How to Calculate a Credit Card Payment

Contents

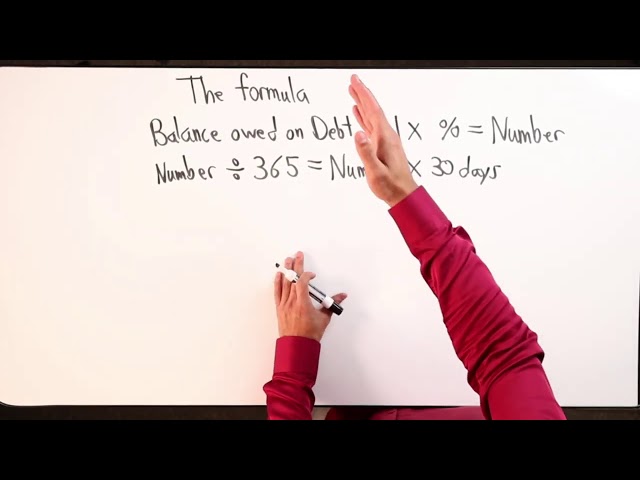

How to Calculate a Credit Card Payment – Credit card companies typically charge interest on a daily basis. The daily rate is a percentage of the balance owed and is calculated by dividing your APR by 365.

Checkout this video:

Introduction

Whether you’re trying to pay down debt or simply manage your monthly expenses, it’s important to know how to calculate a credit card payment. This helpful guide will walk you through the steps so that you can make informed decisions about your finances.

There are two main factors that go into calculating a credit card payment: the interest rate and the balance. The interest rate is the percentage of the balance that you will be charged each month in interest. The balance is the amount of money owed on the credit card.

To calculate your monthly payment, start by multiplying yourinterest rate by your balance. Then, add this number to your minimum payment amount. This is the minimum amount that you are required to pay each month in order to keep your account in good standing.

For example, let’s say you have a balance of $1000 and an interestrate of 18%. To calculate your minimum monthly payment, you wouldstart by calculating 18% of $1000, which equals $180. Then, youwould add this number to your minimum payment amount, which let’ssay is $50. This means that your minimum monthly payment would be$230 ($180 + $50).

If you’re able to pay more than the minimum payment each month,you’ll be able to pay off your debt more quickly and save money oninterest charges. To calculate how much extra you can afford topay each month, simply subtract your minimum payment from yourtotal monthly income (after taxes). For example, if your monthlyincome is $3000 and your minimum payment is $230, you would have$2870 left over each month that could go towards paying down debt.

By following these steps, you can easily calculate how much youneed to pay each month in order to stay current on your credit cardpayments and avoid costly late fees or damaging your credit score.

The Basics of Credit Card Payments

Understanding how credit card payments work is important to avoid being charged interest or late fees. When you make a credit card payment, you are essentially borrowing money from the credit card company. The credit card company will then charge you interest on the money you borrowed, as well as any fees associated with the transaction.

The Minimum Payment

The minimum payment is the smallest amount of money that you can pay on your credit card bill each month and still be in good standing with your credit card company. You’ll still accrue interest on your balance if you only make the minimum payment, but making at least the minimum payment on time each month is important for maintaining a good credit score.

To calculate your minimum payment, you’ll need to know your current balance and your annual percentage rate (APR). The APR is the interest rate that you’re charged on your balance.

Once you have those two numbers, you can use this formula to calculate your minimum payment:

Minimum Payment = Current Balance x Monthly Interest Rate

For example, let’s say that you have a balance of $1,000 and an APR of 15%. Your monthly interest rate would be 0.15% or $1.50 (15% divided by 12 months). Therefore, your minimum payment would be $1,000 x 0.15% or $15.00.

You’ll notice that the monthly interest rate is a very small number. That’s because it’s charged on a monthly basis, not annually like some other debts such as loans. Even though it’s a small number, it can add up quickly if you only make the minimum payments because the interest charges are applied to your balance every month.

If you have a high balance and/or a high APR, you could end up paying hundreds or even thousands of dollars in interest charges if you only make the minimum payments each month. That’s why it’s always best to pay as much as you can above the minimum payment each month to reduce your debt more quickly and save money on interest charges.

Interest

Interest is what you pay for the privilege of borrowing money, whether you’re using a credit card, taking out a loan, or using any other form of debt.

The amount of interest you pay depends on two things: the Annual Percentage Rate (APR) and the amount of time you carry a balance. The APR is the yearly cost of borrowing money, including any fees charged by the lender. The APR for credit cards is usually much higher than for other types of loans, such as mortgages or auto loans.

The second factor that determines how much interest you’ll pay is the amount of time you carry a balance. The longer you carry a balance, the more interest you’ll pay. This is because most credit card companies use a method called “average daily balance.” To calculate your average daily balance, they take the beginning balance on your statement date and add any new charges and subtract any payments or credits made during that billing cycle. They then divide that number by the number of days in the billing cycle. This gives them your average daily balance. Then they multiply your average daily balance by the number of days in the year (365) and multiply that number by your APR (usually given as a percentage). This gives them your total interest charge for the year.

Paying less than your full balance every month will increase the amount of time it takes to pay off your debt and will also increase the amount of interest you’ll pay over time.

Late Fees

Late fees are one of the most common charges associated with credit card usage, and they can be very costly. If you’re late on a payment, you’ll typically be charged a late fee of around $30. In some cases, this fee may be waived if you make your payment within a certain timeframe. However, if you’re habitually late on your payments, your credit card issuer may raise your interest rate or impose other penalties.

To avoid paying late fees, it’s important to understand how they work. Late fees are typically calculated as a percentage of your outstanding balance, with the exact amount depending on your credit card issuer. For example, if you have a balance of $1,000 and your credit card issuer charges a late fee of 3%, you’ll owe a late fee of $30.

If you’re unsure about your credit card’s late fee policy, you can find this information in the terms and conditions that came with your card. Alternatively, you can contact your credit card issuer to ask about their specific policy.

How to Calculate a Credit Card Payment

If you have a credit card, you probably want to know how to calculate your credit card payment. There are a few things to consider when calculating your payment, such as the interest rate, the balance, and the minimum payment. This article will walk you through the steps of how to calculate your credit card payment.

The Formula

P = the monthly payment

r = the monthly interest rate (decimal)

n = the number of payments

A = the loan amount

To calculate your monthly payment, simply plug your numbers into the formula above and hit calculate. For example, if you’re taking out a $10,000 loan with a 4% interest rate and you want to pay it off in three years, your monthly payment would be $299.10.

An Example

Here is an example of how to calculate a credit card payment using the minimum payment method. Let’s say you have a credit card with a balance of $1,000 and an interest rate of 18%. Your minimum payments would be calculated as follows:

First, you would calculate the monthly interest rate by dividing the annual interest rate by 12 (for the number of months in a year). In this example, that would be 18% ÷ 12, which equals 1.5%.

Next, you would multiply the monthly interest rate by the current balance on your credit card. In this example, that would be 1.5% x $1,000, which equals $15.

So, your minimum monthly payment would be $15.

Conclusion

Assuming you make only the minimum payment each month, it would take you approximately 41 years to pay off the $5,000 balance and you would end up paying more than $16,000 in interest. To repay the debt in 3 years, you would need to pay $174 each month. To repay the debt in 5 years, you would need to pay $120 each month. Paying more than the minimum payment each month will help you pay off your debt faster and save money on interest.