Why Is My FICO Score Higher Than My Credit Score?

Contents

- Your FICO score is calculated using the information in your credit report.

- Your credit score is a number that represents your creditworthiness.

- There are a few reasons why your FICO score might be higher than your credit score.

- One reason why your FICO score might be higher than your credit score is because the two scores are calculated using different information.

- Another reason why your FICO score might be higher than your credit score is because your credit score is a snapshot of your creditworthiness at a specific point in time.

- The third reason why your FICO score might be higher than your credit score is because your FICO score is updated more frequently than your credit score.

- There are a few things you can do to improve your credit score.

If you’re wondering why your FICO score is higher than your credit score, there are a few things to keep in mind. First, FICO scores and credit scores are two different things. FICO scores are used by lenders to help make credit decisions, while credit scores are used by potential creditors to help them decide whether or not to extend you credit.

There are a few reasons why your FICO score might be higher than your credit score. One reason could be that your

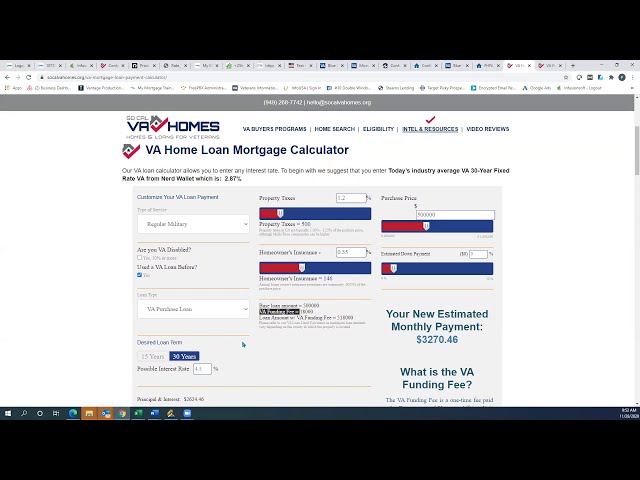

Checkout this video:

Your FICO score is calculated using the information in your credit report.

Your credit score is a number that creditors use to decide whether to give you credit. It is based on your credit history, which is a record of how you have handled borrowing and repaying debt in the past. Your FICO score is a type of credit score, which is a number that creditors use to decide whether to give you credit.

The information in your credit report is used to calculate your credit score.

Your credit score is a number that creditors use to determine your creditworthiness. It is based on the information in your credit report, which is a record of your credit activity and debt.

Creditors use your credit score to decide whether to give you a loan or a credit card, and at what interest rate. A higher score means you’re more likely to get approved for a loan or credit card, and you’ll usually get a lower interest rate.

You have three different credit scores, one from each of the three major credit bureaus: Experian, TransUnion, and Equifax. Your FICO score is the most widely used credit score, and it’s the one that creditors are most likely to look at when considering you for a loan or credit card.

Your FICO score may be different from yourcredit score because it’s based on different information in your credit report.

Your credit score is a number that represents your creditworthiness.

Your credit score is a number that represents your creditworthiness. It is based on the information in your credit report, and is used by lenders to help them decide whether or not to give you a loan. Your FICO score is calculated using the information in your credit report, and is used by lenders to help them decide whether or not to give you a loan.

Your credit score is a number that represents your creditworthiness.

A FICO score is a type of credit score that is used by many lenders. It is based on your credit history and is a good indicator of your ability to repay a loan. A credit score is a number that represents your creditworthiness. It is based on your credit history and is a good indicator of your ability to repay a loan.

Your credit score is used by lenders to determine whether you’re a good candidate for a loan.

A higher credit score means you’re a lower-risk borrower, which could lead to a lower interest rate on a loan. Credit scores are calculated based on your credit history – the information in your credit report – and can range from 300 to 850.

Lenders use credit scores to evaluate the probability that you will repay a loan and make payments on time. The higher your score, the more likely you are to get approved for a loan with favorable terms, such as a lower interest rate. A lower score could lead to a higher interest rate and could mean you won’t be approved for the loan at all.

Your FICO score is a number that represents your creditworthiness. It’s based on information in your credit report, and it’s used by lenders to determine whether you’re a good candidate for a loan. Your FICO score can range from 300 to 850, and the higher your score, the better.

If you have a high FICO score, it means you’re less of a risk to lenders and more likely to get approved for a loan with favorable terms, such as a lower interest rate. A low FICO score could lead to a higher interest rate and could mean you won’t be approved for the loan at all.

Your credit score is also used by landlords to determine whether you’re a good candidate for a lease.

Your credit score is a number that represents your creditworthiness. This number is used by lenders, landlords, and others to determine whether you’re a good candidate for a loan, credit card, or lease.

There are a few different scoring models in use, but the most common one is called the FICO score. Your FICO score is based on information from your credit report, and it’s calculated using a formula created by Fair Isaac Corporation.

Your credit score is important because it can affect your ability to get loans and leases, and it can also affect the interest rates you’re offered. A higher score indicates that you’re a lower-risk borrower, which means you’re more likely to be approved for loans and leases, and you may be offered better interest rates.

If you’re wondering why your FICO score is higher than your credit score from another scoring model, it’s because the two scores are calculated using different formulas. So, if one score is higher than the other, it doesn’t necessarily mean that one scoring model is better than the other. Instead, it just means that the two models are measuring different things.

There are a few reasons why your FICO score might be higher than your credit score.

One reason might be that your credit score is still being calculated based on old data. FICO scores are updated more frequently, so if you’ve made any improvements to your credit history, your FICO score will reflect that quicker. Another possibility is that you have a different credit mix than what’s being factored into your credit score.

One reason why your FICO score might be higher than your credit score is because the two scores are calculated using different information.

One reason why your FICO score might be higher than your credit score is because the two scores are calculated using different information. The FICO score looks at your payment history, credit utilization, length of credit history, and inquiries. The credit score only looks at your payment history.

Another reason why your FICO score might be higher than your credit score is because the FICO score is more forgiving of late payments. If you have made a late payment, it will have less of an impact on your FICO score than on your credit score.

Finally, the FICO score takes into account the types of credit that you have. For example, if you have both revolving credit (such as a credit card) and installment credit (such as a mortgage), this will be reflected in your FICO score but not in your credit score.

Another reason why your FICO score might be higher than your credit score is because your credit score is a snapshot of your creditworthiness at a specific point in time.

Your FICO score is a snapshot of your creditworthiness at a specific point in time, while your credit score is based on your credit report at a single moment. Because your FICO score is constantly changing, it’s possible that your credit score could be lower than your FICO score.

The third reason why your FICO score might be higher than your credit score is because your FICO score is updated more frequently than your credit score.

FICO scores are updated more frequently than credit scores because the information that they are based on, your credit reports, are updated more frequently. Credit reporting agencies are required to give you a free copy of your credit report every 12 months. However, they may update your credit report more often than that if there is activity on your account or if you have requested a copy of your credit report.

Each time your credit report is updated, your FICO score is also updated. So, if you check your FICO score and it is higher than your credit score, it could be because your FICO score is based on a more recent credit report than the one that was used to generate your credit score.

There are a few things you can do to improve your credit score.

First, you need to make sure you are paying your bills on time. This includes your credit card, mortgage, car payment, and any other debts you may have. Additionally, you should try to keep your balances low. This means you should only charge what you can afford to pay off each month. Also, don’t open too many new lines of credit at once.

One thing you can do to improve your credit score is to make sure you make all of your payments on time.

One thing you can do to improve your credit score is to make sure you make all of your payments on time. If you have any late payments, try to get them caught up as soon as possible. You can also try to get rid of any collections or charge-offs that you may have. Another thing you can do is to use less than 30% of your available credit. This will help improve your credit score over time.

Another thing you can do to improve your credit score is to keep your credit card balances low.

There are a few things you can do to improve your credit score. One is to make sure you pay your bills on time. Another thing you can do to improve your credit score is to keep your credit card balances low. If you have a lot of debt, try to pay it off as quickly as possible. You can also get help from a credit counseling service.

The third thing you can do to improve your credit score is to avoid opening new credit accounts.

Opening new credit accounts can be tempting, especially if you’re offered a high credit limit or a low interest rate. But every time you open a new account, you’re borrowing money that you may not be able to pay back, which can hurt your credit score. So if you don’t need to open a new account, it’s best to avoid it.