Which of the Following Actions Can Negatively Impact Your Credit Score?

Contents

One of the most important things you can do to maintain a good credit score is to make sure you keep up with your payments. But what happens if you miss a payment, or make a late payment? Can that negatively impact your credit score?

The answer is yes, it can. Here we’ll take a look at how late payments can impact your credit score, and what you can do to mitigate the damage.

Checkout this video:

Applying for too many credit cards at once

Applying for too many credit cards at once can have a negative impact on your credit score. When you apply for a new credit card, the issuer will do a hard inquiry on your credit report. This can cause your credit score to drop a few points. If you apply for several cards at once, you may see a bigger drop in your score. It’s best to only apply for new credit cards when you really need them.

Closing old credit cards

Closing old credit cards can have a negative impact on your credit score because it can reduce the average length of your credit history, which is a factor in your credit score. Additionally, closing a credit card can increase your credit utilization ratio, which is another factor that goes into your credit score.

Making late payments

One of the most important things you can do to maintain a good credit score is to make all of your payments on time. A history of late or missed payments can have a significant negative impact on your score, and can stay on your credit report for up to seven years. If you have trouble remembering to make your payments on time, you might want to consider signing up for automatic payments through your bank or credit card issuer.

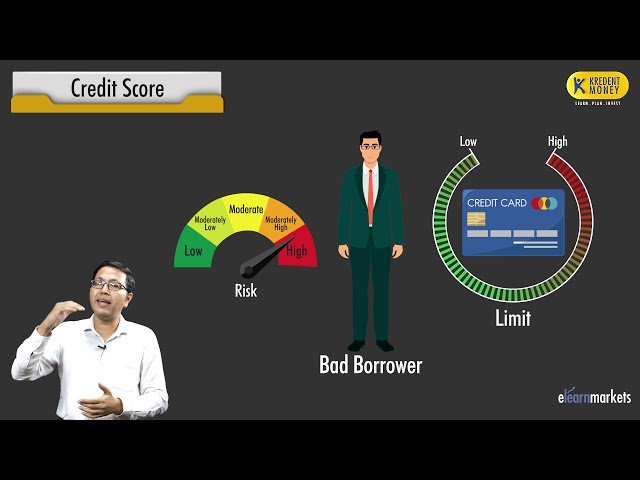

Using too much of your credit limit

When you use more of your credit limit, it can negatively impact your credit score. This is because it can signal to lenders that you are overextending yourself financially and may not be able to make payments in the future. Try to keep your balances below 30% of your credit limit to maintain a good score.

Letting your credit card account go to collections

If you let your credit card account go to collections, it will have a negative impact on your credit score. This is because collection agencies will report the debt to the credit bureaus, and it will appear on your credit report as a negative mark. Additionally, the collection agency may try to collect the debt from you, which could result in additional late payments or even legal action.

Filing for bankruptcy

Filing for bankruptcy is one of the most significant negative factors that can impact your credit score. Bankruptcy remains on your credit report for up to 10 years, and can make it very difficult to obtain new credit during that time. If you are considering filing for bankruptcy, you should first speak with a credit counselor or other financial advisor to explore all of your options.