What is a Direct Plus Loan?

Contents

A Direct Plus Loan is a federal student loan that allows parents and guardians to help cover the cost of their child’s education. If you’re considering taking out a Direct Plus Loan, here’s what you need to know.

Checkout this video:

What is a Direct Plus Loan?

A Direct PLUS Loan is a federal student loan that helps pay for your child’s education after high school. This loan is borrowed by the parent and comes from the U.S. Department of Education. A credit check is required for PLUS Loans, as well as a demonstrated need for the funds.

If you have any questions about this type of loan, please contact the financial aid office at your child’s school.

How to Apply for a Direct Plus Loan

To apply for a Direct PLUS Loan, you must complete a Direct PLUS Loan Master Promissory Note (MPN).

You can complete a MPN online at https://studentaid.gov/h/apply-for-aid/gradplus.

You’ll need your FSA ID to access the online MPN. If you don’t have an FSA ID, you can request one at https://studentaid.gov/fsaid.

If you prefer not to complete the MPN online, you can get a paper MPN from your school’s financial aid office or by contacting the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243) .

Direct Plus Loan Eligibility

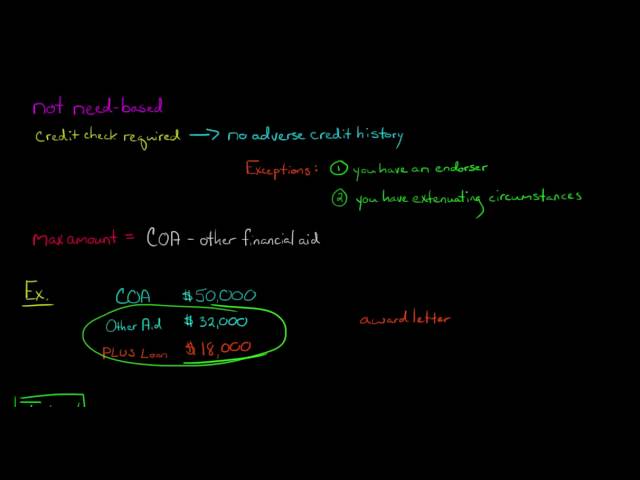

To be eligible for a Direct PLUS Loan, you must be a graduate or professional student enrolled at least half-time, or the parent of a dependent undergraduate student enrolled at least half-time. In addition, you must not have an adverse credit history (a credit check will be performed). If you have an endorser or a co-signer, they also must not have an adverse credit history.

Types of Direct Plus Loans

A Direct PLUS Loan for parents and a Direct PLUS Loan for graduate or professional students are federal loans that have terms and conditions that are generally more favorable than those of private education loans. The U.S. Department of Education (Department) makes Direct PLUS Loans to eligible borrowers through schools participating in the Direct Loan Program.

PLUS Loans help pay for education expenses up to the cost of attendance less any other financial aid received, such as grants and scholarships. A credit-worthy cosigner is not required but may be helpful in obtaining the loan.

Eligible parents can borrow up to the full cost of their child’s undergraduate education minus any other financial aid received, as long as the student is enrolled at least half-time in a degree program at an eligible school. Graduate and professional students can borrow up to the difference between their school’s cost of attendance and any other financial aid they receive if they are enrolled at least half-time in a degree program at an eligible school.

To get a PLUS Loan, you must complete a Free Application for Federal Student Aid (FAFSA®) form and then sign a Master Promissory Note (MPN).

Direct Plus Loan Interest Rates

Interest rates for Direct PLUS Loans first disbursed on or after July 1, 2020, and before July 1, 2021, have a fixed rate of 5.30%.

Direct Plus Loan Repayment

Your loan will be repaid in monthly installments. The U.S. Department of Education (ED) will contact you to remind you when your first payment is due and when future payments are due. If you want, you can set up an automatic debit account so that your payments will be transferred from your bank account to ED each month on the date you choose. You can also choose to make manual payments through the mail or by using a debit card or credit card, although there may be additional fees associated with these methods. You can find more information about making payments on the Direct Plus Loan websites for

-[Parent PLUS Loans](https://studentaid.gov/h/apply-for-aid/fafsa “FAFSA”).

-[Grad PLUS Loans](https://studentaid.gov/h/apply-for-aid/gradplus “Grad PLUS”).