Why Is My Child Tax Credit Pending This Month?

Contents

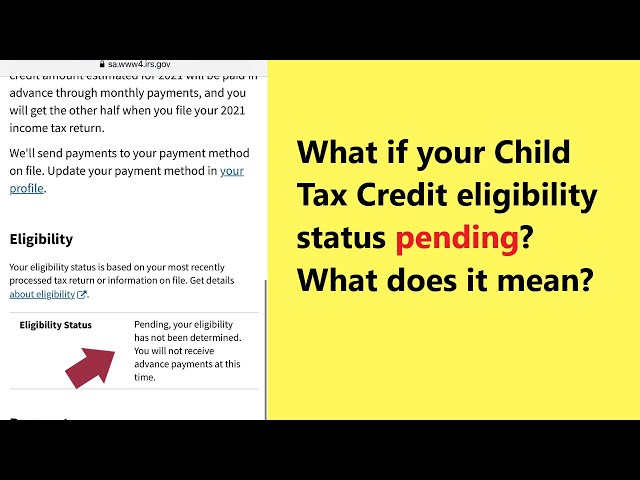

If you’re wondering “Why is my child tax credit pending this month?”, you’re not alone. Many parents are asking the same question. Here’s what you need to know.

Checkout this video:

Reasons for Pending Child Tax Credit

Your Child Tax Credit (CTC) may be pending this month for a variety of reasons. The CTC is a federal program that helps families with children, providing tax breaks and other financial assistance. To be eligible, your child must be under the age of 17 and you must have filed your taxes for the year. If you have questions about your CTC or other tax-related matters, you should speak to a tax professional.

The IRS needs more information from you

If you see that your Child Tax Credit is pending this month, it means that the IRS needs more information from you in order to process your claim. Here are some of the reasons why the IRS might need more information:

-You didn’t provide enough information on your tax return.

-The IRS needs to verify your income.

-The IRS needs to verify that you’re a U.S. citizen or resident alien.

-The IRS needs to verify that you have a qualifying child.

If you think that there’s an error on your tax return, you should contact the IRS right away. You can find their contact information on their website.

You haven’t filed your taxes yet

If you haven’t filed your taxes yet, the IRS won’t have any record of your child or children. You’ll need to file your taxes as soon as possible in order to receive the credit.

You or your spouse owe money to the IRS

If you owe money to the IRS, the government may withhold your refund to cover the debt. This includes past-due federal tax debt, federal student loan debt, or money owed to other federal agencies, such as the U.S. Department of Housing and Urban Development or the Department of Veterans Affairs. The government may also withhold your refund to offset unpaid child support or federal debts such as federally guaranteed student loans.

How to Check the Status of Your Child Tax Credit

The most common reason for a Pending status on your Child Tax Credit is that the IRS needs more information from you. The IRS may need clarification on your income, filing status, or the number of children you have. You can check the status of your Child Tax Credit by logging into your account on the IRS website.

Check the “Where’s My Refund?” tool on the IRS website

If you’re wondering why your child tax credit is pending this month, the first place to check is the “Where’s My Refund?” tool on the IRS website. This tool will provide you with updates on the status of your refund, as well as information on when you can expect to receive it.

If you’re still having trouble understanding why your child tax credit is pending, you can also contact the IRS directly for help. The IRS customer service number is 1-800-829-1040, and they are available Monday through Friday, 7 a.m. to 7 p.m. local time.

Check your tax return

If you filed your taxes electronically, you can check the status of your tax refund by logging in to your account on the IRS website. If you filed a paper return, you can call the IRS Refund Hotline at 1-800-829-1954 to check the status of your refund.

You will need to provide your social security number, filing status, and the exact amount of your refund. The IRS updates refund information once per week, so if you check back regularly, you should be able to get a good idea of when your refund will be processed.

Contact the IRS

If you’re wondering how to check the status of your child tax credit, the best thing to do is contact the IRS.

The IRS has a special hotline for people who have questions about their taxes. The number is 1-800-829-1040, and the hours are Monday through Friday, 7 a.m. to 7 p.m. local time.

When you call, have your Social Security number and your most recent tax return handy. The IRS agent will be able to pull up your information and tell you where you stand with your child tax credit.

What to Do If Your Child Tax Credit Is Pending

If you are expecting to receive the child tax credit this month and it is pending, there are a few things you can do. The first thing you should do is check with the IRS to see if there are any problems with your tax return. If there are no problems, then the credit may just be delayed. You can also check with your state’s tax agency to see if they are experiencing any delays in processing the credit.

Gather the required information

If you’re like most parents, you want to make sure that you’re taking full advantage of all the tax breaks available to you. The child tax credit is one of the biggest and most popular tax breaks for families with young children.

The child tax credit can be worth up to $2,000 per qualifying child, depending on your income. If you have more than one qualifying child, you can claim the credit for each one.

However, there are a few conditions that must be met in order to qualify for the credit. For example, your child must be under the age of 17 at the end of the year in order to qualify. Additionally, the child must be a U.S. citizen or resident alien in order for you to claim the credit.

If your child meets all of the requirements but you are still having trouble claiming the credit, it could be because your child tax credit is pending this month. Here’s what you need to know about why your child tax credit is pending and what you can do about it:

The first thing you need to do is gather all of the required information. This includes your Social Security number, your child’s Social Security number, and your most recent tax return. You will also need proof of income, such as W-2 forms or 1099 forms. Once you have all of this information, you will be able to begin the process of claiming your child tax credit.

File your taxes

If you want to receive the child tax credit, you must file your taxes. The IRS uses the information on your tax return to determine if you’re eligible for the credit and how much you can receive.

If you don’t file taxes, you won’t receive the credit. Even if you’re not required to file taxes, it may be beneficial for you to do so in order to claim the credit.

If you have questions about whether or not you should file taxes, you can speak with a tax professional or use the IRS’s online tool, Do I Need to File a Tax Return?

Contact the IRS

If you have questions about your Child Tax Credit, the best thing to do is contact the IRS. You can reach them by phone at 1-800-829-1040.