Use Our VA Loan Calculator to Determine How Much You Can Afford

Contents

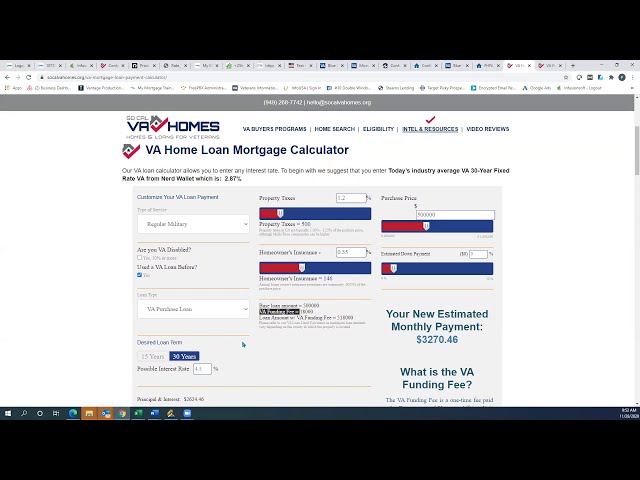

Use this VA Loan Calculator to help you determine how much you can afford. By inputting your monthly obligations and income, we can help you calculate a comfortable monthly loan payment.

Checkout this video:

How to Use the VA Loan Calculator

Veterans and active duty military members have access to unique home loan benefits. One of the most powerful of these is the VA loan, which can help you buy a home with little to no money down. You can use our VA loan calculator to determine how much you can afford. This loan calculator will take into account your income, debts, and other factors to help you get an estimate of what you can afford.

Enter your personal information

In order to use our VA Loan Calculator, you will need to enter some personal information. This includes your:

-Total income (before taxes)

-Monthly debt obligations (credit card payments, car payments, etc.)

-Current mortgage information (if applicable)

After you have entered all of the required information, our VA Loan Calculator will provide you with an estimate of how much you can afford to spend on a new home.

Enter your financial information

To start, you’ll need to enter some basic financial information into the VA Loan Calculator. This includes your:

-Gross monthly income

-Monthly debts (including credit card, car and student loan payments)

-Estimated monthly property taxes and insurance

-Home’s purchase price

Once you have all of this information, you’ll be able to see how much you can afford to spend on a home and how much your monthly payment will be. You can also see how much you could save by using a VA Loan.

Enter your desired loan amount

The first step is to enter the desired loan amount. You can do this by either making a single entry for the entire amount or by entering a down payment amount and then selecting whether you would like to finance the remaining balance or not.

If you have a down payment, you will need to decide whether to finance the remaining balance or not. If you choose to finance the balance, you will need to enter the interest rate and term length of the loan.

The next step is to select your credit score range. This will help determine the interest rate and maximum loan amount for which you may qualify.

The final step is to click on the “Calculate” button. This will calculate your monthly payment and provide you with a breakdown of the interest and principal paid each year.

How the VA Loan Calculator Works

The Department of Veterans Affairs (VA) Loan Calculator is designed to help service members, veterans, and eligible surviving spouses estimate how much they can afford to borrow for a VA-backed home loan. The calculator uses information from the VA’s county-level limits to calculate loan amounts. All you need to do is enter your military status, the state in which the home will be located, and the county where the home will be located.

The VA Loan Calculator uses your personal and financial information to calculate how much you can afford to borrow

When you use the VA Loan Calculator, you will need to input your personal and financial information. This includes your income, debts, and any other financial obligations you have. Based on this information, the calculator will determine how much you can afford to borrow.

The VA Loan Calculator is a great tool to help you determine how much you can afford to borrow. However, it is important to remember that this is just a calculation and not an official loan pre-approval. To get pre-approved for a VA loan, you will need to submit a complete loan application to a lender.

The VA Loan Calculator takes into account your income, debts, and the current interest rate

The VA Loan Calculator is a free online tool that helps you estimate your monthly loan payments. It also helps you see how much you can afford to borrow based on your income, debts, and the current interest rate.

To use the VA Loan Calculator, simply enter your information into the fields provided. Then, click the “Calculate” button. Your results will appear below.

The VA Loan Calculator is a great tool for Veteran homebuyers or their families who are planning to use a VA loan to finance their home purchase. It can also be used by real estate professionals who are helping Veteran homebuyers with their search.

The VA Loan Calculator also considers your down payment and the length of the loan

To use our VA Loan Calculator, simply enter your desired monthly payment, down payment, and loan length, and we’ll calculate your estimated maximum loan amount. The VA Loan Calculator also considers your credit score, as this can impact the interest rate you’ll pay on your loan.

What to Do if the VA Loan Calculator Says You Can’t Afford the Loan

If you’re looking to take out a VA loan, you can use our VA loan calculator to determine how much you can afford. However, if the calculator says you can’t afford the loan, there are still options available to you. We’ll go over what you can do in this situation.

If the VA Loan Calculator says you can’t afford the loan, you may need to adjust your budget

If you’re a veteran or active duty service member, you may be eligible for a VA loan. VA loans are available for both home purchases and refinancing, and can offer some great benefits, like no down payment and no private mortgage insurance (PMI). However, one thing to keep in mind is that VA loans are subject to the same qualification standards as any other loan type – which means you’ll need to prove that you can afford the monthly payments.

If you’re not sure how much you can afford, our VA Loan Calculator can help. Just enter your information and we’ll give you an estimate of what your monthly payments could be.

If the calculator says you can’t afford the loan, don’t despair. There are a few things you can do to try and improve your chances of qualifying:

-Adjust your budget: Take a close look at your budget and see where you can cut back in order to free up more money for your mortgage payment. Even small changes can make a big difference.

-Get a cosigner: If you have good credit but don’t make a lot of money, you may be able to get someone with strong credit and income to cosign your loan. This will make it more likely that you’ll be approved for the loan.

-Look for programs for low-income buyers: There are programs available that can help low-income buyers afford a home. For example, the USDA has a program called Section 502 which offers loans with no down payment for rural properties.

You may also need to consider a different type of loan

If you’re a veteran or active military member, you may be eligible for a VA loan. VA loans offer several benefits, including no down payment and no private mortgage insurance (PMI). However, even if you’re eligible for a VA loan, the loan calculator may tell you that you can’t afford the loan.

There are a few reasons why this could happen:

– You have other debts that need to be paid first

– You have a low credit score

– You have a high debt-to-income ratio

If the loan calculator says you can’t afford the loan, you may need to consider a different type of loan. FHA loans are available to borrowers with a credit score as low as 580. And, if you have a down payment of 10% or more, you can get an FHA loan with a credit score as low as 500. If you’re not eligible for a VA loan or an FHA loan, you may need to consider a conventional loan. Conventional loans typically require a higher credit score and a down payment of 5% or more.

If you’re still not sure, you can always consult with a financial advisor

If you’re still not sure whether or not you can afford the VA loan, it’s always a good idea to consult with a financial advisor. A financial advisor can help you determine if you’re able to afford the loan and can offer guidance on how to budget for your new home.