How to Run a Credit Check on a Tenant

Contents

As a landlord, you want to make sure you’re renting to a responsible tenant who will pay their rent on time and take care of your property. One way to screen tenants is to run a credit check.

In this blog post, we’ll show you how to run a credit check on a tenant. We’ll cover what information you need and how to interpret the results. By the end, you’ll have a better idea of whether a tenant is a good fit for your rental

Checkout this video:

Why run a credit check?

When you’re renting out your property, you want to make sure you’re getting a responsible, trustworthy tenant who will pay their rent on time and take care of your property. One way to screen potential tenants is to run a credit check.

A credit check will give you an idea of their financial responsibility and ability to pay their bills on time. It’s important to remember that a credit check is just one part of the screening process – you should also contact their references and do a background check.

How to run a credit check

A credit check is a vital part of the screening process for any tenant. By running a credit check, you can get an idea of the tenant’s financial history and whether or not they will be able to pay rent on time. There are a few different ways to run a credit check, so let’s get into the details.

Order a credit report

The first step in running a credit check on a tenant is to order a credit report. You can order a credit report from any of the major credit reporting agencies, such as Experian, TransUnion, or Equifax. There are also a number of online companies that specialize in tenant credit reports, such as Rentprep or TenantScreening.

Once you have ordered the report, you will need to provide the following information:

-The tenant’s name, date of birth, Social Security number, and current address

-Your name, address, and contact information

-The property address where the tenant will be living

You will also need to provide your payment information. Most credit reporting agencies will charge a small fee for the report. Once you have provided all of the required information, the agency will generate a report that includes the tenant’s credit history and score.

Check for accuracy

The first thing you should do when you get a tenant’s credit report is to check it for accuracy. Look for any errors, such as incorrect Personal Identification Information (PII), misspelled names, and wrong addresses. If you find errors, you can contact the credit bureau to have them corrected.

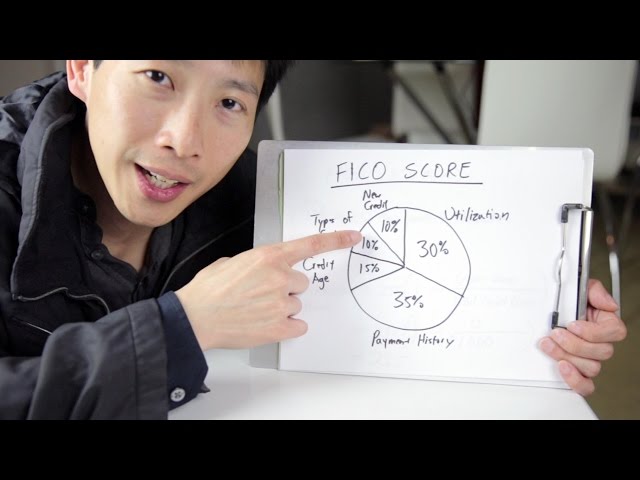

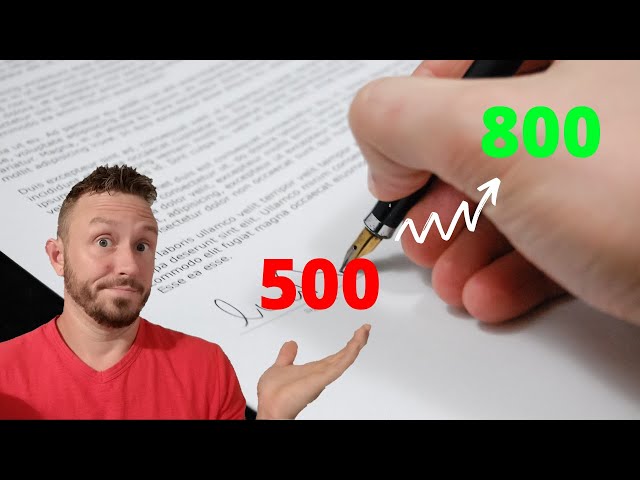

Next, you’ll want to take a look at the tenant’s credit score. This is a number that ranges from 300 to 850 and is used by landlords to get an idea of how well the tenant has managed their finances in the past. The higher the score, the better.

You should also look at the tenant’s payment history, which will show you whether they’ve made any late payments on their debts in the past. This information can be helpful in predicting whether or not the tenant will make their rental payments on time in the future.

Finally, you’ll want to look at the tenant’s debt-to-income ratio (DTI). This is a measures of how much of the tenant’s income is going towards paying off debts each month. A high DTI can signal that the tenant may have difficulty making their rent payments on time if they have other debts to pay off as well.

What to do with the results of the credit check

After you have run a credit check on a tenant, it is important to know what to do with the results. The credit check will give you an idea of the tenant’s financial responsibility and whether or not they are likely to pay their rent on time. It is important to review the credit report carefully and make a decision based on the information that is contained in it.

If the tenant has bad credit

A credit check is an important part of the tenant screening process, but it’s not the only factor to consider. If the tenant has bad credit, you’ll need to take a closer look at their rental history and employment situation to get a better idea of whether or not they’ll be a good fit for your property.

Here are some things to keep in mind when evaluating a tenant with bad credit:

-Rental history: Does the tenant have a history of late rent payments or evictions? If so, that’s a red flag.

-Employment situation: Is the tenant employed full-time and stable in their job? If not, they may be at risk of falling behind on rent.

-Current financial situation: Is the tenant currently dealing with any financial difficulties, such as large medical bills or student loans? If so, that could put them at risk of defaulting on rent.

Ultimately, you’ll need to use your best judgment when deciding whether or not to rent to a tenant with bad credit. If you have any doubts, it’s always best to err on the side of caution and look for another applicant.

If the tenant has good credit

If the tenant has good credit, you can be relatively confident that they will pay their rent on time and take care of the property. You may want to consider offering them a discount on their rent or other perks.