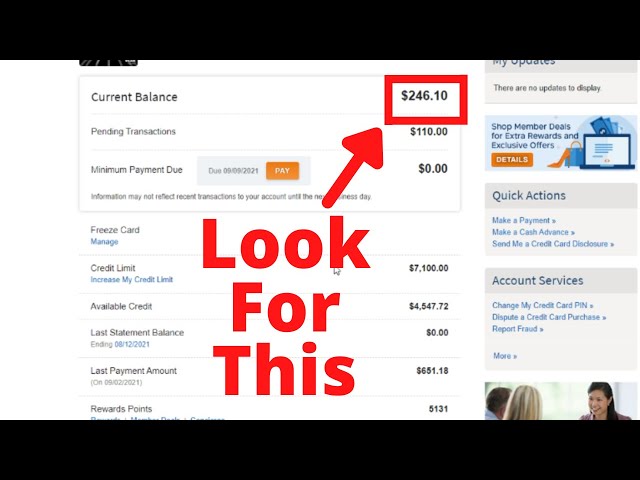

Navy Federal Credit Union reports account information to credit bureaus on a monthly basis. This includes information such as your account balance, payment history, and whether you have missed any payments. Navy Federal does not report information about inquiries or applications for new credit products.

Navy Federal reports both positive and negative information to credit bureaus. Therefore, if you have a Navy Federal credit card and you make all of your payments on time, this will be reported to the credit bureaus and will help improve your credit score. However, if you miss a payment or make a late payment, this will also be reported to the credit bureaus and will hurt your credit score.

If you have any questions about how Navy Federal Credit Union reports to credit bureaus, you can contact customer service for more information.

Navy Federal Credit Union reports to credit bureaus every month, usually on the same day of the month. This means that if you have a Navy Federal Credit Union account, your activity on that account will be reported to the credit bureaus and will impact your credit score.

Navy Federal Credit Union reporting can help you improve your credit score in several ways:

First, if you have a Navy Federal Credit Union account in good standing, it will be reported to the credit bureaus. This can help improve your credit score by showing that you are a responsible borrower.

Second, if you make on-time payments to Navy Federal Credit Union, this will also be reported to the credit bureaus. This can help improve your credit score by showing that you are a reliable borrower.

Third, if you have a Navy Federal Credit Union account with a high credit limit, this will also be reported to the credit bureaus. This can help improve your credit score by showing that you are a low-risk borrower.

Navy Federal Credit Union (NFCU) is a major financial institution that offers credit cards, loans, and other services to its members. NFCU reports information about its members’ account activity to the major credit bureaus (Experian, Equifax, and TransUnion) every month.

If you have an NFCU credit card or loan, your payment history and other account activity will be reported to the credit bureaus. This information will be used to calculate your credit score.

If you have a history of late payments or other negative accountactivity, NFCU’s monthly reporting can hurt your credit score. Conversely, if you have a good payment history with NFCU, the monthly reporting can help your credit score.

You can check your NFCU account activity online or by calling customer service. If you see any errors, you can dispute them with NFCU and the credit bureau.

Navy Federal Credit Union is a credit reporting agency, which means it has the ability to report negative information about you to the credit bureaus. This can negatively impact your credit score and make it harder for you to get approved for new lines of credit. If you have negative information reported by Navy Federal Credit Union, there are a few things you can do to try to improve your credit score.

According to the Navy Federal Credit Union website, they report to all three credit bureaus every month. So, if you have negative information reported by them, it will show up on your credit report.

If you have negative information reported by Navy Federal Credit Union, you can take steps to improve your credit score. You can start by paying your bills on time and keeping your balances low. You can also contact the credit bureau and ask them to remove the negative information from your report.

Take steps to improve your credit score so that you can get the financing you need in the future.

If you have positive information reported by Navy Federal Credit Union, you should take steps to ensure that the information is accurate and up-to-date. You should also make sure that your credit reports reflect your current financial situation.

If you have negative information reported by Navy Federal Credit Union, you may want to dispute the accuracy of the information with the credit bureau. You can also try to negotiate with Navy Federal Credit Union to have the negative information removed from your report.