What Do You Need for a Business Loan?

Contents

Are you thinking about applying for a business loan? Here’s what you need to know. Read on to learn more about the requirements for a business loan.

Checkout this video:

Types of Business Loans

There are four primary types of business loans, each with its own set of benefits and drawbacks:

1. SBA Loans: SBA loans are government-backed loans offered by traditional lenders, such as banks and credit unions. The Small Business Administration (SBA) guarantees a portion of the loan, which makes these loans less risky for lenders and more accessible for small businesses. Interest rates on SBA loans are typically lower than rates on other types of business loans, but the approval process can be lengthy.

2. Business Credit Cards: Business credit cards offer a quick and easy way to access funding, and they can be used for a variety of purposes. However, business credit cards typically have high interest rates and fees, so they should only be used for short-term needs or in emergencies.

3. Merchant Cash Advances: Merchant cash advances provide businesses with a lump sum of cash in exchange for a percentage of future sales. These advances are typically easier to qualify for than other types of financing, but they come with high interest rates and fees. Merchant cash advances should only be used as a last resort.

4. Invoice Financing: Invoice financing is a type of short-term funding that allows businesses to borrow against outstanding invoices. This can be a helpful way to access capital if you have customers who take longer to pay their invoices. However, invoice financing typically comes with high fees and interest rates.

How to Get a Business Loan

Before you can get a business loan, you need to have a few things in place. First, you need to have a well-written business plan. This will give potential lenders an idea of your business’s goals and how you plan to achieve them. You’ll also need to have some financial projections for your business. These projections should show that your business is capable of repaying the loan. Lastly, you’ll need to have good personal credit. Lenders will look at your personal credit history to see if you’re a good risk. If you have all of these things in place, you’re ready to start shopping for a business loan.

Find the right lender

When you’re looking for a business loan, the first step is to find the right lender. There are many different types of lenders out there, each with their own strengths and weaknesses. It’s important to find a lender that matches your needs.

Some things to consider when you’re choosing a lender include:

-The interest rate: The interest rate is one of the most important factors to consider when you’re choosing a loan. Make sure to compare interest rates from different lenders before you make a decision.

-The term length: The term length is the amount of time you have to repay the loan. shorter terms usually have higher interest rates, but they may be easier to repay. Longer terms usually have lower interest rates, but they may be more difficult to repay.

-The fees: Some lenders charge origination fees, processing fees, or other fees. Make sure to compare the total cost of the loan from different lenders before you make a decision.

-Your credit score: Your credit score will affect the interest rate you qualify for. If you have a good credit score, you may be able to get a lower interest rate. If you have a bad credit score, you may have to pay a higher interest rate.

Research the requirements

Before approaching any lender, you should know what you need to qualify for a business loan. This will give you a better idea of what type of loan to look for and which lenders are more likely to approve your loan application.

The first step is to research the general requirements for business loans. Most lenders will require the following:

-A detailed business plan

-Financial statements for your business

-Personal financial statements

-Collateral, such as property or equipment, to secure the loan

-A good credit score

Prepare your documents

When you go to a bank or other lender to ask for a business loan, they’re going to want to see some proof that you’re a good investment. This means that you’ll need to put together some paperwork before you even start the formal loan application process.

The specific documents you’ll need vary depending on the type of business you have, how long you’ve been in operation, and what collateral you’re putting up for the loan. But in general, you should be prepared to submit:

-Your business’s Tax Identification Number

-Your personal Social Security number

-Financial statements for your business, including income statements, balance sheets, and cash flow statements

-Personal financial statements for each owner of the business

– Documentation of any collateral you’re using to secure the loan

– A detailed business plan

What Do Lenders Look for in a Business Loan Application?

When you’re ready to apply for a business loan, there are a few things you’ll need to have in order to make the process go smoothly. First, you’ll need to have a well-written business plan. This document should include your business’s financial projections for the next few years. Lenders will also want to see your personal financial information, such as your personal credit score . Finally, you’ll need to have some collateral to offer up as security for the loan.

Credit history

One of the first things lenders will look at when considering your loan application is your credit history. They want to see how you have managed your personal and business finances in the past, and whether or not you have been timely with your payments. If you have a long history of late or missed payments, it will be very difficult to get a loan.

Lenders will also look at your credit score, which is a numeric representation of your credit history. The higher your score, the more likely you are to get approved for a loan. There are a few things you can do to improve your score, such as paying down any outstanding debt and making all of your payments on time.

Another important factor in getting a loan is the amount of collateral you have to offer. Collateral is an asset that can be used to secure the loan, such as property or equipment. If you have less collateral to offer, you may still be able to get a loan, but it will likely come with a higher interest rate.

Business financials

Most small business loan applications will ask for your business financials, including your balance sheet, income statement, and cash flow statement. Lenders will also ask to see your personal financial statement if you are guarantor on the loan.

Your balance sheet lists all of your business assets and liabilities, and is a snapshot of your company’s financial health at a specific moment in time. Your income statement shows your revenue and expenses over a period of time (usually monthly or annually). Your cash flow statement tracks the incoming and outgoing cash in your business.

Lenders will use your financial statements to assess your past performance and to get an idea of how you will use the money from the loan. They will also look at trends in your financials to see how you are managing growth. Be prepared to explain any large fluctuations in your financials, as well as any trends that may not be immediately obvious.

Business plan

Most lenders will ask to see a business plan before they consider approving a loan. A business plan is a document that outlines your business goals, strategies, and how you plan on achieving them. It should also include financial projections for your business.

Lenders want to see that you have a clear understanding of your business and what you need the loan for. They will also use your business plan to assess your risk as a borrower. If you have a well-thought-out business plan with realistic financial projections, you will be seen as less of a risk and be more likely to get approved for a loan.

Collateral

Most lenders will require some form of collateral for a business loan. Collateral is an asset that can be used to secure the loan, such as real estate, equipment, inventory, or accounts receivable. The lender can then seize the collateral if you default on the loan.

For some loans, such as equipment financing, the collateral is the equipment itself. For other loans, such as working capital loans, you may need to pledge other assets such as accounts receivable or inventory.

Some lenders may be willing to provide an unsecured loan without collateral, but you will generally need to have excellent credit to qualify for this type of financing.

How to Increase Your Chances of Getting Approved for a Business Loan

One of the most important things you need for a business loan is a good credit score. You will also need to have a detailed business plan that outlines your business goals and how you plan on achieving them. Having a strong team of financial backers can also increase your chances of getting approved for a loan. Let’s take a closer look at each of these requirements.

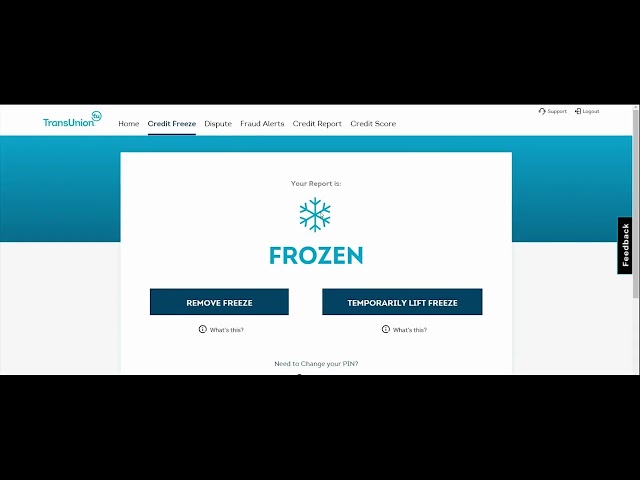

Improve your credit score

One of the best things you can do to improve your chances of qualifying for a business loan is to work on your personal credit score. A higher credit score indicates to lenders that you’re a responsible borrower, which can make it more likely that you’ll be approved for a loan. You can get your credit score for free from a number of sources, including CreditKarma.com and AnnualCreditReport.com.

If your credit score is lower than you’d like, there are a few things you can do to improve it:

-Pay your bills on time: This is the single biggest factor in your credit score, so it’s important to make sure you always pay your bills on time. Set up automatic payments if possible to make sure you never miss a due date.

-Keep balances low on credit cards and other “revolving credit”: Your credit utilization ratio – or the amount of debt you have compared to your credit limits – makes up 30% of your FICO® Score, so it’s important to keep it low. Experts recommend using no more than 30% of your available credit at any given time. So, if you have a $10,000 limit on a credit card, try not to carry a balance of more than $3,000 at any one time.

-Maintain a mix of both revolving and non-revolving debt: You don’t necessarily need to have debt to have good credit, but having different types of debt (including auto loans, mortgages and credit cards) can help boost your score. This is because it shows lenders that you can handle different types of debt responsibly.

Show strong business financials

One of the most important things you can do to increase your chances of getting approved for a business loan is to show strong financials. This means having a well-managed business with good revenue and profit margins. Lenders will also want to see a strong personal credit score, as this is one of the factors they use to determine whether or not you are a good risk.

Another thing you can do to increase your chances of getting approved for a business loan is to have a solid business plan. This should include detailed information about your business, your markets, your competition, and your financial projections. Lenders will want to see that you have a clear understanding of your business and that you have realistic goals.

If you can show lenders that you have a strong track record in business, this will also help your case. Lenders want to see that you have experience running a successful business and that you know how to generate revenue and profit. Having a solid history in business will make it easier for lenders to trust that you will be able to do so again in the future.

Have a detailed business plan

One of the best ways to increase your chances of getting approved for a business loan is to have a detailed business plan. This should include a clear and concise description of your business, your goals and objectives, your marketing strategy, your financial projections, and any other relevant information.

Your business plan should be well-written and easy for the lender to understand. It should also include supporting documentation, such as market research, industry analysis, and financial statements.

If you don’t have a business plan, there are plenty of resources available to help you create one. You can find templates and tips online or work with a professional consultant.

Alternatives to Business Loans

There are a few alternatives to business loans that you may want to consider. One option is to seek out investors. This can be done through crowdfunding platforms or by pitching your business idea to potential investors. Another option is to use a business credit card. This can be a good option if you have good personal credit and can manage to keep your business expenses separate from your personal expenses. Finally, you may want to consider a personal loan. This can be a good option if you have good personal credit and need a smaller amount of money.