How Much of a Title Loan Can I Get?

Contents

How much can I get for a title loan? It’s a common question with a not so common answer. Learn about getting a title loan.

Checkout this video:

How Title Loans Work

A title loan is a type of secured loan where borrowers can use their vehicle title as collateral.1 Borrowers who get title loans must allow a lender to place a lien on their car title, and temporarily surrender the hard copy of their vehicle title, in exchange for a loan amount. Once the loan is repaid, the borrower gets their title back.

How to Get a Title Loan

Title loans are a type of secured loan, which means that the loan is backed by collateral – in this case, your car. To get a title loan, you give the lender the title to your car as well as a set of keys. The lender holds on to the title and keys as collateral while you make payments on the loan. Once you’ve repaid the loan in full, the lender will return the title and keys to you.

If you can’t repay the loan, the lender may choose to repossess your car. That’s why it’s important to only take out a title loan if you’re sure you can repay it.

Before taking out a title loan, be sure to do your research. Make sure you understand all of the terms and conditions of the loan, and be sure to shop around for the best rates.

How Much Money Can You Get from a Title Loan?

Funeral costs, medical bills, and other emergency expenses can add up quickly. If you’re facing a financial emergency and need quick access to cash, you may be considering a title loan. But how much money can you get from a title loan?

The answer depends on several factors, including the value of your car, the interest rate of the loan, and the length of the loan term. In general, you can expect to receive 25% to 50% of your car’s value in cash. So, if your car is worth $10,000, you could receive a loan for $2,500 to $5,000.

Of course, the amount of money you receive will also depend on the interest rate of the loan. Title loans typically have high interest rates – sometimes as high as 300% APR! – so they can be very expensive. That’s why it’s important to only borrow what you need and to repay the loan as quickly as possible.

If you’re considering a title loan, be sure to shop around for the best interest rate and terms. And always make sure you can afford the monthly payments before taking out the loan.

How Much of Your Car’s Value You Can Borrow

When you get a title loan, the amount of money you can borrow is based on the value of your car. The average loan is about $1,000, but it can be more or less depending on the value of your car and the lender you go with. Keep reading to learn more about how title loans work and how much you can expect to borrow.

How Much of Your Car’s Value You Can Borrow

A title loan is a secured loan, which means the lender can take your car if you don’t repay the debt. The amount you can borrow depends on the value of your car, but it’s usually only a fraction of what your vehicle is worth. In most states, lenders can charge anywhere from 25% to 50% of the car’s value in interest and fees, which means you could be paying $250 to $500 in interest and fees on a $1,000 loan.

How Much Does Your Car Have to be Worth to Get a Title Loan?

This is one of the most common questions we get here at Max Cash Title Loans.1 There are a few things that go into how much of your car’s value you can borrow with a title loan. The amount that you can borrow with a title loan is going to be based on the appraised value of your vehicle, which is determined by looking up the Kelley Blue Book value2 of your vehicle make, model, and year and then adjusting for mileage and any cosmetic damage. Some lenders may also consider your income and employment status when determining how much they are willing to lend you.

At Max Cash Title Loans, we try to make getting a title loan as easy as possible. We work with a large network of lenders, so we can find you the best interest rate available, and we will do our best to get you the most money possible based on your car’s value.3 To see how much you could qualify to borrow today, give us a call at 855-561-5626 or fill out our online form.4 One of our loan processors will be happy to give you a free quote with no obligation to take out a loan.

How Lenders Determine How Much You Can Borrow

A title loan is a type of secured loan where borrowers can use their vehicle title as collateral. Lenders give borrowers a loan amount based on the value of their vehicle, and the borrower is then able to keep their vehicle and use it while making monthly loan payments. But how do lenders determine how much to give you?

The Bottom Line: How Much of a Title Loan Can You Get?

It really depends on your lender and your state’s regulations. In some states, the maximum loan amount is set by law. In other states, the lender may have more leeway to offer you a larger loan.

Here are a few things that will affect how much of a title loan you can get:

– The value of your vehicle: The lending company will appraise your car to determine its worth. This will be one of the biggest factors in deciding how much money you can borrow.

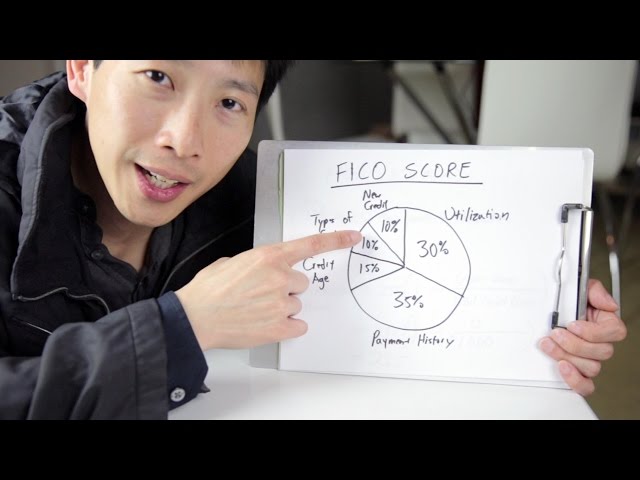

– Your ability to repay: The lender will consider your income and expenses when determining how much you can afford to repay each month. They will also look at your credit history to see if you have a history of making timely payments.

– Your state’s regulations: Some states have laws that limit the amount of money you can borrow from a title loan. Make sure to check your state’s regulations before you apply for a loan.

– The lender’s policies: Each lending company has its own policies for title loans. Some lenders may be willing to offer larger loans than others.

When you’re shopping for a title loan, be sure to ask about the lender’s policies on loan amounts. This way, you’ll know how much money you can expect to borrow before you apply for the loan.