How Does Business Credit Work?

Contents

- What is business credit?

- How can business credit help your business?

- How do you build business credit?

- What are the benefits of having strong business credit?

- How can you use business credit to get financing?

- How can you improve your business credit score?

- What are the different types of business credit?

- How can you get started with business credit?

Business credit is a key factor in obtaining financing for your business. Learn how business credit works and how to build business credit.

Checkout this video:

What is business credit?

Business credit is a type of credit that is extended to businesses by financial institutions. Unlike personal credit, which is based on the creditworthiness of the individual borrower, business credit is based on the creditworthiness of the business. This means that businesses with good credit histories will be able to get better terms on loans and other types of financing than businesses with bad credit histories.

There are two main types of business credit: secured and unsecured. Secured business credit is backed by some kind of collateral, such as real estate or equipment. Unsecured business credit is not backed by any collateral and is therefore riskier for the lender. However, unsecured business credit can be easier to obtain than secured business credit because the borrower does not have to put up any collateral.

Businesses can build their business credit histories by doing things like making all their payments on time, maintaining a good relationship with their creditors, and having a positive banking history.

How can business credit help your business?

There are many benefits to having good business credit, including:

-You may be able to get approved for loans and lines of credit without a personal guarantee.

-You may qualify for lower interest rates on loans and lines of credit.

-You may be able to get better terms on loans and lines of credit.

-Good business credit can help you get approved for leases and contracts.

-Good business credit can help you get insurance at lower rates.

-It can give you more negotiating power with suppliers.

How do you build business credit?

There are a few key ways to build business credit. One is to make sure you pay your bills on time. This includes things like rent, utilities, and loans. You can also use a business credit card to help build your business credit. Make sure you make your payments on time and in full each month. You can also get a business credit report to help you track your progress.

What are the benefits of having strong business credit?

There are many benefits of having strong business credit, including:

-Higher credit limits: Lenders are more likely to extend higher credit limits to businesses with strong credit scores. This can give your business the financial flexibility it needs to grow.

-Lower interest rates: Businesses with strong credit scores typically qualify for lower interest rates on loans and lines of credit. This can save your business money over time.

-Greater lending options: Lenders are more likely to offer financing to businesses with strong credit scores. This means your business will have more options when it comes time to find a loan or line of credit.

-Improved negotiating power: Businesses with strong credit scores often have more negotiating power when it comes to terms and conditions on loans and lines of credit. This can help your business get the best possible terms on financing.

How can you use business credit to get financing?

You can use business credit to get financing for your business in a number of ways. One way is to get a business loan from a bank. Another way is to get a line of credit from a lender. You can also use business credit to finance your business by using credit cards.

How can you improve your business credit score?

There are a number of things you can do to improve your business credit score, including:

-Pay your bills on time

-Keep your balances low

– Use a business credit card

– Get insured

-Monitor your credit report for errors

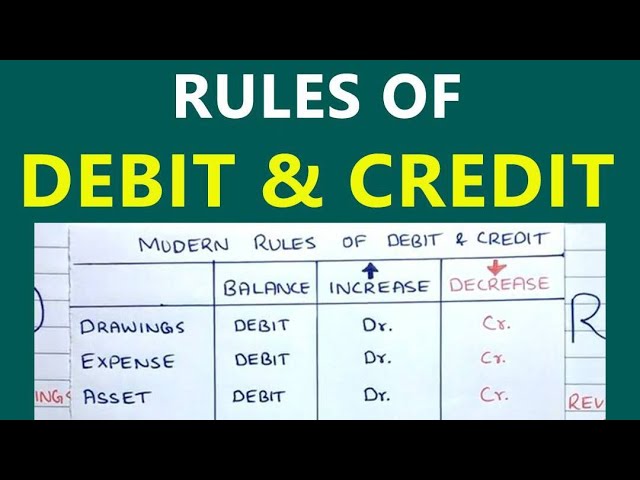

What are the different types of business credit?

There are two main types of business credit:

1. Personal credit: This is credit that is in your name only and is not associated with your business. This might include a credit card or loan that you get for your personal use, but you can also use it for business purposes.

2. Business credit: This is credit that is in your business’s name and is reported to business credit reporting agencies. This might include a business credit card, loan, or line of credit.

You can also have a mix of both personal and business credit, which is known as co-mingled credit. This can be helpful if you’re just starting out and don’t have much business credit history yet. Co-mingled credit can also help you build your business credit more quickly.

How can you get started with business credit?

Building business credit is essential for small business owners who want to establish a good credit history for their business. Business credit can help you get loans, lines of credit, and other financing products at better terms and rates. It can also help you build your business’s reputation and credibility.

There are a few different ways to get started with building business credit. One option is to sign up for a business credit card. With a business credit card, you can begin to build a good payment history, which is one of the most important factors in your business credit score. You can also begin to establish relationships with other businesses that report your payments to the major business credit reporting agencies.

Another option is to take out a small loan or line of credit from a lender that reports to the major business credit reporting agencies. This can help you build a good payment history and establish a relationship with a lender that reports to the major business credit reporting agencies.

You can also join a trade association or Chamber of Commerce. These organizations often offer programs that help businesses build their creditworthiness. By joining one of these organizations and taking advantage of their programs, you can start building your business’s credibility and reputation, which will help you get better terms and rates on loans and other financing products in the future.