What is a Loan Note?

Contents

A loan note is a debt instrument that evidences a loan made by an individual or organization to another individual or organization.

Checkout this video:

Introduction

A loan note is a debt security that represents a claim against the cash flows or assets of a company. Loan notes are often issued by companies to raise capital, rather than issuing shares. Loan notes typically have a fixed or floating interest rate and are repaid over a set period of time, similar to a bond.

Loan notes can be secured or unsecured, and can be convertible into shares at the holder’s option. Convertible loan notes are typically issued by early-stage companies to delay the need for a more dilutive equity funding round.

Loan notes are generally less expensive to issue than bonds, but they are also more risky for investors since they are not backed by collateral.

What is a loan note?

A loan note is a debt security that represents a promise by a borrower to repay a loan to a lender. Loan notes are often issued by corporations to raise capital. They are similar to bonds in that they are debt instruments that mature at a certain date and pay periodic interest payments.

What are the benefits of a loan note?

A loan note is a debt instrument that generally evidences a loan made by an entity to another entity and is repaid over time. Loan notes typically have a term of greater than one year and are senior to equity instruments in a company’s capital structure.

Loan notes typically offer greater flexibility to borrowers than do loans under traditional bank financing arrangements. For example, loan notes may be unsecured, may not have restrictive covenants, may permit the borrower to make voluntary prepayments without penalty, and may have interest rate provisions that better suit the borrower’s needs. In addition, borrowers often find that they can negotiate more favorable overall loan terms when borrowing through the issuance of loan notes than when borrowing under a traditional bank loan arrangement.

What are the risks of a loan note?

A loan note is a debt security that pays periodic interest payments, much like a bond, and comes with the added security of the underlying asset (usually real estate). Loan notes are often used by developers to finance projects that cannot qualify for traditional bank financing. However, because loan notes are not as heavily regulated as bonds, they come with greater risks for investors.

Some of the risks associated with loan notes include:

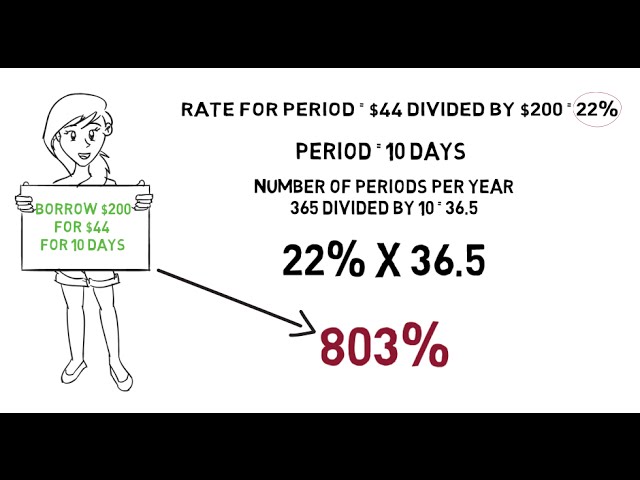

-Higher Interest Rates: Because loan notes are not as heavily regulated as bonds, lenders can charge higher interest rates. This can lead to higher monthly payments and put investors at risk of default if they are not able to make their payments.

-Lack of Transparency: Unlike bonds, which are required to disclose certain information to investors, there is no such requirement for loan notes. This lack of transparency can make it difficult for investors to understand what they are investing in and make informed decisions about their investments.

-Default Risk: If the borrower defaults on the loan, investors could lose their entire investment. This is especially true if the underlying asset is foreclosed upon and sold for less than the outstanding balance of the loan.

How to invest in a loan note

A loan note is a debt security, which is a type of asset-backed security. A loan note is typically issued by a corporation to raise money from investors. The loan note is backed by the company’s assets, which can include cash, real estate, and other assets.

How to find a loan note

There are many ways to find a loan note. You can search the internet, newspapers, or other sources of information. You can also contact a broker who specializes in loan notes.

How to research a loan note

Before investing in a loan note, research the company and the industry to get a better understanding of the risks involved. Consider the following factors:

-The company’s financial stability: Review the company’s financial statements and credit rating to get an idea of its financial stability.

-The industry: Understand the trends and dynamics of the industry in which the company operates.

-The maturity of the loan: Determine how long the loan will be outstanding and whether it is secured by collateral.

-The interest rate: Make sure you understand the interest rate and any conditions attached to it.

-The fees:Be aware of any upfront fees or ongoing charges associated with the loan.

How to negotiate a loan note

Investors should be aware that there are different types of loan notes and each has its own set of risks and rewards. Here are some tips on how to negotiate a loan note:

1. Understand the basics of loan notes.

2. Know what you’re looking for in a loan note.

3. Research the potential returns of different loan notes.

4. Consider the risks associated with each type of loan note.

5. Work with a financial advisor to understand the best options for you.

Conclusion

In conclusion, a loan note is a type of debt security that represents a loan made by an individual or institution to another party. The terms of the loan are typically agreed upon by both parties prior to the issuance of the loan note. Loan notes typically have a fixed interest rate and a set maturity date, at which point the outstanding principal balance is due and payable.