How to Get a 900 Credit Score in No Time

Contents

A 900 credit score is excellent and means you’re a low risk to lenders. You’re likely to get approved for loans and credit cards with the best interest rates and terms. Here’s how to get a 900 credit score in no time.

Checkout this video:

Check your credit report for any errors

The first step you need to take in order to start improving your credit score is to check your credit report for any errors. You can get a free copy of your credit report from each of the major credit bureaus (Experian, TransUnion, and Equifax) once every 12 months.

It’s important to check your report regularly for any errors because even one mistake could be dragging down your score. If you see anything on your report that doesn’t look right, be sure to dispute the error with the credit bureau.

Pay your bills on time

One of the best ways to improve your credit score is to pay your bills on time. Payment history is the biggest factor in calculating your credit score, and even one late payment can hurt your score. So make sure you’re setting up automatic bill pay or reminders so you never miss a payment.

Another way to improve your credit score is to use a credit monitoring service. Credit monitoring can help you track your progress and spot potential problems early. There are many great credit monitoring services available, so be sure to do your research to find one that’s right for you.

If you have any overdue bills, now is the time to pay them off. Not only will this improve your credit score, but it will also give you peace of mind. If you can’t afford to pay off the bill in full, try to negotiate a payment plan with the creditor. This will show that you’re trying to take care of your debts, and it will also help prevent further damage to your credit score.

Once you have a handle on your bills, it’s time to start working on increasing your credit limit. This can be done by getting a new credit card or by asking your current creditors for an increase. Having a higher credit limit will improve your credit utilization ratio, which is another important factor in calculating your credit score.

Last but not least, make sure you keep an eye on yourcredit report so you can dispute any errors that may be dragging down your score. You’re entitled to one free copy of your credit report every year from each of the major credit bureaus, so take advantage of this and check for errors regularly.

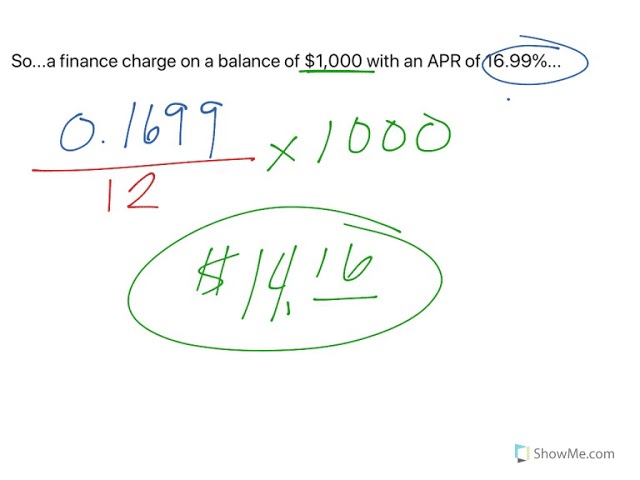

Keep your credit balances low

If you want to get a 900 credit score, you’re going to need to keep your credit balances low. A good rule of thumb is to keep your balances below 30% of your credit limit. That means if you have a credit card with a limit of $1,000, you should keep your balance below $300. The lower your balance, the higher your score will be.

In addition to keeping your balances low, you’ll also need to make sure you’re paying your bills on time. Payment history is one of the most important factors in your credit score, so it’s important to make sure you’re always making at least the minimum payment on time. If you can, it’s best to pay off your entire balance each month.

Finally, you’ll need to make sure you’re using a mix of different types of credit. This includes both revolving and installment loans. A mix of different types of credit shows lenders that you’re responsible with different types of debt, which can help increase your score even further.

Use a mix of credit products

There’s no one credit product that will get you a 900 credit score. You’ll need to use a mix of credit products, including installment loans (like auto or student loans) and revolving lines of credit (like credit cards), to get there. And you’ll need to use them responsibly, keeping your balances low and making your payments on time.

But if you’re not sure where to start, here are a few ideas:

– Get a secured credit card. A secured credit card is one that requires you to put down a deposit equal to your credit limit. This deposit acts as collateral in case you can’t pay your bill, so the issuer is more likely to approve you for this type of card. Just make sure you choose an issuer that reports your payments to the major credit bureaus, so you can build your credit history with this card.

– Become an authorized user on someone else’s account. If you know someone with good credit who trusts you, ask if you can become an authorized user on their account. This person will need to contact their issuer and provide them with your information, but once they do, you’ll be able to piggyback off their good credit and start building yours. Just make sure the account activity is reported to the major credit bureaus.

– Take out a small loan. You may be able to qualify for a small loan from a bank or credit union if you have some form of collateral, like a car or savings account. This can help you build your payment history and improve your credit score over time. And since the loan amount is typically small, it shouldn’t be too difficult to repay it in full and on time each month.

Apply for new credit sparingly

If you’re trying to get a 900 credit score in no time, one of the best things you can do is limit your applications for new credit. When you apply for a new credit card or loan, the lender will pull your credit report and this will result in a hard inquiry on your report.

While a single hard inquiry might not have a major impact on your score, multiple inquiries can together start to drag your score down. So, if you’re trying to get a 900 credit score, it’s best to limit your new applications to only when absolutely necessary.

Monitor your credit report regularly

Monitor your credit report regularly. Check it at least once a year, and more often if you see any suspicious activity. You can get a free copy of your credit report from each of the three major credit reporting agencies – Equifax, Experian and TransUnion – once every 12 months.

When you review your credit report, look for any inaccurate or incomplete information, and dispute anything that doesn’t look right. You can dispute inaccuracies with the credit bureau directly, or contact the company that provided the information to the credit bureau.

If you find anything on your credit report that needs to be fixed, take action right away. The sooner you start working to improve your credit score, the better.