How to Build Credit Quickly and Easily

Contents

If you’re looking to build credit quickly and easily, there are a few things you can do. By following some simple steps and making smart financial choices, you can start building a strong credit history in no time.

Checkout this video:

What is credit?

Credit is basically an agreement between a borrower and a lender in which the borrower agrees to pay back the loan with interest within a certain period of time. The lender may be a bank, a credit card company, or a store that offers financing. There are many ways to build credit, but the most important thing is to make sure you make all of your payments on time.

The difference between good and bad credit

Your credit is a number that lenders use to determine the risk involved in lending you money. The higher your credit score, the lower the risk to the lender and the better your chances of being approved for a loan with a low interest rate. A low credit score indicates to lenders that you may be a high-risk borrower, which could lead to your loan being denied or result in you having to pay a higher interest rate.

There are two types of credit: good and bad. Good credit means that you have a history of making on-time payments and maintaining a balance below your credit limit. Bad credit, on the other hand, indicates that you have missed payments, maxed out your credit cards, or declared bankruptcy in the past. If you have bad credit, it will be more difficult to get approved for loans and lines of credit and you may be charged a higher interest rate if you are approved.

Building good credit is important because it can save you money in the long run. If you have goodcredit, you’ll be more likely to be approved for loans with favorable terms and rates. Additionally, good credit can help you qualify for discounts on insurance premiums and other expenses. There are several ways to build good credit, including making on-time payments, maintaining a low balance on your revolving accounts, and using a mix of different types of credit products.

How to build credit quickly

There are a few things you can do to help build your credit quickly. One way is to get a credit card and use it responsibly. You can also get a car loan or a personal loan and make your payments on time. Another thing you can do is to become an authorized user on someone else’s credit card. If you make all of your payments on time, you will start to see your credit score improve.

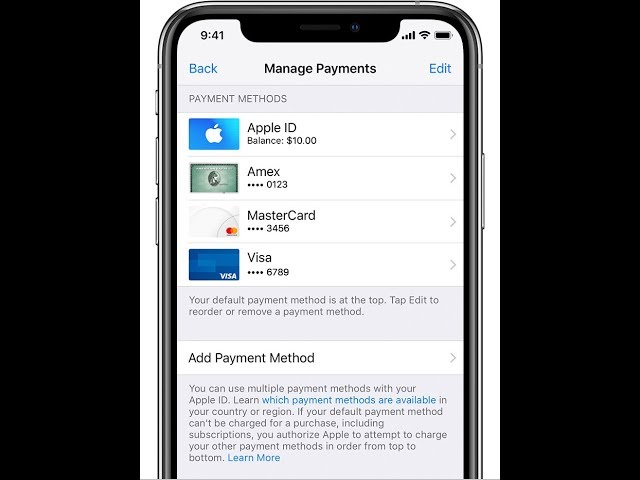

Get a credit card

One of the easiest ways to build credit quickly is to get a credit card. You can start with a secured credit card, which requires you to put down a refundable deposit that serves as your credit limit. Or you can get an unsecured credit card and benefit from a higher credit limit (although you may have to pay an annual fee). Use your credit card wisely by making sure you never spend more than 30% of your credit limit and paying your balance in full every month. Also, avoid closing unused credit cards as this can hurt your credit score.

Use a credit-builder loan

A credit-builder loan can help you build credit quickly and easily. This type of loan is designed for people who have no credit history or who have poor credit. With a credit-builder loan, you borrow a small amount of money and agree to make regular payments over a set period of time. The lender reports your payments to the major credit bureaus, which helps you build a positive credit history.

Credit-builder loans are available from some banks, credit unions, and online lenders. To get started, you can search for lenders that offer this type of loan or contact your bank or credit union to see if they offer this type of product. Once you’ve found a lender, you’ll need to fill out an application and provide some documentation, such as your driver’s license or Social Security number.

After you’re approved for the loan, the lender will deposit the money into a savings account in your name. You’ll then make regular payments on the loan, which will be reported to the credit bureaus. Once you’ve repaid the loan in full, you’ll have a solid record of on-time payments and can start working on building your credit score even higher.

One of the best and fastest ways to improve your credit score is to become an authorized user on someone else’s credit card. This can be a family member, friend, or even a co-worker. As long as the account is in good standing and the issuer reports to the credit bureaus (most do), you will start to see your credit score increase almost immediately after being added to the account.

How to build credit easily

There are a few things you can do to help build your credit quickly and easily. One of the best things you can do is to make sure you make all of your payments on time. This includes any credit cards, loans, or other bills you might have.

Pay your bills on time

One of the best ways to improve your credit is to make your payments on time. Payment history is the biggest factor in credit scoring, so it’s important to keep up with your payments. You can set up automatic payments for your bills to make sure you never miss a payment.

Another way to stay on top of your payments is to use a credit monitoring service. These services will alert you if you have a late payment or if your payment is due soon. This can help you avoid costly late fees and keep your credit score high.

You can also use a credit card to build credit. When you use a credit card, be sure to pay off your balance in full each month. This will help you avoid interest charges and keep your debt levels low. You can also take advantage of cash back or rewards programs offered by some credit cards.

Keep your credit utilization low

Your credit utilization — or the amount of debt you’re carrying compared to your credit limit — is one of the biggest factors in your credit score. The lower your utilization, the better.

To keep your utilization low, you can either pay down your debt or increase your credit limit. If you have a balance on your credit card, paying it down should be your first priority. But if you’re lucky enough to have a zero balance, you can ask your issuer for a credit limit increase. Just don’t be surprised if they ask you to submit documentation of your income and expenses first.

Check your credit report regularly

One of the best ways to build credit is to keep an eye on your credit report and score. You’re entitled to a free credit report from each of the three major credit bureaus once a year, so take advantage of that right. Then, check your credit score frequently so you can see your progress.

There are a number of ways to get your credit score for free, including through some financial institutions and websites. Once you know your score, you can work on improving it. If you see any errors on your credit report, dispute them immediately.