Which Of These Is Not A Method Used To Calculate Finance Charges?

Contents

- What is a finance charge?

- How is finance charge calculated?

- What are the different methods of calculating finance charges?

- Which method of calculating finance charges is the best?

- Why is it important to know how finance charges are calculated?

- What are the consequences of not understanding how finance charges are calculated?

- How can you avoid paying too much in finance charges?

- What should you do if you think you are being charged too much in finance charges?

- What are some tips for reducing finance charges?

- How can you save money on finance charges?

There are several methods that can be used to calculate finance charges, but not all of them are created equal. In this blog post, we’ll take a look at four common methods and see which one is the best option for you.

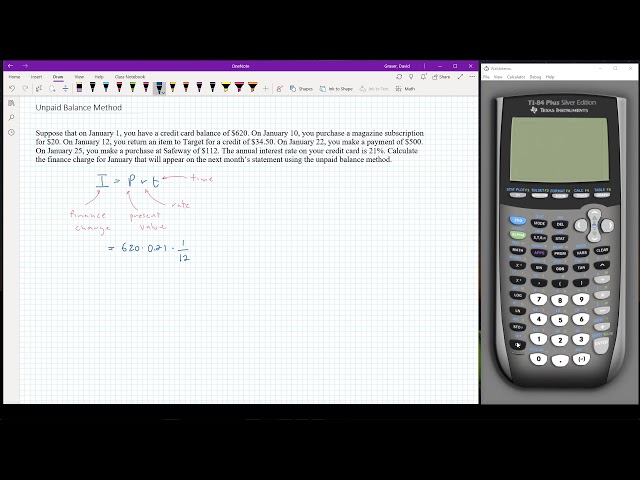

Checkout this video:

What is a finance charge?

A finance charge is a fee charged by a lender for the use of credit. Finance charges can be incurred for a variety of reasons, including but not limited to: annual fees, late fees, establishment fees, cash advance fees and over-limit fees. The method used to calculate finance charges varies depending on the type of credit account you have; it is important to understand how your lender calculates finance charges so that you can try to avoid them.

The most common method used to calculate finance charges is the daily balance method. This method calculates finance charges by taking the daily balance of your account and multiplying it by the daily periodic rate (the APR divided by 365). The daily periodic rate is then multiplied by the number of days in the billing cycle to get the total finance charge.

Other methods used to calculate finance charges include the previous balance method, average daily balance method and adjusted balance method. The previous balance method takes the previous month’s closing balance as the starting point for calculation. The average daily balance method uses the average of your account balances during the billing cycle as the starting point for calculation. The adjusted balancemethod takes into account payments and credits made during the billing cycle; this means that if you make a payment before your bill is due, you will not be charged interest on that amount for that billing cycle.

How is finance charge calculated?

There are a few different ways that finance charges can be calculated, depending on the creditor. The most common methods are the average daily balance method, the adjusted balance method, the previous balance method, and the two-cycle average daily balance method.

With the average daily balance method, finance charges are calculated by taking the average of your outstanding balances during the billing cycle, then multiplying that figure by the periodic interest rate and the number of days in the billing cycle.

The adjusted balance method is similar to the average daily balance method, but it uses the outstanding balance at the beginning of each billing cycle (after subtracting any payments made during that billing cycle) to calculate finance charges.

The previous balance method simply calculates finance charges based on your account balance at the end of the previous billing cycle. No adjustments are made for payments or purchases made during the current billing cycle.

With two-cycle billing, creditors take your average daily balance from both the current and previous billing cycles to calculate finance charges. This method generally results in higher finance charges than if only one billing cycle was used.

What are the different methods of calculating finance charges?

There are a few different ways that credit card companies can calculate your finance charges. The method that your credit card company uses will usually be disclosed in your credit card agreement. Some common methods of calculating finance charges include the daily balance method, the daily balance method with grace period, the two-cycle average daily balance method, and the adjusted balance method.

The daily balance method is the most common way that finance charges are calculated. With this method, your credit card company takes the beginning balance on your statement date and adds any new charges and subtracts any payments or credits that have been applied. This figure is then multiplied by the periodic rate to get the finance charge.

The daily balance method with grace period is similar to the daily balance method, but it uses the ending balance on your statement date rather than the beginning balance. New charges and payments are still added and subtracted from this figure. This figure is then multiplied by the periodic rate to get the finance charge.

The two-cycle average daily balance method is another common way of calculating finance charges. With this method, your credit card company takes all of the balances from the last two billing cycles and adds them together. This figure is then divided by two to get the average daily balance. This figure is then multiplied by the periodic rate to get the finance charge.

The adjusted balance method is a less common way of calculating finance charges. With thismethod, your credit card company subtracts any payments or credits that have been applied fromthe beginning Balance on your statement date to get an adjusted balance figure. This figure isthen multiplied by the periodic rate to get t he finance charge .

Which method of calculating finance charges is the best?

The method you use to calculate your finance charges can have a big impact on your bottom line. There are several different methods that businesses use to calculate finance charges, and each has its own advantages and disadvantages.

The three most common methods for calculating finance charges are the average daily balance method, the two-cycle average daily balance method, and the adjusted balance method.

The average daily balance method is the most commonly used method for calculating finance charges. With this method, your finance charge is based on the average balance of your account over the course of the billing cycle. This means that if you have a high balance one month and a low balance the next, your finance charge will be averaged out over the two months.

The two-cycle average daily balance method is similar to the average daily balance method, but it uses a two-month billing cycle instead of just one. This means that your finance charges will be based on the average of your account balances over a two-month period. This method can be advantageous if you have uneven spending patterns month-to-month.

The adjusted balance method is the least common of the three methods, but it can be advantageous if you pay off your bill in full every month. With this method, your finance charges are calculated based on the outstanding balance on your account at the end of each billing cycle. This means that if you have a high balance one month and then pay it off in full before the next billing cycle, you will not be charged a finance fee for that month.

Why is it important to know how finance charges are calculated?

Finance charges are the fees charged by a lender for the use of their money or credit. It is important to know how finance charges are calculated because it will affect the total amount of money you will have to pay back. There are four common methods used to calculate finance charges:

-The daily balance method

-The average daily balance method

-The adjusted balance method

-The Previous Balance method

Of these four methods, the daily balance and the average daily balance methods are the most commonly used. The other two methods, while not as common, are still used by some lenders. It is important to know how each method works so that you can compare different offers and make sure you are getting the best deal.

What are the consequences of not understanding how finance charges are calculated?

If you don’t understand how finance charges are calculated, you may find yourself paying more than you need to. This can have serious consequences, particularly if you are carrying a balance on your credit card.

Finance charges are the fees charged by lenders for the use of their money. These fees can add up quickly, so it’s important to understand how they are calculated. There are several methods used to calculate finance charges, and not all of them are equally transparent.

Some lenders use the average daily balance method, which calculates finance charges based on the average balance owed during the billing period. This method can be difficult to understand because it doesn’t take into account the amount of time that the balance is carried.

Other lenders use the daily periodic rate method, which calculates finance charges based on the interest rate and the number of days in the billing period. This method is easier to understand because it is based on a simple interest calculation. However, it can still be difficult to compare different offers because lenders may use different periodic rates.

The best way to avoid paying too much in finance charges is to understand how your lender calculates them. Be sure to ask about any fees or charges that you don’t understand before you agree to borrow money from any lender.

How can you avoid paying too much in finance charges?

Finance charges are the fees imposed by a lender when you borrow money. The charge is a percentage of the principal, which is the amount of money you borrow. Depending on the type of loan, the finance charge may be a flat fee or it may be calculated using one of several methods. The most common methods used to calculate finance charges are the daily balance method, the previous balance method, and the average daily balance method.

You can avoid paying too much in finance charges by understanding how your lender calculates them and by making sure you keep your balance low. Ask your lender about the method they use to calculate finance charges so you can estimate what your charges will be. If you have a credit card with a high interest rate, try to pay off your balance each month so you don’t accrue interest.

What should you do if you think you are being charged too much in finance charges?

If you think you are being charged too much in finance charges, you should first check your credit card agreement to see how your issuer calculates finance charges. You can then compare your issuer’s method to the three methods described below to see if there is a discrepancy. If you find that you are indeed being charged too much, you should contact your issuer and ask for a refund.

The three methods used to calculate finance charges are the average daily balance method, the adjusted balance method, and the previous balance method.

With the average daily balance method, finance charges are calculated by taking the sum of all of your balances during the billing cycle divided by the number of days in the billing cycle, and then multiply this by the daily periodic rate times the number of days in the billing cycle.

The adjusted balancemethod starts with your outstanding balance at the beginning of each billing period. Credits and payments are then subtracted, and new purchases are added back in. This final figure is then multiplied by the monthly periodic rate to arrive at your finance charge for that billing period.

Under the previous balance method, finance charges are calculated based on your entire balance from the previous month’s statement. This means that if you paid off your entire balance or made a payment before your statement closing date, you would still be charged interest on that full amount.

What are some tips for reducing finance charges?

There are a few different ways that finance charges can be calculated, and each method can result in a different amount of finance charges being applied to your account. Here are a few tips for reducing finance charges:

1. Pay your balance in full each month. This will help you avoid paying interest on your balance and will keep finance charges to a minimum.

2. If you can’t pay your balance in full, try to pay as much as possible each month. The more you pay, the less interest you will accrue and the lower your finance charges will be.

3. Choose a credit card with a low interest rate. This will help reduce the amount of interest you pay on your outstanding balance and will decrease the amount of finance charges applied to your account.

4. Avoid using your credit card for cash advances and balance transfers. These transactions often come with high interest rates and additional fees, which can add up quickly and increase your finance charges significantly.

How can you save money on finance charges?

There are many ways that you can save money on finance charges. Here are some of the most popular methods:

1. Pay off your balance in full each month: This is the best way to avoid finance charges altogether. If you can’t pay off your balance in full, try to pay as much as possible to reduce the amount of interest you’ll accrue.

2. Use a low interest rate credit card: If you carry a balance on your credit card, you’ll accrue interest charges. To minimize the amount of interest you pay, use a credit card with a low APR (annual percentage rate).

3. Get a 0% intro APR credit card: Many credit cards offer 0% intro APRs for a limited time (usually 12-18 months). This means that you won’t accrue any interest on your balance during that intro period. Be sure to pay off your balance before the intro period ends, or you’ll be stuck with a high APR.

4. Take advantage of balance transfer offers: If you have debt on multiple credit cards with high interest rates, you can save money by consolidating your debt onto one card with a lower APR. Many credit cards offer introductory balance transfer offers with 0% intro APRs for 12-18 months. Just be sure to pay off your transferred balance before the intro period ends, or you’ll be stuck with a high APR.