What is Refinancing a Loan?

Contents

If you’re considering refinancing a loan , you may be wondering what the process entails. Here’s a quick overview of what you can expect when you refinance a loan.

Checkout this video:

Introduction

Refinancing a loan simply means taking out a new loan to replace an existing one. When you refinance, you may be able to secure a lower interest rate or tap into your home equity to get cash for debt consolidation or other purposes. If you have built up equity in your home, refinancing can also provide an opportunity to access that equity without having to sell your home.

What is Refinancing?

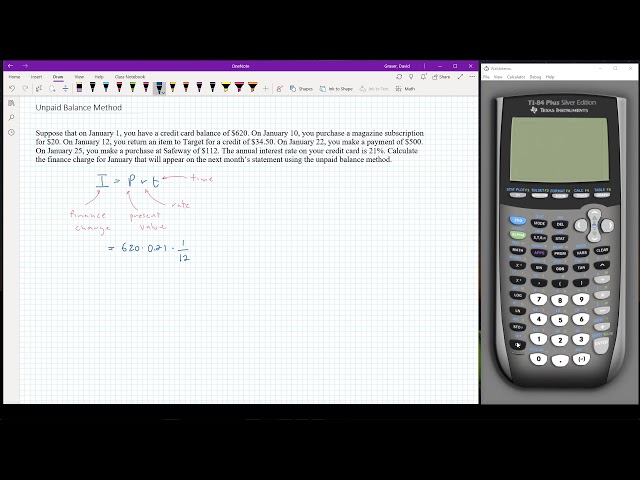

Refinancing is the process of taking out a new loan to pay off an existing loan. The new loan typically has a lower interest rate than the existing loan, which can save you money over the life of the loan. In addition, refinancing can shorten the term of the loan, which can also save you money in interest.

The Process of Refinancing

Refinancing is the process of replacing an existing loan with a new loan. The new loan pays off the old loan, and you begin making payments on the new loan. Refinancing is usually done to secure better loan terms, such as a lower interest rate, a lower monthly payment, or to change the type of loan.

Pros and Cons of Refinancing

The decision to refinance a loan is one that should be made carefully. Pros and cons of refinancing a loan can help borrowers make the right decision. Some reasons to refinance a loan include getting cash out, securing a lower interest rate, shortening the loan term, or consolidating debt.

Cash-out refinancing occurs when a borrower refinances for more than the outstanding balance on their loan. The extra amount is given to the borrower in cash. This equity can be used for any purpose such as home improvements or paying off other debt.

A lower interest rate is another reason to refinance. This often happens when market interest rates decline. Borrowers with adjustable-rate mortgages or home equity lines of credit may also choose to refinance when rates are low to lock in a fixed-rate loan.

Some borrowers want to shorten the term of their loan when they refinance. This could be done to save on interest costs over the life of the loan or because the borrower now has extra income and wants to pay off the debt sooner.

Another common reason for refinancing is to consolidate debt from multiple loans into a single monthly payment. This can simplify repayment and may also save on interest costs if the new loan has a lower rate than the existing loans being consolidated.

Before making the decision to refinance, borrowers should carefully consider all of the pros and cons. Refinancing can offer many benefits but it’s important to understand that it’s not right for everyone.

Who Can Refinance?

Homeowners with an existing mortgage may be able to refinance their loan and save money each month. Refinancing involves taking out a new loan with new terms, which may include a lower interest rate, and using it to pay off your existing mortgage. This can be a good option if interest rates have dropped since you originally took out your mortgage, or if you want to switch from an adjustable-rate mortgage to a fixed-rate mortgage.

Mortgage Refinancing

In order to refinance your mortgage, you will need to meet some basic requirements regarding credit, employment, and equity.

To start, most lenders require a minimum credit score in order to qualify for refinancing. This number can vary from lender to lender, but the average minimum score is usually around 620. If your credit score is below this number, you may still be able to qualify for refinancing, but you may have to pay a higher interest rate.

In terms of employment, most lenders require that you have been employed for at least 6 months in order to qualify for refinancing. If you have been employed for less time than this, you may still be able to qualify, but you may have to provide additional documentation.

Finally, most lenders require that you have at least 20% equity in your home in order to qualify for refinancing. Equity is the portion of your home that you own outright—it is the difference between what your home is worth and what you still owe on your mortgage. If you do not have 20% equity, you may still be able to qualify for refinancing through a government program such as the Home Affordable Refinance Program (HARP).

If you think that you might meet these requirements, refinancing could be a good option for you. Refinancing can help you save money by lowering your interest rate or monthly payments, or it can help you get cash out of your home equity. Contact a loan officer today to learn more about whether refinancing is right for you.

Student Loan Refinancing

To qualify for student loan refinancing, you’ll need to have a good credit score and steady income after graduation. If you don’t have a full-time job lined up, some lenders may still consider you for a loan if you have a strong cosigner.

You’ll need to compare rates and terms from multiple lenders to find the best deal. Student loan refinancing is not available through the federal government, so you’ll need to go through a private lender.

If you’re approved, the new lender will pay off your old loans and issue you a new loan with different terms. You may be able to get a lower interest rate, extend your repayment term or both.

Auto Loan Refinancing

You can refinance an auto loan if you have good credit and have paid at least 20% of the original loan. If you refinance, you may be able to get a lower interest rate and monthly payment. You may also be able to get a shorter loan term, which could save you money on interest over the life of the loan.

How to Refinance

Borrowers refinance a loan for many reasons. Some want to lower their monthly payments by extending the loan term. Others want to reduce the total amount of interest paid by refinancing to a lower interest rate. And still others hope to tap into their home equity by refinancing to a larger loan.

Mortgage Refinancing

When you refinance a mortgage, you take out a new loan to pay off the old one. This time, you aim for a lower interest rate and better terms. However, if your credit score has gone down or if your home value has decreased, you may not qualify for a better mortgage. You’ll have to prove to the lender that you can still afford the payments.

To do this, take a look at your current budget and make sure that your new mortgage payment would still leave you with enough cash flow to cover your other monthly expenses and have some left over for savings or entertainment. You should also have some cushion in case unexpected expenses come up. If everything looks good on paper, it’s time to start shopping for lenders.

Be sure to compare offers from multiple lenders so that you can find the best rate and terms for your situation. Pay attention to things like the interest rate, origination fees, and other costs associated with taking out a new loan. Once you’ve found the right lender, it’s time to fill out an application and get started on the process of refinancing your mortgage.

Student Loan Refinancing

Refinancing your student loans can save you money on interest and help you pay off your debt faster. In order to qualify for refinancing, you generally need good credit and a steady income. You may also be able to get a lower interest rate if you apply with a cosigner.

If you’re thinking about refinancing your student loans, here are a few things to keep in mind:

1. Check your credit score and history. In order to get the best rates, you’ll need a good credit score. You can check your credit score for free with sites like Credit Karma or Annual Credit Report.

2. Compare rates from multiple lenders. Once you know your credit score, you can start shopping around for the best loan rates. Be sure to compare rates from multiple lenders to make sure you’re getting the best deal possible.

3. Consider your repayment terms. When you refinance your loans, you’ll be able to choose new repayment terms that fit your budget and lifestyle. For example, you may be able to choose a shorter repayment term if you’re looking to save money on interest, or a longer term if you need lower monthly payments.

4. Weigh the pros and cons of refinancing. Refinancing isn’t right for everyone – it’s important to weigh the pros and cons before making a decision. Some things to consider include: whether you qualify for lower interest rates, whether you’ll be able to take advantage of any repayment benefits (like student loan forgiveness), and whether refinancing will help you meet your financial goals.

Auto Loan Refinancing

Refinancing your auto loan can save you money if you qualify for a lower interest rate. If you have an excellent credit score and income, and you owe less than the vehicle is worth, you may be able to get a lower rate from another lender and use that to pay off your current loan.

When you refinance an auto loan, you replace your current loan with a new one from another lender. The new loan pays off the balance of your current loan, and you start making payments on the new loan. If you have equity in your car, you may be able to get cash out when you refinance.

You’ll want to consider a few things before refinancing an auto loan, including:

-Your credit score and income: To get the best rates, you’ll need good credit and steady income.

-How much equity you have in your car: You’ll generally need at least 20% equity to qualify for refinancing.

-The terms of your new loan: Be sure to compare the interest rate, monthly payment, and term of the new loan with your current loan to make sure it’s a good deal.

-Whether there are any fees associated with refinancing: Some lenders charge fees for refinancing, which can add to the cost of the new loan.

Conclusion

Refinancing a loan simply means taking out a new loan to pay off an existing loan. By doing this, you can often secure a lower interest rate or monthly payment. However, it’s important to understand the pros and cons of refinancing before you make any decisions.

There are many reasons why people choose to refinance their loans. Some people do it to get a lower interest rate, while others do it to reduce their monthly payments. Still others do it to consolidate multiple loans into one single loan with one monthly payment.

Whatever your reason for refinancing, it’s important to understand how the process works and what the pros and cons are before you make any decisions.

The bottom line is that refinancing can be a great way to save money or improve your financial situation. Just be sure to do your homework first so you know what you’re getting into!