What is the Highest Credit Score?

Contents

What is the highest credit score you can have? This is a common question that people ask when they are trying to improve their credit. The answer may surprise you.

Checkout this video:

What is a credit score?

Your credit score is a number that represents your creditworthiness. It is used by lenders to determine whether you are a good candidate for a loan and what interest rate you will be offered. A high credit score means you are a low-risk borrower, which means you will be offered a lower interest rate. A low credit score means you are a high-risk borrower, which means you will be offered a higher interest rate.

The most popular credit score in the United States is the FICO® Score, which ranges from 300 to 850. The higher your score, the lower your risk of default and the lower your interest rate will be.

The following table shows the breakdown of FICO® scores:

300 – 579: Very Poor

580 – 669: Fair

670 – 739: Good

740 – 799: Very Good

800 – 850: Excellent

If you have a very poor or fair credit score, you may still be able to get a loan but you will likely pay a higher interest rate. If you have an excellent credit score, you will qualify for the best interest rates and terms available.

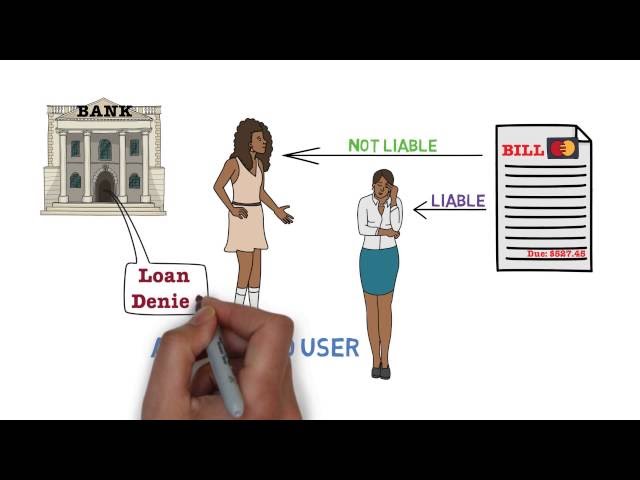

How is a credit score calculated?

Your credit score is calculated using your credit report, which is a record of your credit activity that includes the likes of your loans, credit cards, and bill payments. This information is then used to calculate your score, which lenders use to evaluate your creditworthiness.

There are a few different factors that go into calculating your score, including:

-Payment history: This accounts for 35% of your score and includes whether you pay your bills on time.

-Credit utilization: This makes up 30% of your score and refers to the amount of credit you’re using compared to the amount you have available.

-Credit history: This comprises 15% of your score and looks at how long you’ve been using credit.

-Credit mix: This comprises 10% of your score and looks at the variety of types of credit you have, such as revolving lines of credit (e.g., credit cards) and installment loans (e.g., student loans).

-New credit: This comprises 10% of your score and refers to any new applications for credit you’ve made in the last 12 months.

Keep in mind that these percentages can vary depending on the scoring model used by potential lenders. And while there’s no magic number for what constitutes a “good” credit score, generally speaking, a score of 700 or above is considered good while anything below 600 is considered poor.

What is the highest credit score?

There are many different credit scoring models in use today, and each one assigns its own range of scores. However, the most widely used model is the FICO score, which ranges from 300 to 850. The highest possible credit score is 850.

How can I improve my credit score?

There are a number of ways to improve your credit score, but the most important thing you can do is to make sure that all the information on your credit report is accurate. You can get a free copy of your credit report from each of the three major credit bureaus every year at AnnualCreditReport.com. If you find any errors, dispute them with the credit bureau right away.

Another way to improve your credit score is to make sure you are using no more than 30% of your available credit on each credit card. For example, if you have a credit card with a $1,000 limit, you should try to keep your balance below $300. This is called your “credit utilization ratio” and it is one of the most important factors in your credit score.

You can also improve your credit score by paying down your debts, especially those with high interest rates. This will lower your “debt-to-income ratio” which is another important factor in your credit score. Finally, don’t open any new lines of credit that you don’t need, as this can also lower your score.