How to Calculate Simple Interest on a Loan

Contents

How to Calculate Simple Interest on a Loan. You can use this simple interest calculator to figure out the amount of interest on a loan.

Checkout this video:

What is simple interest?

Simple interest is a quick and easy way to calculate the interest charge on a loan. It is simpler than compound interest because it is only based on the principal amount of the loan, and not on the accumulated interest of previous periods. To calculate simple interest, you need to know the principal amount, the annual interest rate, and the term of the loan.

How is simple interest calculated?

Simple interest is calculated by multiplying the daily interest rate by the principal by the number of days that elapse between payments.

The daily interest rate is determined by dividing the annual percentage rate by 365.

For example, assume you take out a $1,000 loan with a 10% APR and make no additional payments. The table below shows how your simple interest charge accrues over time.

| Days | Interest | Balance |

|———-|—————|—————|

| 1-30 | $0.27 | $1,027 |

| 31-60 | $0.25 | $1,052 |

| 61-90 | $0.23 | $1,075 |

| 91-120 | $0.21 | $1,096 |

As you can see from the table, the daily interest accrued on the loan after day 30 is not as much as it was during the first month because the balance of the loan has decreased.

What are the benefits of simple interest?

Simple interest is a quick and easy way to calculate the interest charged on a loan. It is often used for short-term loans, such as credit card debt or a car loan.

The main benefit of simple interest is that it is easy to calculate. You simply multiply the loan amount by the interest rate, and then multiply that by the number of days that have passed since you took out the loan.

Simple interest is also a good option if you plan on making extra payments on your loan. With simple interest, you only pay interest on the principal balance of the loan. This means that any extra payments you make will go directly towards reducing the principal balance.

Another benefit of simple interest is that it charges interest for a shorter period of time than compound interest. With compound interest, interest is charged on both the principal and the accumulated interest, which can add up quickly over time.

Simple interest can be a good option if you are looking for a low-cost way to finance a purchase. However, it is important to shop around and compare different lenders before taking out a loan.

How to calculate simple interest

Simple interest is money you earn or pay for the use of money you borrow. It’s calculated as a percentage of the principal, which is the amount of money you borrowed. The principal is the amount of money you borrowed, and the interest rate is the percentage of the principal that you’re charged for borrowing the money.

How to use the simple interest formula

Simple interest is money you can earn by investing your money. It’s also the amount that a lender charges for borrowing money. You can calculate simple interest at any time using the simple interest formula.

Here’s how it works: Suppose you invest $1,000 at a 10% annual rate of return. After one year, you would have earned $100 in interest (($1,000 x 0.10 = $100).

To calculate simple interest, you need to know the principal (the amount of money borrowed or invested), the rate (the percentage of interest charged per year), and the time (the length of time the money is invested or borrowed).

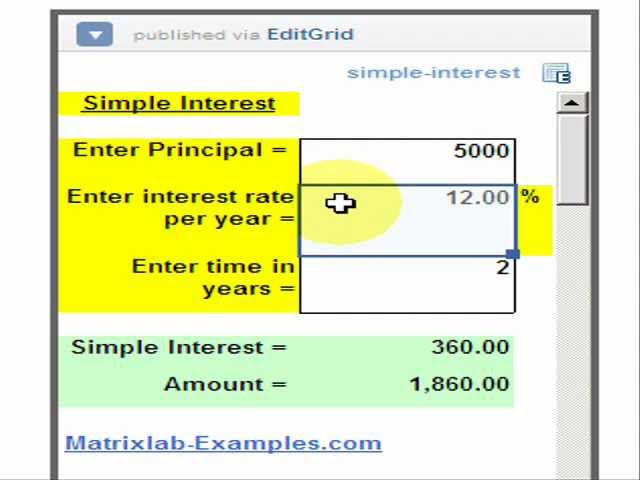

How to use an online simple interest calculator

An online simple interest calculator is a great tool to help you calculate the interest on your loan. All you need is the amount of the loan, the term of the loan, and the interest rate. You can typically find this information on your loan paperwork.

To use an online simple interest calculator, simply enter these values into the appropriate fields and click “calculate.” The calculator will then determine the total amount of interest you will pay over the life of your loan. This can be a useful tool to help you budget for your loan payments and understand the true cost of borrowing money.

What to do with the simple interest amount

Simple interest is the amount of money that is added to the principal of a loan. It is calculated as a percentage of the original loan amount and is typically paid back over the life of the loan. The simple interest amount can be used to calculate the total interest amount that will be paid on the loan.

Use it to make extra payments

Simple interest is the amount of interest earned or paid on a loan, free of any charges or fees. To calculate simple interest, multiply the principal (or initial loan amount) by the interest rate and the length of time the money is borrowed (also called the term of the loan). The result will be the total amount of simple interest you’ll either earn or pay over that period.

Assuming you’re making payments on a loan with simple interest, you can use your periodic payments to make additional principle payments. This will reduce both your total interest costs as well as the length of your loan.

Use it to pay off the loan early

Simple interest is the amount of interest that accrues on a loan without taking into account compounding. Because simple interest is not compounded, it’s often used on short-term loans such as auto loans and personal loans. You can also use simple interest to calculate the interest due at the beginning of a loan or during its repayment period.

To calculate simple interest, use the following formula:

simple interest = P x R x T

P = principal amount of the loan

R = annual interest rate (expressed as a decimal)

T = number of years of the loan