Which of the Following Applications of the Rules of Debit and Credit is True?

Contents

If you’re trying to learn the rules of debit and credit, it’s important to understand which of the following applications is true. This will help you avoid making any mistakes when you’re applying the rules to your own finances.

Checkout this video:

Introduction

The rules of debit and credit are essential for bookkeeping and accounting. By understanding these rules, you will be able to correctly record transactions in your books and prepare financial statements that accurately reflect the financial position of your business.

There are two basic rules of debit and credit:

1. The rule of debit: when an asset is acquired, it is debited; when an expense is incurred, it is debited.

2. The rule of credit: when a liability is incurred, it is credited; when income is earned, it is credited.

There are a few exceptions to these rules, but in general, they hold true. Let’s take a look at a few examples to see how they work in practice.

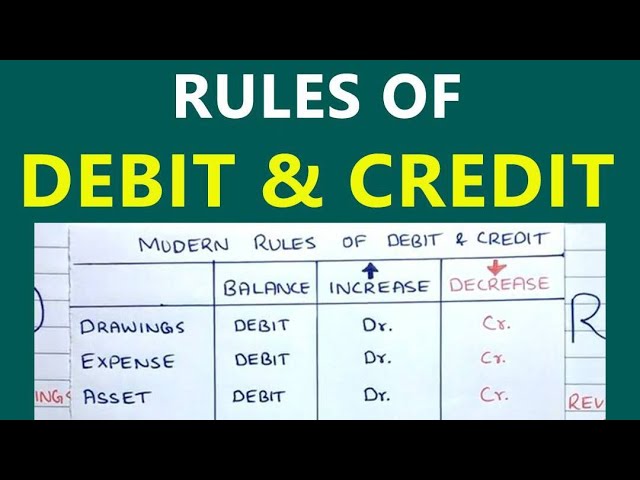

The Three Golden Rules of Debit and Credit

To ensure the accuracy of your accounting entries, you should always follow the three golden rules of debit and credit. First, debit the receiver and credit the giver. Second, debit what comes in and credit what goes out. Third, debit expenses and losses, credit incomes and gains.

The First Rule of Debit and Credit

The first rule of debit and credit is that all assets are increased by a debit and decreased by a credit. The second rule of debit and credit is that all expenses are increased by a debit and decreased by a credit. The third rule of debit and credit is that all liabilities are increased by a credit and decreased by a debit.

The Second Rule of Debit and Credit

The Second Rule of Debit and Credit is that all expenses are debited, and all revenues are credited. This rule is applied regardless of the account in which the transaction is recorded. For example, if an advertising expense is incurred, it will be debited to the Advertising Expense account. If revenue is generated from the sale of merchandise, it will be credited to the Sales account.

The Third Rule of Debit and Credit

The third and final rule of debit and credit is that the total of all debits must equal the total of all credits. In other words, the sum of all debits must be equal to the sum of all credits. This rule is what ensures that the books are balanced.

Applying the Rules of Debit and Credit

In order to apply the rules of debit and credit, one must first understand what the rules are. The rule of debit and credit are simple; when something increases, it is debited, when something decreases, it is credited. This seems easy enough, but there are a few catches.

Application of the First Rule of Debit and Credit

The first rule of debit and credit states that assets increase in value when they are debited and decrease in value when they are credited. In other words, when an asset is debited, it means that the value of the asset has increased, while when it is credited, it means that the value of the asset has decreased.

This rule is applied in different ways depending on the type of asset being considered. For example, for cash, the rule would be applied as follows: if cash is debited, then the company’s cash balance has increased, and if cash is credited, then the company’s cash balance has decreased.

Inventory would be another example where the rule would be applied differently. For inventory, the rule would be applied as follows: if inventory is debited, then the company’s inventory levels have decreased (i.e., there has been a sale), and if inventory is credited, then the company’s inventory levels have increased (i.e., there has been a purchase).

Application of the Second Rule of Debit and Credit

The second rule of debit and credit is often referred to as the ” golden rule of accounting.” This rule states that you should debit increases in assets and expenses and credit decreases in assets and expenses. In other words, when an account increases, you should debit that account. When an account decreases, you should credit that account.

For example, if you purchase office supplies for $100, you would debit the asset Office Supplies and credit the liability Accounts Payable. If you later paid the bill, you would debit Accounts Payable and credit Cash.

Application of the Third Rule of Debit and Credit

The third rule of debit and credit is that all income and gains must be debited, while all expenses and losses must be credited. This rule ensures that the financial statements always reflect a true and accurate picture of the company’s financial position.

Income and gains are typically recorded on the income statement, while expenses and losses are recorded on the balance sheet. This rule is applied when journal entries are made to record transactions. For example, if a company sells one hundred widgets for $100, the transaction would be recorded as follows:

Widget Sales (Income) 100

Cash (Asset) 100

The rules of debit and credit are essential in ensuring that financial statements are accurate and free from error. Without these rules in place, it would be very difficult to produce reliable financial statements.

Conclusion

The answer is that all of the above applications of the rules of debit and credit are true. The key is to remember that the rule for debits is “left side increases, right side decreases”, and the rule for credits is “left side decreases, right side increases”.