What Is The Finance Charge On A Car Loan?

Contents

- How much is a typical finance charge?

- Is finance charge the same as interest?

- Does finance charge include down payment?

- Whats included in the finance charge?

- Do you have to pay finance charges?

- What is considered a high car payment?

- Is it good to finance a car?

- Why do dealers want you to finance?

- When you pay extra on a car loan does it go to principal?

- Is it better to lease or finance a car?

- Does finance charges affect credit score?

- How do you get a finance charge waived?

- How do you calculate a monthly finance charge?

- What APR is good for a car loan?

- Is finance charge the same as interest on a car loan?

- Why does my finance charge change?

- What is excluded from the finance charge?

- Does finance charge include insurance?

- Will not be entitled to a refund of the finance charge?

- What is the minimum finance charge?

- Is $500 a month a lot for a car payment?

- Is $400 a month good for car payment?

- Is 700 a month too much for car payment?

- How long should you finance a car?

- Conclusion

Finance Charge: A Technical Definition The financing charge is the total costs you pay to borrow the money in question, according to accounting and finance terms. This implies that the financing charge comprises the interest and additional costs you pay on top of the loan repayment.

Similarly, How is finance charge calculated on a car loan?

Subtract the entire amount of interest, fees, taxes, and charges from the principle (total amount borrowed) on your loan to get your financing costs To get your financing costs, go to: $679 multiplied by 48 is $32,592. $35,000 minus $32,592 equals $2,408. $2,408 in finance charges

Also, it is asked, Do I have to pay the finance charge on a car loan?

If you’re wondering what a finance charge on a vehicle loan is, it’s normally any kind of upfront price for financing the automobile, as well as all of the interest you pay during the loan’s length.

Secondly, How do I avoid finance charges on a car loan?

Paying your payments in whole and on time each month is the easiest way to prevent interest costs. No interest will be charged on your amount if you pay your whole balance during the grace period each month (the time between the end of your billing cycle and the payment due date).

Also, What is a finance payment on a car loan?

All costs agreed upon in the contract are included in the monthly payment. Your loan’s principle and interest will be included in this figure. Credit insurance premiums or other optional add-ons that you agreed to finance as part of your vehicle loan may be included in your monthly payment.

People also ask, Why is finance charge so high?

Smaller loans often have higher monthly financing charges since the bank profits from these fees and knows that a smaller loan would be paid off faster.

Related Questions and Answers

How much is a typical finance charge?

A typical financing fee, for example, may be 112 percent every month in interest. Finance costs, on the other hand, might range from 1% to 2% to 3% every month. The sums might vary depending on the customer’s size, relationship, and payment history.

Is finance charge the same as interest?

Interest is defined as any charge or expense of borrowing money in financial accounting. Finance charge is a synonym for interest.

Does finance charge include down payment?

Definition of a Finance Charge Borrowers may be less likely to pay down or repay their debts if there is no finance fee. A financing charge might be a set sum or a percentage of the amount borrowed.

Whats included in the finance charge?

A finance charge is the total amount of interest and loan fees you’ll pay over the course of your mortgage loan’s life. This implies you hold the loan until it matures (when the last payment is due) and includes any pre-paid loan fees.

Do you have to pay finance charges?

Unless you pay the whole amount back during the grace period, a finance charge is normally applied to the amount you borrow. Even if you pay the balance in full before the due date, you may be required to pay a financing fee in certain cases, such as credit card cash advances.

What is considered a high car payment?

According to experts, a vehicle payment is excessively expensive if it accounts for more than 30% of your overall income. Remember that your auto payment isn’t the only expenditure you have! Make sure to include in the cost of gasoline and maintenance. Make sure your automobile payment isn’t more than 15% to 20% of your overall revenue.

Is it good to finance a car?

When you want to drive a modern automobile but can’t save up enough money in a fair length of time, financing a car may be a suitable option. Because the interest rate is modest, the additional charges will not have a significant impact on the ultimate cost of the car. Regular payments will not put a strain on your present or future finances.

Why do dealers want you to finance?

“Vehicle dealerships want you to finance through them for two reasons: they can profit from the interest on a car loan you receive through them, and they can profit from the interest on a car loan you get through them. If they act as a mediator between you and another lender, they may get a commission (commission).

When you pay extra on a car loan does it go to principal?

The answer was supplied by “Not necessarily,” says the author. Some vehicle lenders structure their loans such that any additional money goes straight to interest. As a result, indicate on your cheque or online payment that the additional funds are for “principal only.”

Is it better to lease or finance a car?

Monthly lease costs are often cheaper than monthly loan payments on the identical vehicle. You’re paying to drive the automobile, not to own it, with a lease. That means you’ll be paying for the car’s estimated depreciation — or loss of value — as well as a rent charge, taxes, and fees over the lease time.

Does finance charges affect credit score?

Paying the financing fee is the same as paying more toward your amount, which will reduce the length of your debt’s life while having no effect on your credit score.

How do you get a finance charge waived?

Paying your debt in whole and on time every month is the simplest method to prevent interest costs. Credit cards must provide you with a grace period, which is the time between the end of your billing cycle and the due date for payment on your amount.

How do you calculate a monthly finance charge?

You’ll need to know your precise credit card balance every day of the payment cycle to make this calculation manually. Then divide each day’s amount by the annual percentage rate (APR/365). To calculate the monthly financing fee, add each day’s finance charge together.

What APR is good for a car loan?

According to U.S. News, the following are the typical vehicle loan rates as of January 2020: Exceptional (750-850): New cars have a 4.93 percent interest rate, used cars have a 5.18 percent interest rate, and refinancing has a 4.36 percent interest rate. 5.06 percent for new, 5.31 percent for used, and 5.06 percent for refinancing on a good (700-749) credit score.

Is finance charge the same as interest on a car loan?

The financing charge is the total costs you pay to borrow the money in question, according to accounting and finance terms. This implies that the financing charge comprises the interest and additional costs you pay on top of the loan repayment.

Why does my finance charge change?

The cost of borrowing money is referred to as a finance charge. Other costs are included in the charges, in addition to interest. In certain circumstances, making a bigger loan payment than the amount outstanding might lower the financing costs.

What is excluded from the finance charge?

Finance Charges Excluded: 1) application fees charged to all applicants, regardless of credit approval; 2) charges for late payments, exceeding credit limits, or delinquency or default; 3) charges for late payments, exceeding credit limits, or for delinquency or default; 4) charges for late payments, exceeding credit limits, or for delinquency or default; 5) charges for late payments, exceeding credit limits 3) charges for taking part in a credit scheme; 4) the seller’s advantages; 5) Fees associated with real estate: a) the title.

Does finance charge include insurance?

If the creditor does not provide the appropriate insurance, the premium to be included in the financing charge is the cost of a policy of insurance that meets the creditor’s requirements for kind, amount, and duration.

Will not be entitled to a refund of the finance charge?

ACCORDING TO MY STATEMENT, IF I PAY OFF THE LOAN EARLY, I WILL NOT BE ENTITLED TO A PARTIAL REFUND OF THE FINANCE CHARGE. WHAT DOES THIS MEAN, EXACTLY? This implies that you will be charged interest for the time you spent using the money you were given.

What is the minimum finance charge?

A minimum financing charge is a monthly credit card fee that a customer may be charged if the card’s accumulated balance is so low that an interest charge for that billing cycle would otherwise be due.

Is $500 a month a lot for a car payment?

According to a recent Experian research, the average new automobile payment in America has surpassed $500 per month for the first time, landing at $503. And, as if that wasn’t awful enough, the average term of a vehicle loan has now increased to 68 months.

Is $400 a month good for car payment?

As a consequence, the automobile will be much more costly in the end. A vehicle payment of $400 per month for five years (60 months) corresponds to $24,000 in our scenario. However, if you pay $400 a month for six years (72 months), you’ll pay $28,800, vs $33,600 for seven years (84 months)

Is 700 a month too much for car payment?

According to experts, your overall automobile expenditures, which include monthly payments, insurance, petrol, and maintenance, should be about 20% of your monthly take-home income. Let’s suppose your monthly wage is $4,000, and you’re not a math expert like me. Then a monthly automobile expenditure estimate of $800 is a fair bet.

How long should you finance a car?

This is why, if you can afford it, Edmunds suggests a 60-month vehicle loan. A lengthier loan may have a more manageable monthly payment, but it has a lot of disadvantages, which we’ll go through later. The situation is much worse for used automobile loans, with just over 80% of used car loan durations exceeding 60 months.

Conclusion

The “how to avoid paying finance charges on a car loan” is a question that is asked by many people. The answer can be found in the “Finance Charge On A Car Loan?” article.

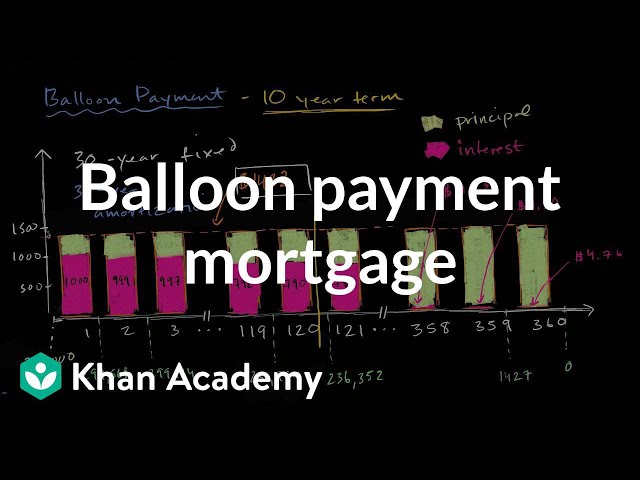

This Video Should Help:

The “how to reduce finance charges on a car loan” is the process of reducing the amount of interest that you will pay over the life of your loan. The finance charge on a car loan is the total amount of money that you will pay in interest over the life of your loan.

Related Tags

- finance charge on car loan calculator

- why is there a finance charge on my car loan

- do i have to pay the finance charge on a loan

- what are finance charges ally auto

- what is a finance charge on a loan