How to Not Pay Interest on Credit Cards

Contents

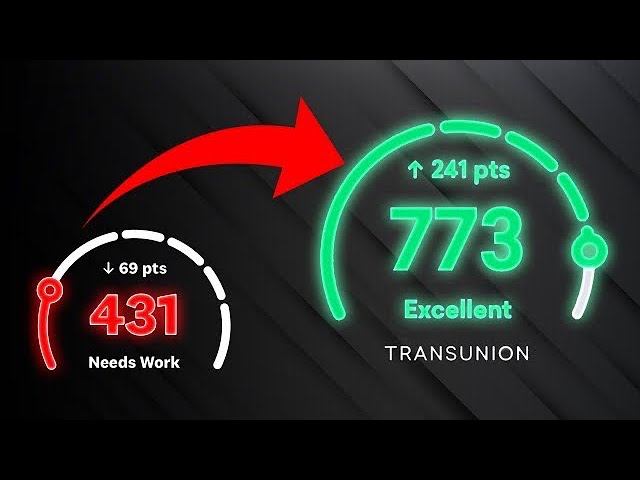

If you’re like most people, you probably have a few credit cards with balances that you’re paying interest on every month. Here’s how to not pay interest on your credit cards so you can save money and get out of debt faster.

Checkout this video:

Know when your grace period ends

Your credit card issuer must give you at least 21 days to pay your bill before it charges interest on new purchases (unless you have a good reason for not paying on time). This is called the grace period.

But not all issuers give you a grace period if you carry a balance from month to month. If that’s the case, you’ll start accruing interest on new purchases as soon as they post to your account.

To avoid paying interest, make sure you pay off your entire balance before your grace period ends. You can find the date when your grace period ends on your monthly credit card statement.

Use a credit card that offers a 0% APR introductory rate

If you have outstanding credit card debt, one of the best things you can do is find a credit card that offers a 0% APR introductory rate. This means that for a set period of time, usually 12 to 18 months, you will not be charged any interest on your balance.

This can be an excellent way to save money, especially if you are able to pay off your balance before the intro period expires. Just be sure to read the fine print and make sure you understand all the terms and conditions before signing up for a new card.

Pay your balance in full every month

The best way to avoid paying interest on your credit card balance is to pay the full balance every month. That way, you’ll never be charged interest.

If you can’t pay your balance in full every month, try to pay as much as you can. The more you pay, the less interest you’ll be charged.

Paying just the minimum balance each month will cost you a lot in interest and will take a long time to pay off your debt.

Avoid cash advances and balance transfers

In order to avoid paying interest on your credit card, you should avoid cash advances and balance transfers. Cash advances will often have a higher interest rate than your regular purchases, so it is best to avoid them if possible. Balance transfers may also have a higher interest rate, so you should only use them if you are confident you can pay off the balance within the promotional period.