Why Is My Available Credit Zero?

Contents

If you’re wondering why your available credit is zero, there could be a few reasons. In this blog post, we’ll explore a few potential causes and what you can do to fix the issue.

Checkout this video:

Reasons your credit may be zero

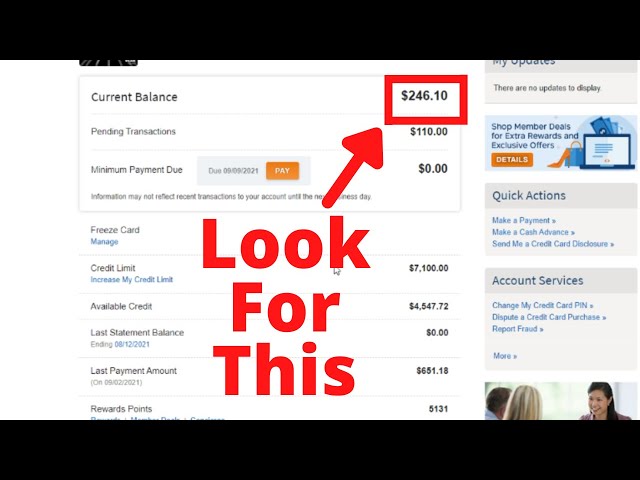

There are a few reasons your available credit may be zero. One reason could be that you have a balance on your credit card. If you have a balance, your credit card company will report your balance to the credit bureaus, which will lower your credit score. Another reason could be that you have a high credit utilization ratio. This happens when you use a high percentage of your credit limit, which also lowers your credit score.

You have no credit history

If you have never had a credit card or taken out a loan, you have no credit history. Lenders have no way to gauge your ability to repay a debt, so they are unlikely to approve you for a loan or offer you a credit card. You can start building your credit history by applying for a secured credit card or taking out a small personal loan from a credit union. Once you have established a history of on-time payments, you will begin to build your credit score.

You have a very low credit score

If you have a very low credit score, it’s likely that you won’t have any available credit. A low credit score signals to lenders that you’re a high-risk borrower, which means they’re less likely to approve you for a loan or extend you credit. If you’re just starting out, you may not have had time to build up a strong credit history yet. In this case, consider opening a secured credit card, which requires a cash deposit that becomes your credit limit. You can use a secured card to make purchases and payments just like a regular credit card, but your spending is limited to the amount of money you have on deposit. As you make timely payments over time, you can rebuild your credit score and eventually qualify for an unsecured card with a higher limit.

You have a high credit utilization ratio

Your credit utilization ratio is the percentage of your credit limit that you’re using at any given time. So, if you have a $1,000 credit limit and a balance of $500, your credit utilization ratio would be 50%. The higher your credit utilization ratio, the more it hurts your credit score.

Many experts recommend keeping your credit utilization ratio below 30%. Some even recommend keeping it below 10%. The lower you can keep it, the better.

A high credit utilization ratio can be caused by a few different things. Maybe you’ve recently opened a new line of credit and you’re carrying a balance from month to month. Or maybe you’ve had the samecredit card for a long time and you’ve gradually increased your spending (and not increased your credit limit).

How to improve your credit

If you have zero available credit, it means that you are using all of your available credit. This can be harmful to your credit score and make it difficult to get approved for new credit in the future. There are a few things you can do to improve your credit.

Use a credit-builder loan

A credit-builder loan is a type of loan where the borrower uses the loan proceeds to build their credit. The loan is reported to the credit bureaus, and as the borrower makes monthly payments on time, their credit score improves. Credit-builder loans are often used by people with bad credit or no credit history.

There are a few different types of credit-builder loans, but the most common is a secured credit-builder loan. With a secured credit-builder loan, the borrower uses collateral to secure the loan. The most common type of collateral is a savings account, but some lenders may also accept other forms of collateral, such as a car or home equity.

The advantage of a secured credit-builder loan is that it usually has a lower interest rate than an unsecured loan. This makes it easier for the borrower to make their monthly payments and improve their credit score. The disadvantage of a secured credit-builder loan is that if the borrower defaults on the loan, they could lose their collateral.

Get a secured credit card

If you’re looking to improve your credit, one of the best things you can do is get a secured credit card. A secured credit card is a credit card that is backed by a cash deposit that you make upfront. The deposit acts as collateral for the credit card, which means that if you don’t make your payments, the issuer can take the money from your deposit to cover the debt.

While secured credit cards may not have all the bells and whistles of regular credit cards, they can be a great way to build or rebuild your credit. And, if used responsibly, they can help you transition to a regular unsecured credit card.

There are a few things you can do to improve your credit, and becoming an authorized user on someone else’s credit card is one of them. Becoming an authorized user means that you’re allowed to use someone else’s credit card, but you’re not responsible for paying the bill. This can help you build your credit if the card owner has good credit habits.

Before you Becoming an authorized user, make sure that the person whose credit card you’ll be using is willing and able to make all the payments on time. You don’t want to damage your own credit by becoming an authorized user on a card that isn’t being paid on time.

Use a credit counseling service

There are many reputable credit counseling services out there that can help you get your finances back on track. A credit counselor will work with you to create a budget and help you develop a plan to pay off your debt. They can also negotiate with your creditors to try to get them to lower your interest rates or waive certain fees.

If you decide to use a credit counseling service, make sure you choose one that is accredited by the National Foundation for Credit Counseling or the Association of Independent Consumer Credit Counseling Agencies. These organizations require their members to adhere to certain standards, so you can be sure you’re getting quality help.