How to Get a Loan for Home Renovations

Contents

Learn how to get a loan for home renovations by following these steps. You can find the right lender and get the best deal on your loan by following these tips.

Checkout this video:

Home Improvement Loans

Types of home improvement loans

There are a few different types of home improvement loans that you can choose from, depending on your needs and situation. Here are some of the most common types of loans that people use for home renovations:

1. Home equity loan: This is a second mortgage on your home, and you can use the equity that you’ve built up to finance your renovation project. Because this is a secured loan, it usually comes with a lower interest rate than other types of loans.

2. Personal loan: This is an unsecured loan that you can use for any purpose, including home renovations. Personal loans usually come with higher interest rates than other types of loans, but they can be easier to qualify for.

3. HELOC: A home equity line of credit is a line of credit that’s secured by your home’s equity. You can use the funds from a HELOC for anything you want, including home renovations. HELOCs usually have lower interest rates than other types of loans, but they can be more difficult to qualify for.

4. Government grant: If you’re doing energy-efficient renovations, you may be able to get a government grant to help cover the cost of your project. Grants are usually only available for specific projects or purposes, so make sure to do your research before applying for one.

How to get a loan for home renovations

Almost any type of loan can be used for home renovations, but the most common are personal loans, home equity loans and lines of credit, and credit cards. The best option for you will depend on the amount of money you need to borrow and your financial situation.

Personal loans:

Personal loans can be taken out for a set amount of time with set repayments, making them ideal for large projects that will be paid off over several months or years. They usually have lower interest rates than credit cards, but you’ll need to have good credit to qualify for the best terms.

Home equity loans and lines of credit:

If you own your home and have equity in it, you can use a home equity loan or line of credit to finance renovations. These types of loans come with low interest rates and flexible repayment terms, but they require collateral (your home) so they’re not ideal for everyone.

Credit cards:

A final option is to finance your renovations with a credit card. This can be a good option if you only need to borrow a small amount of money or if you need the flexibility to pay for materials as you go. However, credit cards usually have high interest rates so this option should be used with caution.

Home Equity Loans

A home equity loan is a type of secured loan, which uses your home as collateral. This means that if you fail to repay the loan, the lender could repossess your home. Home equity loans are usually much cheaper than unsecured personal loans, but they are still a big financial commitment. Home equity loans can be used for a variety of purposes, such as home improvements, debt consolidation, or other major expenses.

What is a home equity loan?

A home equity loan is a type of second mortgage. Your “first” mortgage is the one you used to purchase your home, but you can place additional loans against the property as well—in this case, using your home equity. These loans are popular because they allow homeowners to access a large amount of cash, usually at a lower interest rate than credit cards or unsecured personal loans. And unlike refinancing, a home equity loan doesn’t require you to start making payments all over again from scratch.

To qualify for a home equity loan, you must have significant equity in your house — enough that you could sell it at market value and pay off your mortgage with cash to spare. Lenders typically only offer loans equal to 80% to 85% of your available loan-to-value (LTV) ratio to limit their exposure in case the market value of your home decreases. So if your home is currently valued at $300,000 and you owe $200,000 on your mortgage, you might be able to borrow up to $40,000 through a home equity loan — 80% of $300,000 equals $240,000, minus the $200,000 you already owe equals $40,000.

How to get a home equity loan

A home equity loan is a lump sum of cash that’s essentially borrowed against the equity of a home. Equity is the difference between the appraised value of your house and what you currently owe on your mortgage.

If you need money to pay for home renovations, a new roof, or other expensive repairs, a home equity loan may be the solution. Here’s what you need to know about how to get a home equity loan, including how much you can expect to pay in interest and fees.

Personal Loans

Personal loans can be used for a variety of purposes, including home renovations. If you’re looking to get a loan for home renovations, there are a few things you’ll need to keep in mind. First, you’ll need to find a lender that offers personal loans. There are a variety of lenders out there, so be sure to shop around and compare rates. Once you’ve found a lender, you’ll need to fill out an application and provide some documentation. Be sure to read over the loan terms and conditions before signing anything.

What is a personal loan?

A personal loan is a type of loan that is typically used for personal expenses, such as home renovations, medical bills, or consolidating debt. Personal loans are often unsecured, which means they are not backed by collateral, such as a house or car. This makes personal loans a riskier proposition for lenders, which generally results in higher interest rates than secured loans.

How to get a personal loan

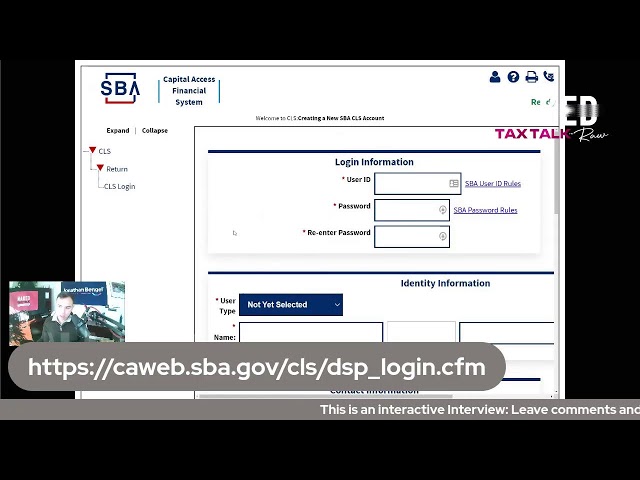

There are a few different ways to get a personal loan. You can go through a bank or credit union, apply for a loan through an online lender, or get a loan from a peer-to-peer lending platform.

Each type of lender has its own pros and cons, so it’s important to compare your options before you decide on a loan. For example, banks tend to have lower interest rates but stricter eligibility requirements. Online lenders may have higher interest rates but they might be more flexible when it comes to creditworthiness.

If you’re not sure where to start, you can use a prequalification tool to compare personal loans from multiple lenders at once. This will give you an idea of what interest rate you could qualify for and how much money you could borrow.

Once you’ve found a few personal loans that fit your needs, it’s time to start the application process. When you apply for a personal loan, you’ll need to provide some basic information about yourself, such as your name, address, and date of birth. You’ll also need to share your financial information, including your income, debts, and assets.

After you submit your application, the lender will review your information and make a decision about whether or not to approve your loan. If you’re approved, the lender will provide you with an offer detailing the terms of your loan. Make sure to review the offer carefully before accepting it. Once you accept an offer, the lender will send the money directly to your bank account.