How Long Does It Take To Get An Eidl Loan?

Contents

How Long Does It Take To Get An Eidl Loan? We have the answer!

Checkout this video:

Applying for an EIDL

The first step in applying for an EIDL is to fill out an application. The application will ask for information about your business, including contact information, business location, and the number of employees. You will also need to provide financial information, such as your business’s revenue and expenses. After you have submitted your application, a loan officer will review it and determine if you are eligible for an EIDL.

How to qualify

The Small Business Administration’s Economic Injury Disaster Loan program provides low-interest loans of up to $2 million to small businesses and nonprofits that have suffered substantial economic injury as a result of the coronavirus (COVID-19) pandemic.

To be eligible for an EIDL, you must:

-Be based in the United States with a physical place of business

-Have suffered substantial economic injury as a result of the coronavirus pandemic

-Be unable to obtain credit elsewhere

To apply for an EIDL, you will need to fill out and submit a short online application. You will also need to provide:

-Your business’s tax information

-Your personal tax information (if you are self-employed)

-Your business’s financial statements

-A description of how your business has been affected by the coronavirus pandemic

How to apply

The first step is to get logged into the SBA Disaster Loan Portal. You will be asked to create an account if you don’t already have one.

The application consists of seven parts:

– Personal information (name, social security number, address, business information)

– Legal entity information (type of business, ownership structure)

– Economic injury information (purpose for loan, how disaster has impacted your business)

-Financial information (revenues and expenses, assets and liabilities)

– Personal financial statement (for each owner with 20% or more ownership stake in the business)

– Authorization and certification (to authorize the release of tax return information and certify that the information provided is true and correct to the best of your knowledge)

– Disclaimer and signature ( acknowledging that you understand the terms and conditions of the loan)

How long it takes to get an EIDL

EIDL stands for Economic Injury Disaster Loan.It is a long-term, low-interest loan from the Small Business Administration(SBA).The SBA says that it can take up to 21 days to get your loan,but some people have reported that it takes longer.

Factors that affect the timeline

The amount of time it takes to get an EIDL loan can vary depending on a number of factors. The most important factor is how quickly you get your application and supporting documentation to the SBA. If you complete and submit your application online, you should receive a confirmation email within 24 hours. However, it can take up to 10 days for your application to be processed.

Other factors that can affect the timeline include:

-The size of your business

-The number of employees

-Your business revenue

-Your business location

-The disaster declaration date

The average timeline

The average timeline for the EIDL process is 21 days from the time you submit your application to the time you receive your loan disbursement.

Of course, this timeline can vary depending on a number of factors, including:

-The size and complexity of your business

-How quickly you submit required documentation

-The current workload of the SBA loan officer assigned to your case

-Any additional information the SBA requests from you during their review

If you are approved for an EIDL, you will receive a loan disbursement within 5-10 days from the date of approval.

What to do if your application is taking longer than expected

The EIDL loan process can be lengthy, and sometimes it can feel like your application is taking forever. However, there are a few things you can do if your application is taking longer than expected. First, make sure you have completed all the required paperwork. Second, reach out to your loan officer and see if they have any update. Lastly, be patient and don’t give up!

Check the status of your application

If your application is taking longer than expected, the best thing to do is check the status of your application online. You can do this by logging into your account and clicking on the “My Applications” tab. Once you click on this tab, you will be able to see the status of your application, as well as any messages from the SBA.

Contact the SBA

If your EIDL loan application is taking longer than expected, you may want to contact the Small Business Administration (SBA) directly. You can reach the SBA by calling 1-800-659-2955 or by email at [email protected].

How to use your EIDL

EIDL loans can be a great way to get the funding you need to start or expand your small business. The process is simple and straightforward, and you can get the money you need in as little as two weeks. But how long does it actually take to get an EIDL loan? We’ll explore the timeline of the EIDL loan process so you can be prepared for every step.

What you can use the loan for

The loan can be used for a wide variety of purposes, such as:

– replenishing inventory

– paying for employee salaries and benefits

– meeting increased production demands due to COVID-19

– paying rent or mortgage payments

– repaying debt

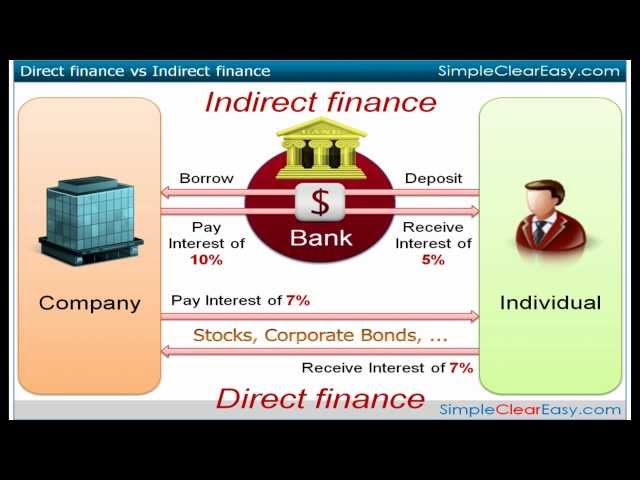

How to repay the loan

EIDLs are low-interest loans that can provide up to $2 million in working capital. The terms of the loan are determined by the Small Business Administration (SBA). There is no collateral required, and the loan does not need to be repaid if the business is closed.

The SBA will work with you to determine a repayment schedule that is affordable for your business. You will need to begin repaying the loan within one year of receiving the funds, unless you have been granted a deferral. The interest rate on an EIDL is 3.75%, and you will be responsible for paying all interest and fees associated with the loan.