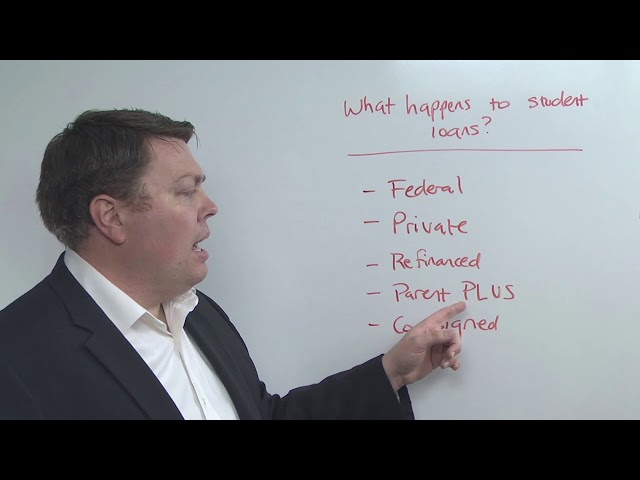

What Happens to Student Loan Debt When You Die?

Contents

What happens to student loan debt when you die? This is a question that many people have, especially given the current state of the economy. While there is no one definitive answer, there are a few things to keep in mind. First, it’s important to understand that student loan debt is not like other types of debt. It is not dischargeable in bankruptcy, which means that the debt will still need to be paid even if you can’t afford it. Additionally, if you die,

Checkout this video:

Introduction

When you die, your student loan debt does not disappear. Your loan balance will still need to be paid off by either your cosigner or your estate. If you have a private student loan, your cosigner may be required to immediately repay the full outstanding balance of the loan. If you have a federal student loan, the debt may be discharged if the borrower or cosigner dies.

What Happens to Student Loan Debt When You Die?

If you have student loan debt, you might be wondering what happens to it when you die. Unfortunately, the answer is not so simple. It depends on a few factors, such as the type of loan you have and whether or not you have a co-signer. In this article, we’ll go over what happens to student loan debt when you die so that you can be prepared.

Federal student loan debt

When you die, your federal student loan debt is discharged. This means that you or your estate will no longer be responsible for repaying the debt. Your family members will not be responsible for the debt either.

To have your federal student loan debt discharged, you must submit a copy of your death certificate to your loan servicer. You can get a death certificate from the funeral home or from the Vital Records office in the state where the death occurred.

If you have a private student loan, the rules are different. Private student loans are not discharged when you die. If you die with a private student loan, your family members may be responsible for repaying the debt.

Private student loan debt

Most private student loans are not dischargeable in bankruptcy, which means that the debt will still be owed even if the borrower dies. In some cases, the lender may agree to discharge the debt if the borrower or co-signer can prove that repaying the loan would cause them undue hardship.

How to Protect Your Family from Student Loan Debt After Your Death

If you die with student loan debt, it’s important to know what will happen to that debt and how it could affect your family. Student loan debt is generally not dischargeable in bankruptcy, so your family may be responsible for repaying the debt if you die. There are a few ways to protect your family from this burden, and we’ll explore them in this article.

Make a plan

No one likes to think about what will happen after they die, but if you have student loan debt, it’s important to have a plan in place for your family. Student loan debt is not discharged after your death, which means that your family will be responsible for repaying the loans.

There are a few things you can do to make sure your family is prepared to handle your student loan debt:

-Make a list of all of your loans and lenders. Include the contact information for each lender, as well as the balance and interest rate for each loan. This will give your family a good starting point when they begin dealing with your student loan debt.

-Talk to your family about your student loan debt and make sure they are aware of the responsibility they will assume after you die. It’s important to have an open and honest conversation about money so that everyone is on the same page.

-Consider setting up a trust or estate plan that includes provisions for your student loan debt. This can help ensure that the loans are paid off in a timely manner and that your family does not experience any financial hardship as a result of your death.

Student loan debt can be a burden for families, but with some planning, it doesn’t have to be. By taking these steps, you can help protect your loved ones from financial difficulties after you’re gone.

Include your student loan debt in your will

It is important to include your student loan debt in your will in order to protect your family from having to pay off the debt after your death. You can do this by including a clause in your will that states that the debt will be forgiven in the event of your death. This will ensure that your family is not burdened with the debt and they will not have to worry about paying it off.

Consider life insurance

One of the best ways to protect your family from student loan debt after your death is to take out a life insurance policy. If you have a life insurance policy, the death benefit can be used to pay off any outstanding student loan debt. This will ensure that your family is not left with this burden after you pass away.

There are two main types of life insurance policies: term life insurance and whole life insurance. Term life insurance policies provide coverage for a specific period of time, typically 10, 20, or 30 years. Whole life insurance policies provide coverage for your entire life.

When considering a life insurance policy, you should consider your needs and goals. If you have young children, you may want to consider a longer-term policy so that the death benefit can be used to cover their education costs. If you are closer to retirement age, you may want to consider a shorter-term policy so that the death benefit can be used to cover any outstanding debts or final expenses.

No matter what type of life insurance policy you choose, make sure that you name your beneficiaries properly. You should also keep your life insurance policy in a safe place where your loved ones can easily find it after your death.

Conclusion

Though student loan debt is generally not dischargeable through bankruptcy, there are some circumstances in which debt may be forgiven. For example, if the borrower dies, the debt may be forgiven. Additionally, if the borrower becomes disabled, the debt may be forgiven. Finally, if the borrower is able to show that repayment would cause undue hardship, the court may forgive part or all of the debt.