Which One of the Following Uses Your Credit History to Determine Your Credit Score?

Contents

If you’re wondering which one of the following uses your credit history to determine your credit score, the answer is all of them. That’s right, all three of the major credit reporting agencies use your credit history to calculate your credit score. So, if you’re looking to improve your credit score, it’s important to focus on building a strong credit history.

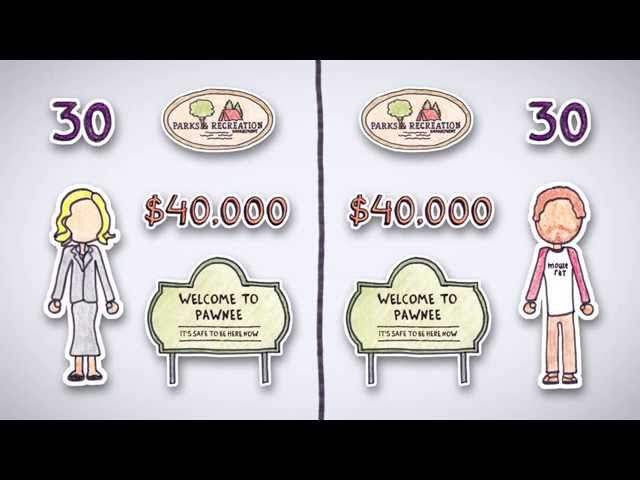

Checkout this video:

What is a credit score?

A credit score is a number that represents your creditworthiness. It is used by lenders to determine whether or not you are a good candidate for a loan or credit card, and it can also affect the interest rate and terms you are offered. Your credit score is based on your credit history, which is a record of your borrowing and repayment activity.

There are several factors that go into determining your credit score, but your credit history is one of the most important. Lenders will look at your credit history to see how you have handled borrowing and repayments in the past, and this information will be used to determine your credit score.

How is a credit score determined?

There are many factors that go into determining your credit score, but one of the most important is your credit history. This is a record of how you’ve handled borrowing and repayment in the past, and it’s one of the first things that lenders will look at when considering you for a loan.

Your credit history is used to calculate your credit score, which is a number that lenders use to determine your riskiness as a borrower. The higher your score, the lower your interest rates will be, and the better your chances of getting approved for a loan. So if you’re looking to improve your credit score, it’s important to focus on building a strong credit history.

What are the different types of credit scores?

There are many types of credit scores, and lenders may use a different type of credit score than FICO® to make lending decisions. Credit scores are not included with credit reports.

FICO® scores are the most widely used type of credit score, but even FICO® has many different versions. Auto lenders, for example, often use versions of the FICO® Score that focus on recent information to better predict a borrower’s future ability to repay auto loans.

Other common types of credit scores include the following:

-VantageScore

-Experian National Equivalency Score

-TransUnion New Account Score 2

-Equifax Credit Score power by Pinnacle

How do lenders use credit scores?

Lenders use credit scores to evaluate the creditworthiness of borrowers. They do this by looking at a number of factors in your credit history, including your payment history, the types of credit you have, the length of your credit history, and how much debt you have.

Your credit score is a numeric representation of your creditworthiness. The higher your score, the more likely you are to be approved for a loan or line of credit. A low score may mean that you will be denied for a loan or that you will be offered a loan with less favorable terms, such as a higher interest rate.

How can you improve your credit score?

Your credit score is a number that lenders use to decide whether or not to give you a loan. The higher your credit score, the lower the interest rate you’ll have to pay on a loan. A low credit score could also mean you won’t be approved for a loan at all.

You can improve your credit score by paying your bills on time, maintaining a good credit history, and using less of your available credit. You can also improve your credit score by taking steps to fix errors on your credit report.