Who Can Qualify for a VA Loan?

Do you think you might qualify for a VA Loan? Check out this blog post to see if you meet the qualifications set by the Department of Veterans Affairs.

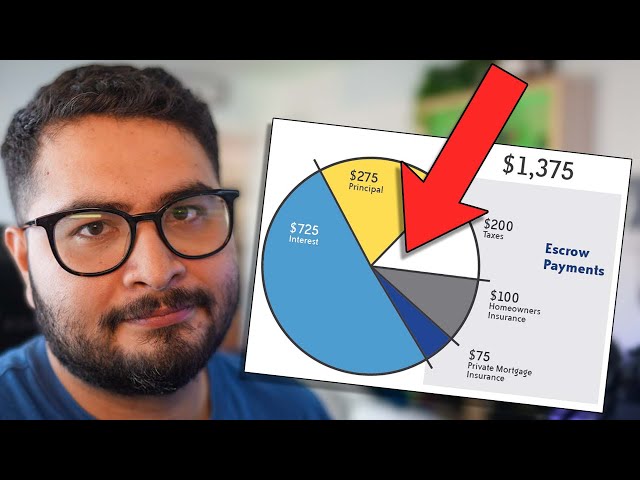

Checkout this video:

General Qualifications

Many veterans, active military, National Guard and Reserve members, and certain surviving spouses become eligible for a VA-backed home loan. But there are a few things you should know about VA home loan eligibility before moving forward with your homebuying journey. The first step is to get your Certificate of Eligibility (COE).

Must have a Certificate of Eligibility (COE)

To get a VA direct or VA-backed loan, you’ll need a Certificate of Eligibility (COE) to show your lender that you qualify for this benefit based on your service history and duty status.

If you’re eligible, you can apply for a COE online through eBenefits, by mail using the Veterans Application for Estimated Benefits form, or through your lender. If you already have your DD214 form, don’t upload it. The COE verifies to the lender that you are eligible for a VA-backed loan. The COE doesn’t guarantee a loan–the lender still needs to approve your loan application.

Served at least 90 days during wartime or 181 days during peacetime

If you’re a veteran who served on active duty during wartime or peacetime, you might be eligible for a Veterans Affairs (VA) loan. You’ll need to meet certain service requirements and other qualifications, but if you do, a VA loan could help you buy a home with significant advantages.

To qualify for a VA loan, you must have served on active duty for at least 90 days during wartime or 181 days during peacetime. If you were discharged because of a service-related disability, you may be eligible with fewer days of service.

You must also have a satisfactory credit history and sufficient income to cover your mortgage payment and other monthly expenses. In addition, you’ll need to obtain a Certificate of Eligibility (COE) from the VA to prove your eligibility for the loan.

Must have received an honorable discharge

In order to qualify for a VA loan, the borrower must have received an honorable discharge from their military service. If the borrower is still active duty, they may be eligible for a VA loan after at least six months of service. Reservists and National Guard members may also be eligible for a VA loan after completing six years of service.

Qualifying Income

There are plenty of misconceptions about what kind of income will or will not qualify you for a VA Loan. In reality, as long as you can provide evidence of a steady income stream, you should be eligible for a VA Loan, no matter where that income comes from.

Must have a steady income

In order to qualify for a VA loan, you must have a steady income. This can be from a job, self-employment, retirement benefits, or other sources. The key is that you have a regular income that can be used to make your monthly loan payments.

Must have a good credit history

A minimum credit score of 620 is required to qualify for a VA loan. However, lenders often require a minimum credit score of 640. If your credit score is below 640, you’ll need to work on your credit before you can apply for a VA loan.

Qualifying Property

One of the first things you’ll need to do when considering a VA loan is to make sure the property you wish to buy qualifies. The type of property, location, and intended use all play a part in determining eligibility. In order for the property to qualify, it must:

Must be for a primary residence

Not only must the property serve as your primary residence, but it must also be a “qualified home.” That generally means a single-family dwelling, a condominium unit in an eligible project, a manufactured home or a multi-unit property in which you occupy one unit as your primary residence and rent the others.

Must be a single-family home, a condominium, a townhouse, or a manufactured home

To qualify for a Veterans Affairs loan, you must be a veteran, active military personnel, or a member of the National Guard or Reserves. You must also occupy the home as your primary residence. The home must be a single-family home, a condominium, a townhouse, or a manufactured home. A duplex or other multifamily dwelling unit is not eligible for VA financing.

Must meet minimum property standards set by the VA

All properties purchased with a VA loan must go through a VA appraisal. The purpose of this appraisal is to ensure the home meets the minimum property standards set by the VA. These standards protect borrowers from purchasing a home that could quickly fall into disrepair and become a financial burden.

The appraiser will look at all aspects of the home, from the foundation to the roof and all areas in between. They will also take into account any improvements that have been made to the property since it was built. If the appraiser finds any problems with the home, they will be noted in the appraisal report.

The borrower is responsible for ensuring that all necessary repairs are made before closing on the loan. However, there are some circumstances where the repairs can be made after closing. For example, if the cost of repairs is less than 5% of the total loan amount, then these repairs can be financed into the loan. The borrower would then have up to 12 months to make these repairs.

If you are planning on purchasing a home with a VA loan, it is important to work with a real estate agent who is familiar with these guidelines. They can help you find a property that meets all of the necessary requirements and avoid any potential problems down the road.