What Bank Is Credit Karma on Plaid?

Contents

We get a lot of questions about which bank Credit Karma is on Plaid. Here’s the answer!

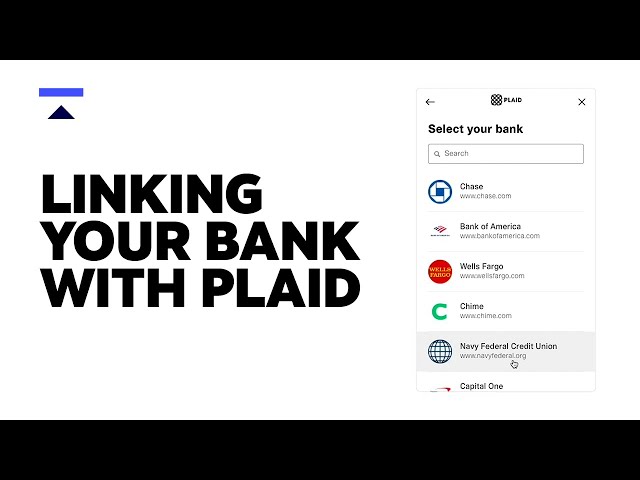

Checkout this video:

What is Credit Karma?

Credit Karma is a free service that provides you with your credit score and report, along with personalized recommendations on how to improve your credit. You can also use Credit Karma to check for errors on your credit report and dispute them if necessary. Credit Karma is available to everyone, regardless of whether you have good or bad credit.

What is Plaid?

Plaid is a financial technology company that provides a platform for consumer applications to connect with users’ bank accounts. Credit Karma is one of the many companies that use Plaid to provide their services.

What is the relationship between Credit Karma and Plaid?

Credit Karma is a personal finance company that offers free credit monitoring and reporting, along with other financial tools and resources. Plaid is a technology company that partners with financial institutions to help people more easily access their financial data.

Credit Karma has integrated with Plaid to provide its users with more comprehensive credit information. By connecting Credit Karma with your bank account, you can get an updated view of your spending and credit activity, as well as insights into your overall financial health.

How does this affect consumers?

Credit Karma is a financial technology company that provides free credit scoring and monitoring services to consumers. Consumers can also use Credit Karma to get personalized recommendations for credit cards, loans, and other financial products. Credit Karma is headquartered in San Francisco, California.

In January 2020, Credit Karma announced that it had entered into an agreement to be acquired by Intuit for $7.1 billion. Intuit is the maker of TurboTax, QuickBooks, and Mint.

The acquisition of Credit Karma by Intuit will likely have a positive impact on consumers. Intuit is a well-established company with a good reputation. The acquisition will give Intuit access to Credit Karma’s large database of consumer financial information. This will allow Intuit to provide even more personalized recommendations to consumers across its different products.