How Long Does It Take to Get an SBA Loan?

Contents

The answer to this question depends on a number of factors, including the type of loan you’re applying for and the lender you’re working with. However, in general, the process of getting an SBA loan can take anywhere from a few weeks to a few months.

Checkout this video:

SBA Loan Application Process

The SBA loan process can seem long and daunting, but if you follow the steps and remain patient, you will eventually get the loan you need. The first step is to gather all the required documentation. This includes tax returns, bank statements, and financial statements. Once you have all the documentation, you will need to fill out the loan application.

SBA Loan Application

The first step in the SBA loan application process is to fill out the SBA form 1920. This form must be filled out completely and accurately. Once you have submitted the form, you will need to provide additional documentation to the SBA. This documentation includes financial statements, tax returns, and a business plan. The SBA will review your application and determine whether or not you are eligible for an SBA loan. If you are approved, you will be required to sign a promissory note and provide collateral for the loan.

SBA Loan Approval

The SBA loan approval process can take anywhere from a few days to a few months. The exact timeline depends on a number of factors, including the type of loan you’re applying for and the lender you’re working with.

The first step in the SBA loan approval process is to submit your loan application. Once your application is received, the SBA will review it to make sure you meet their eligibility requirements. If you do, they will send your loan package to one or more participating lenders.

The participating lender(s) will then review your loan package and decide whether or not to approve your loan. If they approve it, they will send you a commitment letter outlining the terms of the loan. Once you accept the terms of the loan, the lender will disburse the funds to you.

SBA Loan Types

The SBA loan process can seem daunting, but it doesn’t have to be. In this article, we’ll break down the different types of SBA loans and how long it takes to get each one. We’ll also give you some tips on how to speed up the process.

7(a) Loan

The 7(a) loan program is the Small Business Administration’s most popular program. SBA 7(a) loans are offered through banks, credit unions and other lenders that partner with the SBA. These loans can be used for working capital, to refinance debt or to buy a business, real estate or equipment.

The maximum loan amount is $5 million and the interest rate is based on the prime rate plus a margin. The term of the loan is generally 10 years for working capital and 25 years for real estate. There is no minimum credit score required, but you will need to provide collateral for loans over $25,000.

To qualify for a 7(a) loan, you must have a strong credit history and be able to show that you have the financial ability to repay the loan. The SBA does not lend money directly to small businesses, but it does guarantee a portion of the loan, which reduces the risk to the lender and makes it more likely that you will be approved for financing.

504 Loan

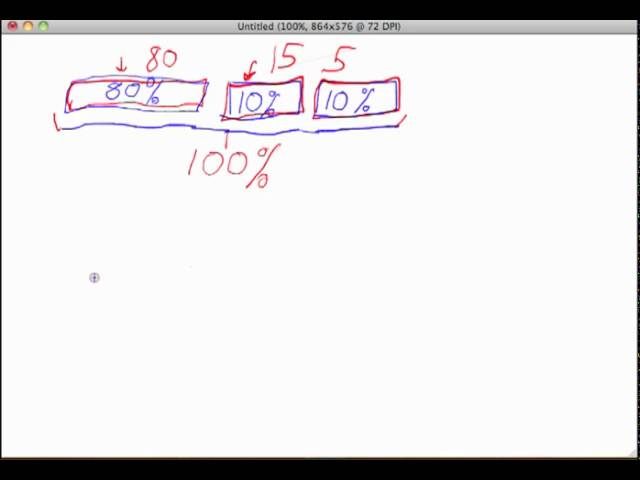

The SBA 504 Loan is specifically for businesses that need to purchase or improve fixed assets, like land or a building. This type of loan is perfect for businesses that plan on expanding their operations or increasing production. With a 504 loan, business owners can put down as little as 10% and still get competitive rates and long-term financing.

Microloan

The SBA’s Microloan Program provides very small loans to start-up, newly established, or growing small business concerns. Microloans can be used for working capital or the purchase of inventory, supplies, furniture, fixtures, machinery, and/or equipment.

The maximum microloan is $50,000. The average microloan is about $13,000.

Terms can range from six months to five years; the average term is three years. Interest rates are variable and are generally between 8% and 13%.

The SBA makes funds available to designated intermediary lenders who in turn make loans to eligible borrowers in their service areas.

SBA Loan Terms

The Small Business Administration (SBA) is a U.S. government agency that provides financial assistance to small businesses. SBA loans are made by banks and other lenders, and the SBA does not lend money directly to small businesses. SBA loan terms can vary depending on the lender, but the maximum repayment term is usually 10 years.

Loan Maturity

The maturity date is the last day you can make a loan payment. Your maturity date will be different from your disbursement date, which is the first day you can receive loan proceeds.

The final maturity date for most 7(a) loans cannot exceed 10 years from the date of the first disbursement. For working capital loans, the maximum maturity is 7 years. For real estate loans, the maximum maturity is 25 years.

Interest Rates

The Small Business Administration (SBA) sets the maximum interest rates that lenders can charge on 7(a) loans. The current maximum interest rate ranges from 7.50% – 10.00%, depending on the size of the loan and the amount being borrowed. These rates are updated every January 18, 2019.

Fees

The SBA guarantee fee is a percentage of the total loan amount. The fee is paid to the SBA by the lender and is non-refundable.

The guarantee fee for 7(a) loans is:

-2.75% for loans up to $350,000

-3.375% for loans between $350,001 and $2 million

-4% for loans over $2 million

How to Get an SBA Loan

The first step in getting an SBA loan is to fill out the SBA loan application. This can be done online or in person at a local SBA office. Once you have submitted your application, the SBA will review it and determine whether or not you are eligible for a loan. If you are approved, you will be contacted by a lending officer who will help you through the next steps.

SBA Loan Application

The SBA loan application process can take anywhere from a few days to a few weeks. The length of time it takes to get an SBA loan depends on a number of factors, including the lender, the type of loan you’re applying for, and your own personal qualifications.

Here’s a general overview of what you can expect during the SBA loan application process:

1. Research different lenders and compare rates, terms, and conditions.

2. Gather the required documents, including your business tax returns, financial statements, and a detailed business plan.

3. Fill out the online loan application or contact the lender to start the process.

4. The lender will review your application and supporting documents to determine if you qualify for an SBA loan. If you do, they will send you a formal offer outlining the terms and conditions of the loan.

5. You will have a chance to review the offer and decide whether or not to accept it. If you accept it, you’ll sign the paperwork and officially become an SBA borrower!

SBA Loan Approval

The Small Business Administration (SBA) is a federal agency that provides support to small businesses through a variety of programs and services. One of the most popular programs offered by the SBA is their loan program.

SBA loans are attractive to small business owners because they offer competitive interest rates and flexible repayment terms. But how long does it take to get approved for an SBA loan?

The answer to that question depends on a number of factors, including the type of loan you are applying for and the lender you are working with. The SBA does not directly approve or deny loan applications. Instead, they provide guidelines and support to lenders who then make the final decision on whether or not to approve a loan.

Generally speaking, the approval process for an SBA loan can take anywhere from a few days to a few weeks. But in some cases, it can take longer. The best way to ensure a quick and easy approval process is to work with an experienced SBA-approved lender. They will be familiar with the SBA’s requirements and processes and can help you through every step of the application process.

When to Get an SBA Loan

Many people don’t realize that the SBA loan process can take quite a while – anywhere from a few weeks to a few months. If you’re thinking about getting an SBA loan, it’s important to start the process as early as possible. This way, you’ll have plenty of time to gather all the required documents and information.

SBA Loan Application

The SBA loan application process can take anywhere from a few days to a few weeks. The length of time it takes to get an SBA loan depends on a number of factors, including the type of loan you’re applying for, the lender you’re working with, and your own personal circumstances.

The first step in the SBA loan application process is to fill out the necessary paperwork. This includes the Standard Form 424 (which is used for all federal government contracting), as well as the SBA’s own forms and documents. Once you’ve completed the paperwork, you’ll need to submit it to the SBA for review.

Once your application is received, the SBA will review it to make sure you meet their eligibility requirements. If you do, they’ll send your application on to a participating lender. The lender will then review your application and make a decision about whether or not to approve your loan.

If your loan is approved, the next step is to finalize the terms of your loan agreement. This includes things like interest rates, repayment schedules, and other important details. Once everything has been finalized, you’ll be ready to start making payments on your loan.

The entire process from start to finish can take anywhere from a few days to a few weeks. It’s important to remember that the timing can vary depending on the type of loan you’re applying for, the lender you’re working with, and your own personal circumstances. If you have any questions about how long it will take to get an SBA loan, be sure to ask your lender for more information.

SBA Loan Approval

The Small Business Administration (SBA) does not lend money directly to small business owners. Instead, the agency provides a guarantee to banks and lenders that encourages them to approve loans for qualified borrowers.

SBA-backed loans are attractive to small business owners because they offer lower interest rates and longer repayment terms than traditional bank loans. However, the approval process can take several weeks or even months.

Here is a typical timeline for the SBA loan approval process:

1. The small business owner completes an application and submits it to the lender.

2. The lender reviews the application and determines whether the borrower qualifies for an SBA-backed loan.

3. If the borrower qualifies, the lender submits the loan application to the SBA for approval.

4. The SBA reviews the loan application and makes a decision within 10 days.

5. If the loan is approved, the lender disburses the funds to the borrower.