What is a Benefit of Having a Good Credit Score?

Contents

A good credit score is important for several reasons. First, it can help you get approved for loans and other forms of credit. A good credit score can also help you get lower interest rates on loans, which can save you money. Finally, a good credit score can help you rent an apartment or get a job.

Checkout this video:

Introduction

Your credit score can affect many aspects of your financial life, from getting approved for a credit card to qualifying for a mortgage. A good credit score can save you money in interest and help you get access to the best loan terms.

There are many benefits of having a good credit score, but here are four of the most important ones:

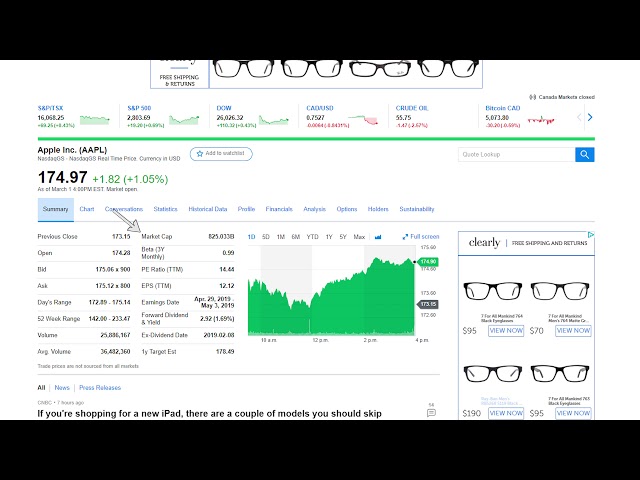

1. You’ll save money on interest.

If you have a good credit score, you’ll likely qualify for lower interest rates on loans and credit cards. This can save you hundreds or even thousands of dollars in interest over the life of a loan. For example, if you have a $20,000 auto loan with an interest rate of 5%, you’ll end up paying $1,500 in interest over the life of the loan. But if your interest rate is 3%, you’ll only pay $600 in interest.

2. You’ll have more borrowing options.

A good credit score gives you more options when it comes to borrowing money. You’ll be able to qualify for better loans with lower interest rates and more favorable terms. And, if you ever need to borrow money in an emergency, you’ll have a better chance of being approved for a loan.

3. You may be able to get insurance discounts.

Some insurance companies offer discounts to drivers with good credit scores. This can save you money on your car insurance premiums each year.

4. You’ll have peace of mind knowing that you’re financially healthy.

A good credit score is a sign that you’re managing your finances well and it can give you peace of mind knowing that you’re on solid financial footing.

What is a credit score?

A credit score is a number that reflects the creditworthiness of an individual. Credit scores are used by financial institutions to make decisions about whether or not to lend money to an individual. The higher an individual’s credit score, the more likely they are to be approved for a loan.

There are many benefits of having a good credit score. One benefit is that individuals with good credit scores are more likely to be approved for loans. Another benefit is that individuals with good credit scores may be offered lower interest rates on loans. Good credit scores can also help individuals save money on insurance premiums and rent payments.

What are the benefits of having a good credit score?

There are many benefits of having a good credit score. A good credit score can help you get a lower interest rate on a loan, get approved for a lease, or even get a job. A good credit score shows lenders that you’re a responsible borrower, and it can help you save money in the long run.

Conclusion

A good credit score is important because it gives you access to the best interest rates on loans and credit cards. It also allows you to qualify for the most favorable terms on loans. A good credit score can save you thousands of dollars in interest over the life of a loan.