When Does Your Credit Score Update?

Contents

Your credit score is a number that represents your creditworthiness. It’s used by lenders to decide whether to give you credit.

Your credit score is updated constantly, but how often it changes depends on the type of information that’s being reported to the credit bureaus.

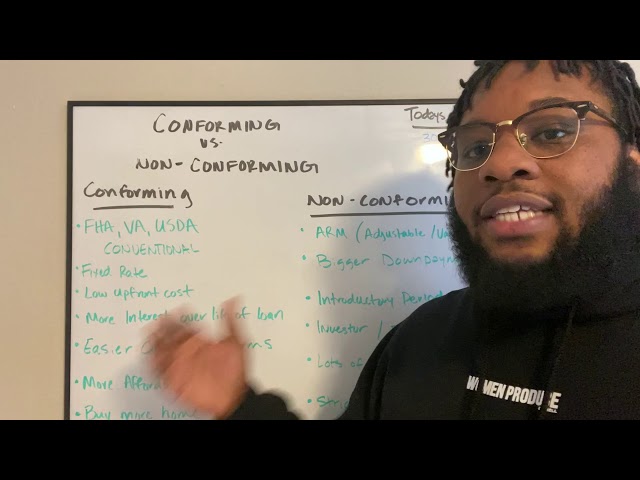

Checkout this video:

The Basics of Your Credit Score

Your credit score is a number that represents your creditworthiness. It is based on your credit history, which is a record of your borrowing and repayment activity. The higher your score, the more likely you are to be approved for a loan or credit card. Your score is updated periodically, typically every month.

What is a credit score?

A credit score is a three-digit number that lenders use to decide whether to give you a loan and at what interest rate. It is based on information in your credit report, which includes your borrowing history and how well you have repaid your debts.

Your credit score is important because it can affect the interest rate you are offered on a loan, as well as whether you are approved for a loan at all. A high credit score indicates to lenders that you are a responsible borrower who is likely to repay your debts on time, while a low credit score may make it more difficult for you to get a loan or may result in you being offered a loan with a higher interest rate.

What is a FICO score?

Your FICO score is a number that represents your credit risk. It is used by lenders, including credit card issuers, to help them decide whether to give you a credit card and how much of a credit limit to extend to you. The higher your FICO score, the better your chances are of being approved for a credit card and the higher your credit limit will be.

FICO scores range from 300 to 850, and the vast majority of people fall into the 700 to 749 range. A score of 750 or above is considered excellent, and a score of 700 to 749 is considered good. A score of 650 to 699 is considered fair, while a score of 550 to 649 is poor.

Your FICO score is based on information in your credit report. That information includes things like how much debt you have, whether you make your payments on time, and how long you have been using credit. The most important factor in your FICO score is your payment history — whether you have made all of your payments on time.

How Your Credit Score is Calculated

Your credit score is important because it is used to determine the interest rates you will be offered on loans. A high credit score means you will be offered a lower interest rate, and a low credit score means you will be offered a higher interest rate. Your credit score is also used to determine if you will be approved for a loan.

The five factors that make up your credit score

Your credit score is a number that indicates how likely you are to repay a loan. The higher your score, the more likely you are to repay the loan. The lower your score, the less likely you are to repay the loan.

Your credit score is made up of five factors: payment history, credit utilization, credit history length, mix of credit types, and new credit.

Payment history: This is the most important factor in your credit score. It accounts for 35% of your score. Payment history includes whether you have made payments on time or late and whether you have ever defaulted on a loan or had a collection.

Credit utilization: This is the second most important factor in your credit score. It accounts for 30% of your score. Credit utilization is how much of your available credit you are using at any given time. For example, if you have a credit card with a limit of $1,000 and you have a balance of $500, then your credit utilization would be 50%. The lower your utilization, the better for your score.

Credit history length: This factor accounts for 15% of your credit score. Credit history length is how long you have been using credit. The longer you have been using credit, the better it is for your score.

Mix of credit types: This factor accounts for 10% of yourcredit score. Mix of credit types is the variety of different types of loans that you have in yourcredit history . For example , if you have a mortgage , an auto loan , and twocredit cards , that would be considered a mixof four different typesof credits . A mixof credits can show thatyou can manage various typesof debts responsibly .

New Credit: This factor accounts for 10%of yourcredit score . New Credit includes any new linesof creditsuch as acredit card or loan thatshows up onyourcredit report . Applyingfor new linesof credittoo often can sometimesloweryourcredit score because it looks likeyou’re tryingto borrowa lotof money all atonce .

How these five factors are weighted

Credit scoring models typically consider five categories of information when calculating your score. The importance, or weight, of each category depends on the credit scoring model used.

Payment history (35%)

Your payment history is the most important factor in your credit score. It accounts for about 35% of your score. Payment history includes whether you’ve made all your payments on time, as well as any late or missed payments in the last seven to 10 years.

Amounts owed (30%)

Amounts owed accounts for about 30% of your credit score and reflects the types and number of accounts you have, as well as how much of your available credit you’re using. This is also known as credit utilization or debt-to-credit ratio. The lower this percentage is, the better it will be for your score. A good rule of thumb is to keep your credit utilization below 30%.

Credit history (15%)

Reflecting how long you’ve been managing credit, credit history is also sometimes called length of credit history or length of time at current job – 15%

Credit mix (10%)

The “credit mix” refers to the variety of types of borrowing in your credit history. Creditors like to see that you’re able to handle different types of credit responsibly. Credit mix is 10%

New credit (10%)

Opening several new accounts in a short period can hurt your score because it looks like you’re taking on new debt too quickly – 10%

When Does Your Credit Score Update?

Your credit score is a three-digit number that lenders use to assess your creditworthiness. A high credit score means you’re a low-risk borrower, which could lead to a lower interest rate on a loan. A low credit score could lead to a higher interest rate and could mean you won’t be approved for a loan at all. So, when does your credit score update?

How often your credit score is updated

Your credit score is updated regularly, typically every month. The exact date of the update depends on the credit reporting agency, but it generally falls around the same time each month.

If you check your credit score and see that it’s changed, there are a few possible explanations. One is that your payment history or credit utilization has changed since the last update. Another possibility is that a lender has updated their information with the credit reporting agency.

If you’re trying to improve your credit score, it’s important to check it regularly so you can track your progress. You can get free access to your credit score through a number of personal finance websites, including Credit Karma and NerdWallet.

What causes your credit score to change?

There are a number of factors that can cause your credit score to change, including:

-Missing a payment: If you miss a payment on a debt, your credit score will likely go down.

-Paying off debt: If you pay off a debt, your credit score will likely go up.

-Opening a new account: If you open a new credit card or loan, your credit score may go down slightly, because you have more debt.

-Closing an account: If you close a credit card or loan, your credit score may go up slightly, because you have less debt.

-Having a high balance on an account: If you have a high balance on a credit card or loan, your credit score may go down.

– lowering your credit limit: If you lower your credit limit, your credit score may go down.

How to Check Your Credit Score

Your credit score is a snapshot of your financial health at a given moment. It’s important to keep tabs on your credit score because it can affect your ability to get a loan, credit card, or mortgage. The higher your credit score, the better your chances of getting approved for financing. There are a few ways to check your credit score.

How to check your credit score for free

Most major credit card issuers and some financial institutions offer free access to your credit score. If your issuer or bank doesn’t provide this service, you can get a free credit score from one of the many websites that do.

To get a free credit score, you’ll usually have to provide your name, address, date of birth, Social Security number and other personal information. Some sites also require you to create an account. Once you’ve provided this information, the site will run a soft credit check, which won’t impact your score.

You can usually check your credit score as often as you want without it affecting your score. However, if you apply for new credit or a loan, lenders will do a hard inquiry on your credit report, which can temporarily lower your score by a few points.

How to interpret your credit score

Your credit score is a number that reflects the risk you pose to lenders, based on your credit history. A higher score indicates less risk, and a lower score indicates more risk. The most widely used credit scoring model is the FICO® Score, which ranges from 300 to 850.

Here’s how to interpret your FICO® Score:

· 720-850: Excellent

· 690-719: Good

· 630-689: Fair

· 550-629: Poor

300-549: Very Poor

If you have a high score, you’re in good shape for approval from most lenders for the credit products you’re interested in. If you have a low score, you may still be able to get some credit products, but you may pay higher interest rates and fees.