What is a Brokered Loan?

Contents

A brokered loan is a type of financing that is obtained through a broker, rather than through a direct lender. Brokered loans are often used by people with bad credit or by businesses that are looking for a large amount of financing.

Checkout this video:

What is a brokered loan?

A brokered loan is a loan that is arranged by a broker. The broker brings together the borrower and the lender and acts as a middleman between them. The broker takes a fee for their services, which is usually a percentage of the loan amount.

Brokered loans can be useful for people who have difficulty qualifying for a loan from a traditional lender, such as a bank. They can also be used to get more favorable terms than the borrower would be able to get on their own.

however, brokered loans can also be more expensive than loans obtained directly from a lender. This is because the broker’s fee will increase the overall cost of the loan. Borrowers should carefully compare all offers before deciding on a loan.

How do brokered loans work?

A brokered loan is a type of loan where the borrower works with a broker to find a lender. The broker is usually paid a fee by the borrower or the lender, or both. Brokered loans can be for personal loans, business loans, mortgages, and more.

The broker will collect information from the borrower about their financial situation and what they are looking for in a loan. The broker will then work with their network of lenders to try to find a loan that meets the borrower’s needs. Once a loan is found, the broker will help to facilitate the process of getting the loan approved and funded.

Brokered loans can be a good option for borrowers who are having trouble qualifying for a loan on their own. They can also be a good option for borrowers who do not have time to shop around for loans on their own. However, borrowers should be aware that brokered loans may come with higher fees than loans that are obtained directly from a lender.

What are the benefits of a brokered loan?

When you get a loan through a broker, the broker will work with a variety of banks and financial institutions to find you the best deal on your loan. The benefit of this is that the broker can often find you a better interest rate or other terms than you could get on your own.

The disadvantage of using a broker is that you will generally have to pay the broker a fee for their services. This fee can be a percentage of the loan amount or a flat fee.

What are the risks of a brokered loan?

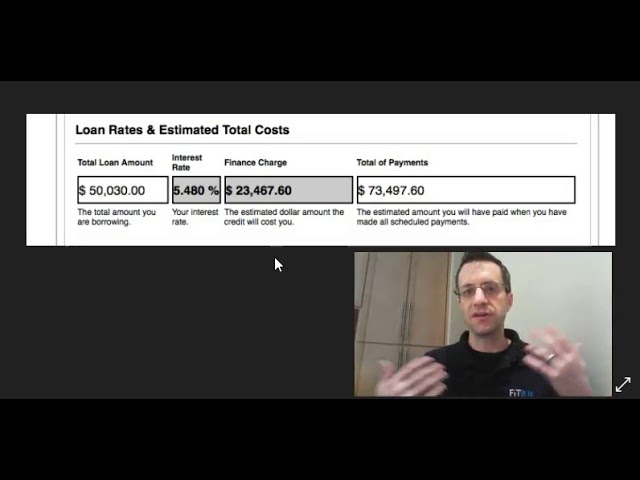

There are a few risks to be aware of before taking out a brokered loan. One is that the loan may have a higher interest rate than if you went directly to a lender. This is because the broker will charge a fee for their services, which will be passed on to you in the form of a higher interest rate.

Another risk is that the broker may not be able to find a lender willing to give you a loan. This could happen if your credit score is low or if you’re asking for a large loan amount. If the broker isn’t able to find a lender, you’ll have to look for one yourself, which could take time and be frustrating.

Finally, there’s always the possibility that the broker could give your personal information to lenders without your knowledge or consent. This could lead to multiple lenders contacting you and trying to sell you their products, which could be annoying and overwhelming. To avoid this, make sure you only work with reputable brokers who have good privacy policies in place.

How can I get a brokered loan?

A brokered loan is a type of loan that is arranged by a broker. The broker works with a number of lenders and will try to get you the best deal possible. Brokered loans can be used for a variety of purposes, including buying a new home, refinancing an existing loan, or taking out a personal loan.

In order to get a brokered loan, you will first need to find a broker. There are a number of ways to do this, including asking your bank or financial institution if they can recommend a broker, or searching online for brokering services. Once you have found a broker, you will need to provide them with some information about your financial situation and what type of loan you are looking for. The broker will then work with the lenders to find you the best deal possible.

Brokered loans can be a great way to get the best interest rate possible on a loan. However, it is important to remember that brokers typically charge a fee for their services. This fee can vary depending on the broker and the type of loan you are looking for. Be sure to ask about any fees before you agree to use a brokering service.