Which Of These Is Not A Way In Which Credit Card Companies Assess Finance Charges

Contents

- What is a finance charge?

- How do credit card companies assess finance charges?

- What are the different ways in which credit card companies assess finance charges?

- What is the method most commonly used by credit card companies to assess finance charges?

- How can you avoid paying finance charges?

- What are the consequences of not paying your finance charges?

- How can you dispute a finance charge?

- What is the statute of limitations on finance charges?

- What happens if you die before paying off your credit card debt?

- Can you negotiate with your credit card company to waive finance charges?

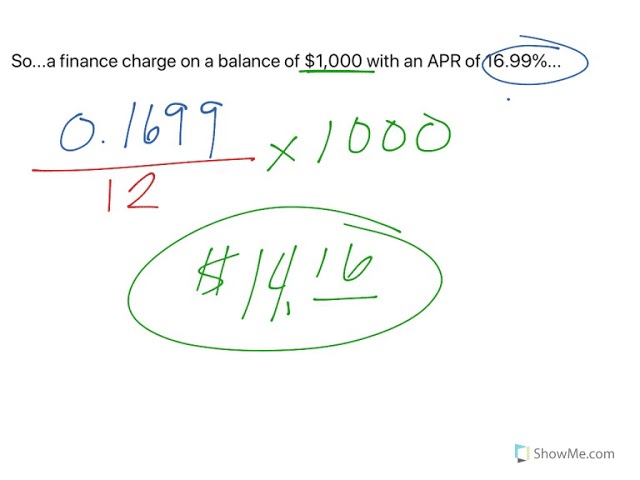

If you’re wondering which of these is not a way in which credit card companies assess finance charges, the answer is pretty simple. Credit card companies assess finance charges in a number of ways, but the most common method is through the use of a APR, or annual percentage rate.

Checkout this video:

What is a finance charge?

A finance charge is a fee that a credit card company charges for the use of its credit products. Finance charges are assessed on a monthly basis, and the total amount is due at the end of each billing cycle.

There are several ways in which credit card companies assess finance charges, but the most common method is through the use of a credit card’s interest rate. Credit card companies will also assess finance charges for late payments, annual fees, cash advances, and balance transfers.

How do credit card companies assess finance charges?

Credit card companies assess finance charges in a number of ways. One common method is to charge a fixed percentage of the outstanding balance on the card each month. This percentage is typically somewhere between 1 and 3 percent. Another way to assess finance charges is to charge a flat fee for each purchase made on the card, regardless of the amount of the purchase. Finally, some credit card companies will charge a variable rate based on the prime rate, which is the rate banks charge their best customers.

What are the different ways in which credit card companies assess finance charges?

Credit card companies assess finance charges in different ways, depending on the type of card and the issuer. The most common method is the daily periodic rate, which is applied to the outstanding balance on the account each day. Other methods include the average daily balance, adjusted balance, previous balance, and two-cycle average daily balance. Some issuers also charge a flat fee for each purchase made with the card.

What is the method most commonly used by credit card companies to assess finance charges?

The three most common ways that credit card companies assess finance charges are the average daily balance method, the adjusted balance method, and the previous balance method. With the average daily balance method, finance charges are calculated by taking the average of your account balance throughout the billing cycle and multiplying that amount by the daily periodic rate and the number of days in the billing cycle. The adjusted balance method calculates finance charges by taking your account balance at the beginning of the billing cycle and subtracting any payments or credits you made during that billing cycle; Finance charges are then calculated by multiplying this adjusted balance by the monthly periodic rate and the number of days in the billing cycle. The previous balance method is calculated by taking your account balance at the beginning of the billing cycle and multiplying it by the monthly periodic rate and the number of days in that billing cycle. In general, credit card companies assess finance charges using one of these three methods.

How can you avoid paying finance charges?

There are a few things you can do to avoid paying finance charges on your credit card:

– Pay your balance in full every month. If you can’t do this, try to at least pay more than the minimum due.

– Keep your credit card balance low. The lower your balance, the less interest you will accrue.

– Avoid using your credit card for cash advances andbalance transfers. These transactions usually come with a higher interest rate than purchases.

– Use a 0% APR credit card for new purchases. Many credit cards offer 0% APR for a limited time, usually 12 to 18 months. This can help you avoid paying any interest on your new purchases.

If you are already carrying a balance on your credit card, there are still things you can do to reduce the amount of interest you’re paying:

– Shop around for a lower APR credit card. If you have good credit, you may be able to qualify for a card with a lower interest rate than the one you’re currently using.

– Ask your current credit card company to lower your APR. If you have been a good customer, they may be willing to do this for you.

– Make a larger payment each month. The more you pay each month, the faster you’ll pay off your balance and the less interest you’ll accrue.

What are the consequences of not paying your finance charges?

There are a few different ways in which credit card companies assess finance charges, and the consequences of not paying them can vary depending on which method is used. One way is to simply add the finance charges to your outstanding balance, which will then accrue interest at the standard rate. Another way is to use a separate “finance charge” account, on which interest is charged immediately. Not paying your finance charges can lead to late fees, higher interest rates, and damage to your credit score.

How can you dispute a finance charge?

If you think a finance charge on your credit card bill is incorrect, you can contact your credit card issuer to dispute the charge. You’ll need to provide documentation to support your claim, such as receipts or canceled checks. If the issuer agrees that the charge is incorrect, it will reverse the finance charge and send you a corrected bill.

There are several other ways in which credit card companies assess finance charges, including:

-Balance transfers: A balance transfer fee is usually charged when you transfer debt from one credit card to another.

-Cash advances: A cash advance fee is charged when you use your credit card to get cash from an ATM or financial institution.

-Foreign transactions: A foreign transaction fee is charged when you make a purchase in a currency other than U.S. dollars.

What is the statute of limitations on finance charges?

There is no statute of limitations on finance charges. However, if you believe that a finance charge has been assessed incorrectly, you should contact the credit card issuer as soon as possible to dispute the charge.

What happens if you die before paying off your credit card debt?

There is no definite answer, as each credit card company has its own policies and procedures. In general, though, if you die before paying off your credit card debt, your estate will be responsible for repaying the debt. Your estate includes any assets you have, such as property, savings, and life insurance policies. If your estate is not able to repay the debt, your creditors may try to collect from your family members or other beneficiaries named in your will.

Can you negotiate with your credit card company to waive finance charges?

Credit card companies assess finance charges in a number of ways. The most common is the daily periodic rate, which is simply a fraction of the APR applied to the outstanding balance each day. Other methods include the adjusted balance, previous balance, average daily balance, and two-cycle average daily balance methodologies. Your credit card agreement will specify which method is used to calculate your finance charges. In most cases, you cannot negotiate with your credit card company to waive finance charges.