How to Calculate Credit Card Payments

How to Calculate Credit Card Payments – This post covers the different methods you can use to calculate your credit card payments, including the minimum payment, average daily balance, and adjusted balance methods.

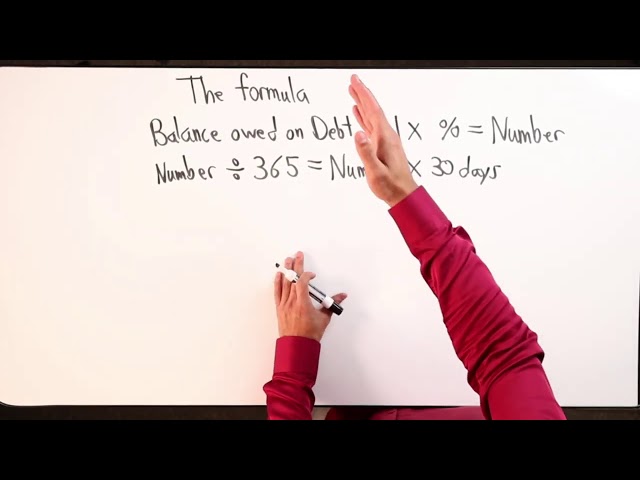

Checkout this video:

Introduction

Introduction

If you’re like most people, you probably have a credit card or two that you use on a regular basis. And if you’re like most people, you probably don’t give much thought to how your credit card payments are calculated. But if you’re interested in getting the most for your money, it’s worth taking a closer look at how your credit card issuer calculates your payments.

There are two main ways that credit card issuers calculate payments: the average daily balance method and the adjusted balance method. In general, the average daily balance method results in a higher minimum payment than the adjusted balance method. So if you’re trying to pay off your credit card balance as quickly as possible, you’ll want to make sure that your issuer is using the adjusted balance method.

Here’s a closer look at how each of these methods works:

The Average Daily Balance Method

With the average daily balance method, your minimum payment is calculated based on the average of your account balances for each day of the billing cycle. To calculate the average daily balance, your issuer will take the beginning balance for each day of the billing cycle and add any new charges or interest that accrues during that day. Then, they’ll divide that total by the number of days in the billing cycle. This resulting figure is your average daily balance.

Your minimum payment will then be calculated as a percentage of your average daily balance. The percentage will vary depending on your issuer, but it’s typically around 2%. So if your average daily balance is $1,000, your minimum payment would be $20.

The Adjusted Balance Method

With the adjusted balance method, your minimum payment is calculated based on the account balance at the end of each billing cycle, minus any unpaid interest or fees. So if your account balance at the end of the billing cycle is $1,000 and you have $10 in unpaid interest and fees, your minimum payment would be $990 ($1,000 – $10).

Minimum Payment

The minimum payment is the lowest amount you can pay on your credit card bill each month and still keep your account in good standing. Your credit card company will typically require you to pay at least the minimum payment due every month.

Calculating your minimum payment is usually pretty simple: it’s either a fixed percentage of your total balance (usually around 2%), or a flat dollar amount (usually around $25). However, some issuers have been experimenting with higher minimum payments in recent years. And if you’re only making the minimum payment, it’ll take you a long time to pay off your debt (more on that below).

So how do you calculate your credit card minimum payment? Let’s take a look at an example:

Say you have a balance of $1,000 on your credit card with an interest rate of 15%. Your issuer’s minimum payment policy is either 2% of the balance or $25, whichever is greater. In this case, the 2% minimum would be $20 (2% of $1,000), but since that’s less than $25, your minimum payment would be $25.

Now let’s say you have a balance of $5,000 on a different credit card with the same interest rate and minimum payment policy. In this case, the 2% minimum would be $100 (2% of $5,000), and since that’s greater than $25, your minimum payment would be $100.

Average Payment

The average payment method is the most common way to calculate credit card payments. To calculate your monthly payment using this method, you simply take your total balance and divide it by the number of months in your repayment period. So, if you have a balance of $1,000 and you’re repayment period is 12 months, your monthly payment would be $83.33.

While this method is easy to use, it’s not the most efficient way to pay off your debt. That’s because with this method, you’ll end up paying more in interest than you would with other methods.

Fixed Payment

A fixed payment is the same amount each month that you pay towards your credit card balance. You can usually choose your own fixed payment amount, as long as it is above the minimum payment required by your card issuer. To calculate your fixed payment, simply divide your current credit card balance by the number of months you want to pay it off.

Conclusion

The takeaway is that you have many options when it comes to credit card payments, and the best method for you depends on your individual circumstances. There are pros and cons to each method, so be sure to consider all of your options before making a decision. If you need help deciding which method is best for you, please contact a financial advisor.