How to Take Out a Loan

Contents

How to take out a loan? This is a question that we are often asked and it is one that we will attempt to answer in this blog post.

Checkout this video:

Introduction

Taking out a loan can give you the financial resources you need to make a major purchase, consolidate debt, or cover unexpected expenses. But before you borrow, it’s important to understand the different types of loans available and the pros and cons of each. This guide will help you determine if taking out a loan is right for you and provide guidance on how to compare offers and choose the best loan for your needs.

How to Take Out a Loan

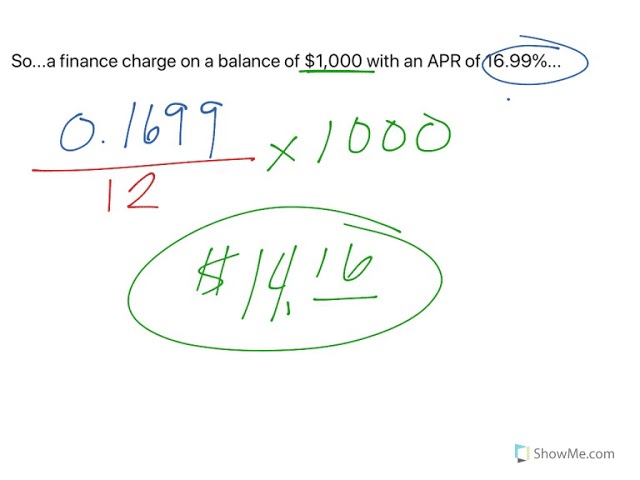

Before you can take out a loan , you need to understand how loans work. A loan is when you borrow money from a lender and agree to pay it back over time. The amount of time you have to pay back the loan is called the loan term. The loan term is usually between two and five years. You will also have to pay interest on the loan , which is the cost of borrowing the money. The interest rate is the percentage of the loan that you will have to pay back to the lender.

Research the Different Types of Loans

You need to know how much money you will realistically need and what you will use it for. This way, you can narrow your loan options down to a handful that fit both your financial situation and your business goals.

For example, if you are looking to purchase inventory for your store, you may want to consider an inventory loan, which is a type of short-term working capital loan. These loans are typically easier to qualify for because they are secured by the inventory itself.

On the other hand, if you are looking for long-term financing to help you expand your business, you may want to consider a term loan. Term loans are typically used for specific purposes, such as funding the purchase of equipment or real estate. They have fixed repayment terms and usually require collateral, such as a home or business equity.

Consider the Pros and Cons of Each Loan Type

There are many different types of loans, and it’s important to understand the pros and cons of each before you make a decision. Take some time to learn about the different options so you can choose the one that’s right for you.

Secured loans are those that require collateral, such as a car or home. The benefit of a secured loan is that it usually comes with a lower interest rate than an unsecured loan. The downside is that if you default on the loan, your collateral may be seized by the lender.

Unsecured loans do not require collateral and may be easier to qualify for, but they usually come with higher interest rates.

Fixed-rate loans have an interest rate that remains the same for the life of the loan. This makes budgeting easy because your payments will always be the same. The downside is that if interest rates fall, you will not be able to take advantage of the lower rates.

Variable-rate loans have an interest rate that can change over time. This means your payments could go up or down, making budgeting more difficult. The benefit is that if rates fall, you may be able to save money on your loan payments.

Choose a Lender

There are many different types of lenders that you can choose from when you are taking out a loan. Each type of lender has its own advantages and disadvantages, so it is important to choose the right one for your needs. Here is a brief overview of the most common types of lenders:

-Banks: Banks are one of the most popular types of lenders for loans. They usually have low interest rates and offer a variety of repayment options. However, they can be difficult to qualify for if you have bad credit.

-Credit Unions: Credit unions are another popular type of lender for loans. They often have lower interest rates than banks, and they may be more willing to work with people with bad credit.

-Online Lenders: Online lenders are a good option if you need a loan quickly. They often have quick approval times and can deposit the money into your account within a few days. However, they may have higher interest rates than other types of lenders.

Apply for the Loan

Before you begin looking for a loan, you should pull your credit reports from the three credit bureaus: Experian, Equifax and TransUnion. This will give you a clear picture of your credit history and allow you to see if there are any negative marks that need to be addressed before you apply for a loan.

Once you have your credit in order, it’s time to start shopping around for a loan. You can apply for a loan through a bank, credit union or online lender. It’s important to compare rates, terms and conditions before you choose a lender.

When you’ve found a lender that you’re comfortable with, it’s time to fill out an application. The lender will ask for information about your income, employment history, debts and other financial obligations. Be sure to read over the terms and conditions of the loan before you sign anything.

Once your application is approved, the lender will send you the money either by direct deposit into your bank account or by mailing a check. Make sure to keep up with your payments so that you don’t damage your credit score any further.

Conclusion

In conclusion, taking out a loan can be a great way to finance a large purchase or consolidate debt. However, it’s important to understand the terms of your loan and make sure you can afford the monthly payments. Keep in mind that missed payments can damage your credit score and make it more difficult to get a loan in the future.