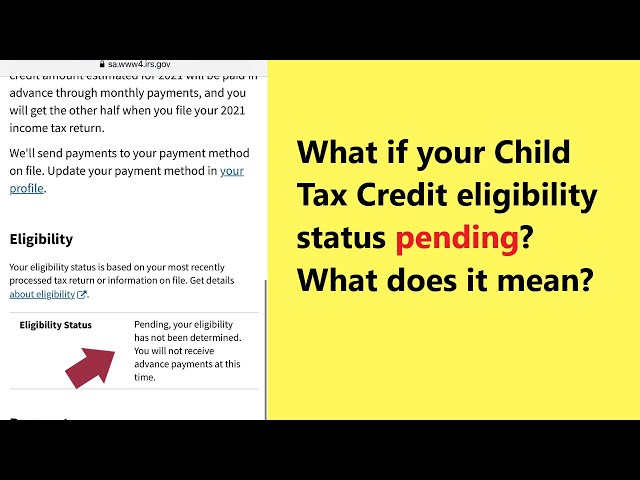

Why Is My Eligibility Pending for Child Tax Credit?

Contents

If you’re wondering why your eligibility for the Child Tax Credit is pending, don’t worry. In this blog post, we’ll explain everything you need to know.

Checkout this video:

Overview of the Child Tax Credit

The Child Tax Credit is a Federal tax credit available to families who have qualified children under the age of 17. The credit is worth up to $2,000 per child and can be used to offset the cost of raising a child. To be eligible for the credit, families must meet certain income requirements and file a tax return.

If your eligibility for the Child Tax Credit is pending, it means that the IRS is still processing your tax return and has not yet determined if you qualify for the credit. There are several reasons why your eligibility might be pending, including:

-You haven’t provided all of the required information or documentation.

-The IRS needs to verify your income or other information on your tax return.

-You owe back taxes or other debts to the IRS.

-You are subject to an audit or investigation by the IRS.

If your eligibility for the Child Tax Credit is pending, you should not expect to receive any benefits from the credit until your status has been resolved. In some cases, you may be able to speed up the process by providing additional information or documentation to the IRS.

Reasons Your Eligibility May Be Pending

The IRS may flag your child tax credit for a few different reasons. The most common reason is that the IRS needs more information from you in order to process your claim. This can happen if you haven’t provided enough information on your taxes, or if the IRS needs to verify your identity. Sometimes, the IRS will also flag your claim if they think you’ve made a mistake on your taxes. If this happens, you’ll need to provide additional information or documentation to the IRS.

You Haven’t Filed Your Taxes Yet

If you’re wondering why your eligibility for the Child Tax Credit is pending, one possibility is that you haven’t filed your taxes yet. The IRS requires that you file a tax return in order to claim the credit, so if you haven’t filed your taxes for the year in question, that could be the reason your eligibility is pending.

Another possibility is that you haven’t provided all of the required information on your tax return. In order to claim the Child Tax Credit, you must provide information about each child who qualifies, including their name, Social Security number, and relationship to you. If you’re missing any of this information, your eligibility for the credit will be pending until you provide it.

Finally, it’s possible that your income exceeds the income limits for the credit. The Child Tax Credit is available to taxpayers with incomes up to $75,000 for single filers and $110,000 for married couples filing jointly. If your income is above these limits, you won’t be eligible for the credit.

You Have a Balance Due on Your Taxes

If you have a balance due on your taxes, your eligibility for the CTC will be pending until the balance is paid in full. You can make a payment online, by mail, or by phone. Once your payment is processed, your CTC will be released.

You Haven’t Provided Additional Documentation

If you’ve been told your eligibility for the child tax credit is pending, it may be because you haven’t provided the IRS with additional documentation. When you file your taxes, you’ll need to include information about any dependent children who live with you. The IRS will use this information to determine if you’re eligible for the credit.

If you’re missing any required documentation, the IRS will send you a notice letting you know what they need. You’ll have a limited time to provide the missing information. If you don’t, your eligibility for the credit will be denied.

There are a few other reasons why your eligibility for the child tax credit may be pending. Read on to learn more.

How to Resolve Your Pending Eligibility

The Canada Revenue Agency (CRA) is responsible for determining your eligibility for the child tax credit. If your eligibility is pending, it means that the CRA needs more information from you in order to make a decision. There are a few ways that you can resolve your pending eligibility.

File Your Taxes

If you’re wondering why is my eligibility pending for Child Tax Credit, one of the first things you should do is make sure that you have filed your taxes. If you have not filed your taxes, this will be the first step in rectifying the situation. You can file your taxes online or by mail. Be sure to include all necessary documentation, such as your W-2 forms and 1099s.

Pay Your Tax Bill

If you owe taxes, you need to pay your tax bill before your eligibility for the child tax credit can be resolved. You can do this by mailing a check or money order to the IRS or by paying online. Be sure to include your social security number or taxpayer identification number on your payment so that it can be processed correctly.

If you can’t pay the full amount of your tax bill, you should still pay as much as you can. This will reduce the amount of interest and penalties that you’ll owe. You can also set up a payment plan with the IRS if you think you’ll be able to pay your balance within 120 days.

Once you’ve paid your tax bill, the IRS will need to process your payment and update their records. This usually takes a few weeks. Once they’ve done this, they’ll send you a letter letting you know that your eligibility for the child tax credit has been resolved and telling you how much credit you’re eligible for.

Submit the Required Documentation

If you’re unsure of what documentation is required, you can call the IRS at 800-829-1040. Once you have the required documentation, send it to the address listed on your notice. Be sure to include your Social Security number and the tax year for which you’re claiming the credit.