How to Properly Use a Credit Card

Use your credit card the right way by following these simple tips. You’ll avoid fees, save money, and improve your credit score.

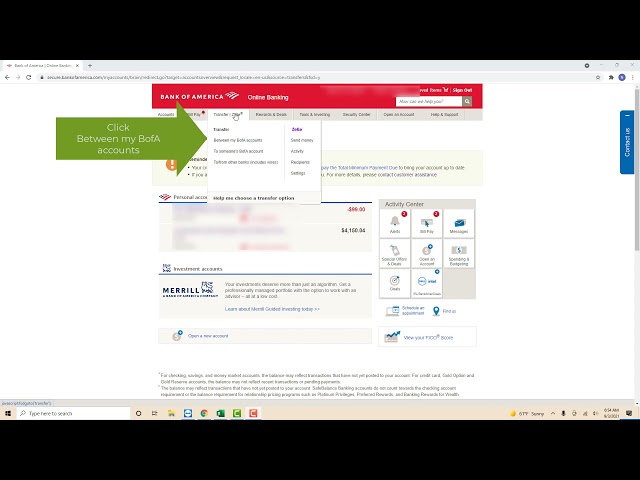

Checkout this video:

Introduction

Welcome to our guide on how to properly use a credit card. In this guide, we will go over everything you need to know about credit cards, from the different types available to how to use them responsibly. We’ll also provide some tips on what to do if you find yourself in a difficult financial situation.

We hope that this guide will help you make the most of your credit card and avoid some of the common mistakes that people make. Let’s get started!

How to Use a Credit Card

Credit cards can be a great tool to build your credit or earn rewards. But if not used correctly, they can also lead to debt and high interest payments. In this article, we will cover how to use a credit card responsibly. We’ll discuss topics like how to choose the right card, how to avoid paying interest, and how to keep your credit score high.

Use a credit card for convenience

While not necessary, a credit card can be a helpful tool. It’s important to remember that a credit card is a loan, and should be treated as such. When used correctly, a credit card can offer a number of benefits, including convenience, security and rewards.

Here are a few tips on how to use a credit card:

• Use your credit card for convenience. A credit card can be a helpful tool for making purchases or payments when you don’t have cash on hand. Just be sure to pay off your balance in full each month to avoid interest charges.

• Use your credit card for security. When used wisely, a credit card can provide an extra level of security. For example, if you make a purchase with your credit card and the item turns out to be defective, you may be able to get a refund from your credit card company.

• Use your credit card for rewards. Many credit cards offer rewards, such as cash back or points that can be redeemed for travel or merchandise. If you pay off your balance in full each month, you can reap the benefits of these rewards without paying any interest charges.

Use a credit card for emergencies

A credit card can be a helpful tool if used correctly. Many people use credit cards for everyday purchases, but this can lead to debt. It’s important to know how to use a credit card responsibly before you get one.

One way to use a credit card responsibly is to only use it for emergencies. This means you should only charge something on your credit card if you absolutely need it and can’t pay for it with cash or a debit card. For example, if your car breaks down and you don’t have the money to pay for the repairs, you could charge it on your credit card. This way, you can pay off the balance over time without accruing interest.

Another way to use a credit card responsibly is to pay off your balance in full every month. This means you’re not paying interest on your purchases, which can save you money in the long run. To do this, you need to make sure you’re not spending more than you can afford to pay back each month.

If you can follow these two tips, using a credit card can be a helpful financial tool. However, if you don’t use a credit card responsibly, it can lead to debt and financial problems.

Use a credit card for cash back or rewards

If you want to use your credit card for cash back or rewards, be sure to first read the terms and conditions. Many cards will offer a sign-up bonus, but you may have to spend a certain amount of money within the first few months to qualify. Once you’ve reached the minimum spending requirement, you’ll start earning cash back or rewards points on every purchase you make. Be sure to redeem your rewards points before they expire, and check if there’s a limit on how much cash back you can earn each year.

How Not to Use a Credit Card

Credit cards are a great way to build credit and make purchases that you may not be able to afford with cash. However, there are some dangers to using credit cards if you are not careful. Let’s go over some of the things you should avoid doing if you want to keep your credit in good standing.

Do not use a credit card for impulse purchases

It can be tempting to use a credit card for every purchase, especially when you are first starting out and trying to build your credit. However, this is not a good idea for several reasons. First, it is important to only use your credit card for things that you can afford. If you make impulse purchases with your credit card, you may find yourself in debt very quickly. Second, if you use your credit card for everything, you will not have any money left over for emergencies. Finally, if you only use your credit card for impulse purchases, you will not be building a good history of responsible credit use.

Do not use a credit card for large purchases

You should never use a credit card to make a large purchase. This is because you will be charged interest on the purchase from the day that you make it. It is better to save up your money and pay for the purchase in cash. If you must use a credit card, only charge what you can afford to pay off at the end of the month.

Do not use a credit card for recurring payments

Using a credit card for recurring payments can be a slippery slope. You might think you’re in control, but if you miss a payment or two, the late fees and interest can quickly get out of hand. Before you know it, you’re in debt and it feels like there’s no way out.

If you absolutely must use a credit card for recurring payments, be sure to pay your bill in full and on time every month. This will help keep your debt under control and avoid costly late fees and interest charges.

Conclusion

If used correctly, credit cards can be a great financial tool. They can help you build your credit history and improve your credit score, which can save you money in the long run. They can also offer you rewards and perks that can save you money on everyday purchases.

However, if used incorrectly, credit cards can lead to debt and financial problems. It’s important to understand how credit cards work before you start using them. Make sure you know how much you can afford to spend and always pay your bill on time. If you’re not sure you can use a credit card responsibly, it’s best to avoid them altogether.