Which Two of These Are Essential for Completing an Initial Mortgage Loan Application?

Contents

If you’re in the process of applying for a mortgage loan, you might be wondering which information is absolutely essential to include on your application. Here’s a quick rundown of the must-have items for a complete mortgage loan application.

Checkout this video:

Applying for a Mortgage Loan

Applying for a mortgage loan can be a daunting task, but it doesn’t have to be. There are a few things you’ll need to have in order to get started. First, you’ll need to have a good credit score. Second, you’ll need to have a down payment. Finally, you’ll need to have a job.

What You Need to Know

To get started, you’ll need to gather some important financial documents and information about your employment history. Keep in mind that the amount of documentation may vary based on your unique circumstances, so it’s always a good idea to check with your lender beforehand.

In general, you’ll need the following:

-Your most recent pay stubs

-W2 forms from the last two years

-Federal tax returns from the last two years

-A list of all your debts and assets

-Proof of any additional income

-Your most recent bank statements

The Mortgage Application Process

When you’re ready to begin the mortgage loan application process, you’ll need to gather some essential information. Most importantly, you’ll need to provide proof of income and your credit score. You’ll also need to have a down payment saved up, as well as an estimate of your closing costs.

Applying for a Mortgage Loan

The mortgage application process starts with the completion of a loan application, which can be done in person, over the phone, or online. During the application process, you will be asked to provide personal information such as your Social Security number, date of birth, current and previous addresses, employment history, and annual income. You will also need to supply information about the property you are looking to purchase, including the address, purchase price, estimated value, and any outstanding loans against the property.

After your loan application has been submitted, a loan officer will review your information and pull your credit report. The loan officer will then provide you with a list of required documents that must be submitted in order for your loan application to be processed. These documents may include pay stubs, tax returns, bank statements, and proof of employment. Once all required documents have been received and reviewed, the loan officer will make a decision on your loan application.

If you are approved for a mortgage loan, you will then need to complete a loan disclosure form which outlines the terms of your loan. Once this form has been signed by both you and the lender, your loan will be funded and you will be ready to close on your new home.

The Mortgage Application Process

There are a few key steps in the mortgage application process, and each one is important in its own way. Here are two of the most essential steps for completing an initial mortgage loan application:

1. Providing Detailed Income Documentation

When you apply for a mortgage, lenders will want to see proof of your income. This can include tax returns, pay stubs, W-2 forms, and more. Lenders use this information to determine how much of a loan you can afford and whether or not you have a steady income.

2. Applying for a Property Appraisal

An appraisal is an important part of the mortgage application process because it helps lenders determine the value of the property you’re looking to purchase. The appraisal gives lenders peace of mind that the property is worth at least as much as the loan amount you’re requesting.

Applying for a Mortgage Loan

The mortgage loan application process can be a time-consuming and frustrating experience, but there are a few things you can do to make it go more smoothly. First, it’s important to understand that there are two types of mortgage loan applications: the initial application and the follow-up application. The initial mortgage loan application is the one that you fill out when you first apply for a loan. This is the application that will determine whether or not you qualify for the loan. The follow-up application is used if you need to provide additional information or if your financial situation has changed since you first applied for the loan.

One of the most important things you can do when applying for a mortgage loan is to make sure that all of your information is accurate. This includes your social security number, your employment history, and your credit history. Lenders will use this information to determine whether or not you’re a good candidate for a loan, so it’s important that everything is correct. Inaccurate information could result in your loan being denied, so take care to double-check everything before you submit your application.

Another thing to keep in mind when applying for a mortgage loan is that there are certain documents that you’ll need to provide in order to complete the application process. These include things like your most recent pay stubs, tax returns, and bank statements. Having all of these documents on hand before you start the application process will make it go much smoother and help ensure that you don’t run into any delays along the way.

So, which two of these are essential for completing an initial mortgage loan application? The answer is accuracy and complete documentation. Make sure that all of your information is accurate and that you have all of the required documents on hand before starting the process and you’ll be well on your way to getting approved for a loan.

The Mortgage Application Process

The mortgage application process can be a complicated and lengthy one. There are many different forms and documents that need to be completed and submitted in order for your loan to be approved. However, not all of these forms and documents are essential for completing an initial mortgage loan application. The two that are most important are the Uniform Residential Loan Application (URLA) and the Appraisal Report.

The URLA is a form that is used by nearly all lenders in order to gather information about the borrower and the property that is being purchased. It is important to note that certain sections of the URLA, such as the employment history, will need to be verified by the lender through other means such as tax returns or pay stubs. The Appraisal Report is an independent assessment of the value of the property being purchased. This report is required in order for the lender to determine how much money they are willing to lend on the property. Other forms and documents that may be required depending on the lender include bank statements, tax returns, and asset declarations.

Applying for a Mortgage Loan

Are you planning on buying a house? If so, you will need to fill out a mortgage loan application. But what exactly do you need to include in this application? Do you need a down payment? What other documents will the lender require?

What You Need to Know

In order to complete an initial mortgage loan application, you will need the following:

1. Your social security number

2. Your current address and phone number

3. A list of your current debts, including credit cards, car loans, student loans, etc.

4. Your current employment information, including your boss’ name and contact information, as well as your salary and the length of time you have been employed

5. Your bank account information, including account numbers and routing numbers

6. Information on any other assets you may have, such as stocks, bonds, or real estate

7. Two years of tax returns

The Mortgage Application Process

Applying for a mortgage loan can seem like a daunting task, but it doesn’t have to be. You’ll need to gather some essential information before you begin the mortgage application process. In this article, we’ll go over what you’ll need to have in order to complete an initial mortgage loan application.

Applying for a Mortgage Loan

There are a few things you should know before applying for a mortgage loan. The first thing is that there are two types of mortgage loans: conventional and government-backed. Conventional loans are the most common type of loan and are offered by private lenders, such as banks or credit unions. Government-backed loans, on the other hand, are backed by the federal government and include programs like VA loans, FHA loans, and USDA loans.

The second thing you should know is that there are two essential parts to completing an initial mortgage loan application: a credit report and a property appraisal. The credit report will show lenders your credit history and help them determine whether or not you’re a good candidate for a loan. The property appraisal will help lenders determine how much the property is worth and whether or not it meets their lending criteria.

Now that you know these two things, you’re ready to begin the mortgage loan application process!

The Mortgage Application Process

The mortgage application process involves several key steps, including getting pre-qualified, completing a loan application, having your home appraised, and closing on the loan. Of these steps, which two are essential for completing an initial mortgage loan application?

The first essential step is getting pre-qualified for a loan. Pre-qualification gives you an estimate of how much you can borrow and helps you narrow down your home search. To get pre-qualified, you’ll need to provide some basic financial information to a lender, who will then give you a pre-qualification letter estimating the size of the loan you could qualify for.

The second essential step is completing a loan application. This is where you’ll provide detailed information about your finances and property to the lender. Once your loan application is approved, the lender will order an appraisal of your property to determine its value. The appraisal will be used to help ensure that the amount you’re borrowing is appropriate given the value of your home.

Once you’ve completed these two essential steps, you’ll be well on your way to getting a mortgage loan!

Applying for a Mortgage Loan

Completing a mortgage loan application can seem like a daunting task, but it doesn’t have to be. There are a few key things you’ll need in order to get started. You’ll need to provide information about your income, employment history, and debts. You’ll also need to have a down payment saved up. In this article, we’ll cover everything you need to know about applying for a mortgage loan.

What You Need to Know

You’ve probably heard that you need a down payment and good credit to get a mortgage loan. But, what else do you need to know about applying for a loan?

This article will give you the rundown on everything you need to know (and have) before applying for a mortgage loan. We’ll cover the following topics:

-Your Employment Status

-Your Debt-to-Income Ratio

-Your Credit Score

-Your Residence History

-Your Financial Assets

Your Employment Status: In order to qualify for most loans, lenders require that you have a steady source of income. This means that you must either be currently employed or have a verifiable source of income. If you are self-employed, you will likely need to provide additional documentation, such as tax returns, to verify your income.

Your Debt-to-Income Ratio: Lenders will also want to know what your current debt obligations are in relation to your income. This is known as your debt-to-income ratio (DTI). To calculate your DTI, simply add up all of your monthly debts (such as car payments, credit card payments, student loans, etc.), and then divide that number by your gross monthly income. Most lenders prefer to see a DTI of 36% or less.

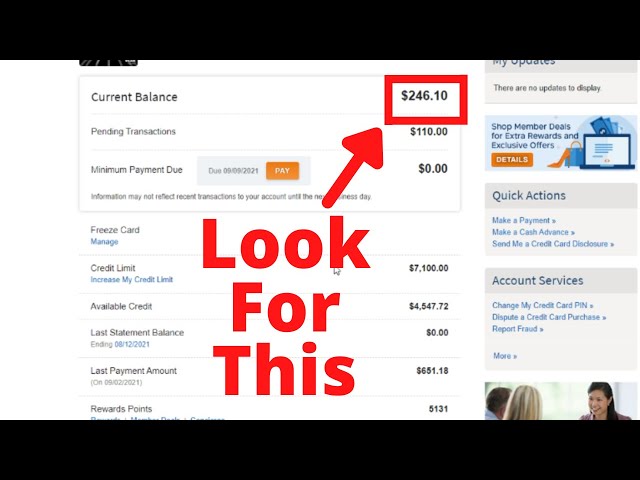

Your Credit Score: Your credit score is one of the most important factors in determining whether or not you will qualify for a loan. In general, the higher your score, the better your chances of qualifying for a loan with favorable terms. If you’re not sure what your score is, you can check for free using one of many online services.

Your Residence History: Lenders like to see borrowers with stability, which is why they often prefer borrowers who have lived in the same home for at least two years. However, if you have moved frequently over the years, don’t despair – there are still loan options available to you. You may just need to provide additional documentation, such as rental agreements or mortgage statements, to prove your residency history.

Financial Assets: When applying for a loan, lenders will want to know what financial assets you have available to help make payments in case of hardship. This could include savings accounts, investments, and even gifts from friends or family members. Be prepared to provide documentation detailing these assets when applying for a loan