How To Understand Finance?

Contents

A beginner’s guide to understanding the basics of finance .

Checkout this video:

Introduction to finance

Finance is a field that deals with the study of investments. It includes the dynamics of assets and liabilities over time under conditions of different degrees of uncertainty and risk. Finance can also be defined as the science of money management. Finance aims to price assets based on their risk level and their expected rate of return. Finance can be broken into three different sub-categories: public finance, corporate finance and personal finance.

Public finance deals with the financial system that is used by governments to raise money to fund public goods and services. Corporate finance deals with the financial system that is used by businesses to raise money to fund their operations. Personal finance deals with the financial decisions that individuals make about saving, investing and spending their money.

The role of finance

Finance is a field that is concerned with the allocation of assets and liabilities over time under conditions of certainty and uncertainty. A key point in finance is the time value of money, which states that a dollar today is worth more than a dollar tomorrow. The time value of money is an important concept in financial decision-making.

Finance is also concerned with the management of risk. Risk refers to the chance that an investment will not earn the expected return. There are two types of risk: systematic risk and unsystematic risk. Systematic risk is due to factors that affect all investments, such as economic conditions. Unsystematic risk is specific to a particular investment, such as company-specific risk.

The role of finance is to make sure that the allocation of assets and liabilities is done in a way that maximizes the value of the firm. This can be done through the use of financial instruments, such as loans, bonds, and equity instruments.

The time value of money

The time value of money is one of the most important concepts in finance. It is the idea that money today is worth more than money in the future. This is because money can be invested and earn a return. The time value of money is used to discount future cash flows. This means that future cash flows are worth less than they would be if they were received today.

Risk and return

In finance, risk and return are closely related. Return is the amount of money earned or lost on an investment, while risk is the chance that an investment’s actual return will be different than expected.

Risk and return are two of the most important concepts in finance. Understanding how they work is essential to making smart investment decisions.

Risk is the chance that an investment’s actual return will be different than expected. Return is the amount of money earned or lost on an investment. The relationship between risk and return is one of the most important concepts in finance.

Generally speaking, investments with higher risks offer higher potential returns. That’s because investors demand a higher rate of return to compensate them for taking on additional risk. However, there are no guarantees when it comes to investing. So even a “safe” investment with low risks can lose money if market conditions change unexpectedly.

It’s important to remember that all investments come with some degree of risk. Even so-called “safe” investments such as government bonds can lose money if interest rates rise unexpectedly. The key is to find investments that offer a level of risk that you’re comfortable with and that fit your financial goals.

Financial markets and institutions

An understanding of financial markets and institutions is crucial to grasping the working of the economy as a whole. The financial system is important because:

* It is the means by which firms raise finance to invest in new projects

* It is the arena in which savings are channeled into investment

* It influences the cost and availability of finance

The financial system comprises a series of markets in which those with surplus funds (savers) lend to those who wish to borrow (borrowers). In return for lending their funds, savers expect to receive an income stream from the borrowers – typically in the form of interest payments. The market in which savers lend directly to borrowers is known as the ‘real’ or ‘primary’ market.

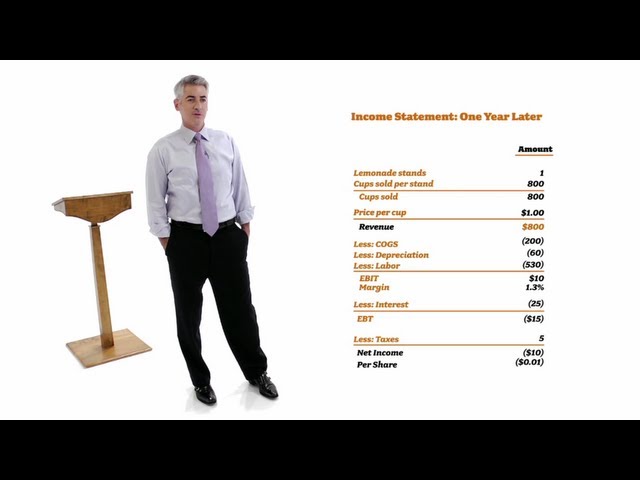

Financial statements

In order to understand finance, you need to be able to read and interpret financial statements. Financial statements are written reports that quantify the financial strength, performance and liquidity of a company. The four main types of financial statements are balance sheets, income statements, cash flow statements and statement of shareholder equity. Financial statements are compiled on a quarterly and annual basis. Most public companies are required by law to share their financial statements with the public.

Valuation and investment

In finance, valuation is the process of determining the present value of an asset. Investment, on the other hand, is the process of putting money into something with the expectation of getting a financial return. Both concepts are important for understanding how the financial markets work.

Valuation is used to determine the price of an asset, which can be used to buy or sell that asset. For example, when you buy a stock, you are valuing that stock at its current price. If you think the stock is undervalued, you may buy it and hope that the stock price goes up so you can sell it at a profit. Alternatively, if you think a stock is overvalued, you may short it (i.e., bet that the stock price will fall).

Investment, on the other hand, is all about putting money into something with the expectation of getting a positive return. For example, when you invest in a company by buying its stock, you are expecting that company to make money and generate shareholder value. If the company does well and its stock price goes up, then you will make money on your investment. However, if the company does poorly and its stock price falls, then you will lose money on your investment.

Capital budgeting

Capital budgeting is a process that companies use to identify and invest in long-term projects. These projects may be new initiatives, such as building a new factory, or expanding an existing one. Capital budgeting decisions are important because they can have a major impact on a company’s profitability and growth.

There are several methods that companies use to assess the viability of capital investment projects. The most common method is the net present value (NPV) method. This approach discounts the cash flows from a project to determine its NPV. The higher the NPV, the more attractive the investment is.

Another common method is the internal rate of return (IRR) method. This approach calculates the expected return from an investment and compares it to the required rate of return. The higher the IRR, the more attractive the investment is.

Companies also use payback period and profitability index when making capital budgeting decisions. However, these methods are not as commonly used as NPV and IRR.

Making capital budgeting decisions is not an easy task. There are many factors to consider, such as risk, expected return, and required rate of return. However, using the NPV or IRR methods can help simplify the process and allow companies to make more informed decisions about which projects to invest in.

Working capital management

Working capital management is the process of managing a company’s short-term assets and liabilities to ensure that it has the liquidity it needs to operate smoothly.

This process involves managing three key elements of a company’s finances: its inventory, its accounts receivable, and its accounts payable.

The goal of working capital management is to ensure that a company has enough cash on hand to meet its short-term obligations, while also maintaining enough inventory to meet customer demand.

There are a number of different techniques that can be used to manage working capital, including just-in-time inventory management, accounts receivable factoring, and accounts payable management.

Financial planning and forecasting

Financial planning and forecasting is the process of creating financial statements in order to make financial decisions. Financial statements are used to determine how much money a company or individual has, how much they owe, and what their overall financial status is.

Forecasting is the process of making predictions about future events, based on past data and current trends. Financial forecasting is used in order to make decisions about where to allocate resources, what products to develop, and what prices to charge.

Businesses use financial planning and forecasting in order to make strategic decisions about the future of their company. Individuals can use these techniques to make decisions about their personal finances.