How Is Credit Score Calculated?

Contents

A credit score is a numerical expression based on a statistical analysis of a person’s credit files, to represent the creditworthiness of that person.

Checkout this video:

The Basics of Credit Scores

Your credit score is a key part of your financial health. It’s a number that lenders use to decide whether to give you a loan and what interest rate to charge. A high credit score means you’re a low-risk borrower, which could lead to a lower interest rate on a loan. A low credit score could lead to a higher interest rate and could mean you won’t be approved for a loan at all. In this article, we’ll cover the basics of credit scores and how they’re calculated.

What is a credit score?

A credit score is a number that represents the creditworthiness of an individual. It is a statistical measure used by lenders to determine whether an individual is likely to repay a loan. The higher the credit score, the more likely the individual is to repay the loan. A credit score is also known as a FICO score, which is the name of the company that developed the scoring system.

The FICO score ranges from 300 to 850, and the higher the score, the better. However, it’s important to note that there is no magic number at which you are guaranteed to get approved for a loan. Lenders will also consider other factors, such as your income and debts, when making their decision.

There are many different factors that go into calculating a credit score. Some of the most important are listed below:

-Payment history: This accounts for 35% of your score and includes information on whether you have made your payments on time.

-Credit utilization: This accounts for 30% of your score and measures how much of your available credit you are using at any given time. It’s important to keep your usage low in order to maintain a good score.

-Credit history: This accounts for 15% of your score and includes information on how long you have had each of your accounts open. The longer you have been using credit responsibly, the better.

-Credit mix: This accounts for 10% of your score and measures the variety of types of credit you have, such as revolving (e.g., credit cards) and installment (e.g., loans). Having a mix of different types of credit can help boost your score.

-New credit: This accounts for 10% of your score and measures how often you have applied for new lines ofcredit in recent months. Too many applications in a short period of time can be a red flag for lenders.

What is a FICO score?

FICO scores are the credit scores most lenders use to determine your credit risk. A FICO score is a three-digit number between 300 and 850—the higher, the better.

Credit scores are based on information in your credit reports. They show how likely you are to repay a loan or credit card debt. FICO scores are used by most lenders, and by three of the four largest U.S. credit reporting agencies (Equifax, Experian and TransUnion).

FICO scores are also used by some landlords, employers and utility companies to decide whether to do business with you.

What’s in a FICO score?

Your FICO score considers five categories of information in your credit report:

-Payment history (35%)—Do you pay your bills on time?

-Amounts owed (30%)—How much debt do you have?

-Length of credit history (15%)—How long have you been using credit?

-Credit mix (10%)—Do you have a mix of different types of credit accounts? For example, a mortgage, car loan and student loans.

-New credit (10%)—Have you applied for any new loans or lines of credit recently?

How is credit score calculated?

Credit scoring is used by financial institutions to help make decisions about whether to approve loan applications and how much interest to charge on loans. The credit score is calculated based on information from the applicant’s credit report, which includes information on the applicant’s payment history, outstanding debt, and credit history.

There are a variety of credit scoring models in use today, but the most common is the FICO® score, which was developed by Fair Isaac Corporation. The FICO® score ranges from 300 to 850, with a higher score indicating a lower risk of default.

Several factors are used to calculate a person’s FICO® score, including:

-Payment history: This is one of the most important factors in determining your credit score. It includes information on whether you have made your payments on time and whether you have been late or missed payments.

-Amounts owed: This information is used to calculate your debt-to-credit ratio, which is one of the most important factors in determining your credit score. It includes information on how much debt you have and how much credit you have available.

-Credit history: This is a measure of how long you have been using credit and how well you have managed your credit over time. It includes information on whether you have ever been late with a payment or had an account sent to collections.

-Credit mix: This is a measure of the types of credit you have, including revolving accounts such as credit cards and installment loans such as auto loans or mortgages.

-New credit: This is a measure of how often you have applied for new credit in the past 12 months.

The Five Components of a Credit Score

Your credit score is a number that represents your creditworthiness. It is used by lenders to determine whether or not you are a good candidate for a loan. Your credit score is made up of five components: payment history, credit utilization, credit history, credit mix, and new credit. Let’s take a closer look at each of these components.

Payment history

Payment history is the most important factor in any credit score calculation, making up 35% of the total. Payment history includes whether you have made all of your payments on time, and if not, how late they were. Any missed payments will be reflected on your credit report and will likely result in a lower credit score. For this reason, it’s important to always make your payments on time, even if it’s just the minimum amount due.

Credit utilization

Credit utilization, which makes up 30% of a FICO score, is the amount of debt you have compared to your credit limits. It’s important to keep your balances low — 10% or less of the credit limit is ideal — because creditors see high balances as a sign that you’re more likely to get into trouble financially.

Length of credit history

One of the five components that make up a credit score is length of credit history, which is based on the date the first account was opened. A longer credit history is better than a shorter one, because it shows you’ve been managing debt responsibly for a longer period of time.

Length of credit history accounts for 15% of a FICO score, so it’s an important factor to consider when you’re trying to improve your credit score. However, it’s not the only factor that matters. Payment history (35%), credit utilization (30%), credit mix (10%), and new credit (10%) are all important factors as well.

Credit mix

One component of your credit score is credit mix, which looks at the types of credit you have. A good mix includes revolving debt, like credit cards, and installment debt, like auto loans or student loans. This shows lenders that you can handle different types of debt responsibly.

New credit

Credit mix: This component of your credit score looks at the different types of debt you have. Creditors like to see that you can manage different types of debt responsibly.

New credit: This component of your credit score looks at how often you are applying for new credit. Applying for too much new credit at once can be a red flag for creditors.

The Three Credit Bureaus

There are three credit bureaus in the United States which are Equifax, Experian, and TransUnion. They all use different methods to calculate your credit score. However, the most important factor that they look at is your payment history. If you have a history of making late payments, your credit score will suffer.

Equifax

Equifax is a credit reporting agency (CRA) that provides credit reports, credit scores, and other financial information to businesses and consumers.

Equifax collects and maintains information on more than 800 million consumers and 91 million businesses worldwide.

-FCRA compliance

-Identity theft protection

-Consumer assistance

-Business services

Experian

Experian is one of the three major credit bureaus in the United States. It is one of the largest consumer credit information services in the world. Experian collects and compiles information on more than 220 million individual consumers and more than 27 million businesses worldwide.

TransUnion

One of the three major credit bureaus, TransUnion, uses the FICO Score 8 scoring model to calculate your credit score. This is the most widely used credit score model in the US.

Your TransUnion FICO Score 8 is based on information in your TransUnion credit report at the time it is requested. Information that could affect your score include:

-Payment history

-Credit utilization

-Account balances

-Age of credit history

-Recent credit activity

-Available credit

Improving Your Credit Score

Your credit score is important because it is used by lenders to determine whether or not to give you a loan and at what interest rate. A higher credit score means you’re a lower-risk borrower, which could lead to lenders offering you better terms. There are a few things you can do to improve your credit score, and we’ll cover them in this article.

Pay your bills on time

One of the most important things you can do to improve your credit score is to pay your bills on time. Payment history is the biggest factor in your credit score, accounting for 35% of your score. So, if you’ve been making payments late or skipping them altogether, you’ll likely see a drop in your credit score. Conversely, if you have a good payment history, you’ll likely see your score go up.

Another thing to keep in mind is that late payments can stay on your credit report for up to seven years, so it’s important to make sure you pay on time going forward. You can set up automatic payments with most creditors so you never have to worry about missing a payment again.

Keep your balances low

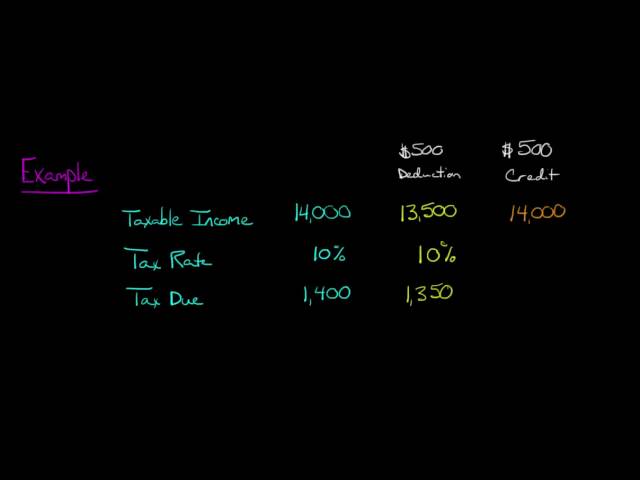

One factor that is used to calculate your credit score is your credit utilization ratio. This is the amount of debt you have compared to the amount of credit you have available. For example, if you have a $1,000 balance on a credit card with a $5,000 credit limit, your credit utilization ratio would be 20%.

It’s important to keep your credit utilization ratio low — ideally below 30% — because it shows lenders that you’re using a responsible amount of credit. If your ratio is too high, it could indicate that you’re overextended and may have trouble making payments.

Use credit cards wisely

Credit cards can be a great way to improve your credit score if used wisely. Make sure you always make your payments on time and in full. If you only make the minimum payment, it will take you a long time to pay off your debt and your credit score will suffer. You should also try to keep your credit card balances low. If you can, aim for using no more than 30% of your credit limit on each card. This demonstrates to lenders that you can be responsible with borrowing money.

Monitor your credit report

Your credit score is a number that indicates your creditworthiness. Lenders use your credit score, along with other factors, to decide whether or not to give you a loan and what interest rate to charge you. A higher credit score means you’re seen as a lower-risk borrower, which could lead to getting a lower interest rate on a loan. A lower credit score could lead to a higher interest rate and could mean you won’t be approved for a loan at all.

You can check your credit score for free with Credit Sesame to see where you stand and track your progress over time.

There are two main types of credit scores: FICO® Scores and VantageScores. FICO® Scores are the most widely used credit scores, so we’ll focus on those in this article. Credit Sesame uses TransUnion’s VantageScore 3.0 model to calculate your score because it’s generally more forgiving than other scoring models and gives you a more holistic view of your finances. However, both scoring models use similar methods to calculate your score.

Your credit score is calculated using five key factors:

-Payment history: This makes up 35% of your FICO® Score. It includes things like whether you make your payments on time, how often you miss payments, and how long it takes you to pay off your debts.

-Credit utilization: This makes up 30% of your FICO® Score and refers to the amount of debt you have compared to the amount of available credit you have—in other words, how much of your available credit you’re using at any given time.

-Credit age: This makes up 15% of your FICO® Score and refers to the length of time each account has been open, as well as the age of your oldest account and the average age of all accounts on your report.

-Credit mix: This makes up 10% of your FICO® Score and refers to the different types of accounts—for example, revolving (like credit cards) versus installment (like student loans)—that appear on your report.

-New Credit inquiries: This makes up 10% of your FICO® Score and refers to when you’ve applied for new lines of credit in the past 12 months or so. Multiple inquiries in a short period can hurt your score because they indicate that you might be taking on too much new debt—but rate shopping for a mortgage or auto loan is an exception and won’t count against you as long as all inquiries occur within 14 days of each other.