Which Loan Type Provides Interest Subsidy?

Contents

There are a number of loan types available to borrowers, each with its own set of benefits and drawbacks. One type of loan that may offer an interest subsidy is a government-backed loan. These loans are typically available to low- and moderate-income borrowers, and the interest subsidy can help make the loan more affordable.

Checkout this video:

Introduction

There are many different types of loans available to borrowers, and each type has its own benefits and drawbacks. One important factor to consider when choosing a loan is whether or not the loan offers an interest subsidy.

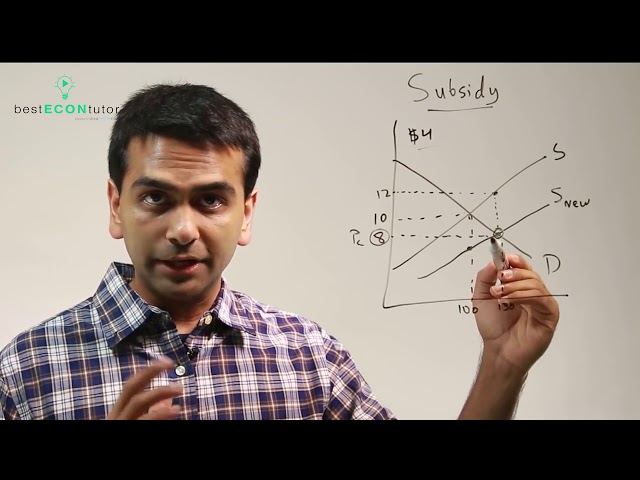

An interest subsidy is a reduction in the amount of interest that a borrower must pay on a loan. Interest subsidies can be provided by the government or by private organizations, and they can be offered on both federal and private loans.

Federal loans that offer interest subsidies include Direct Subsidized Loans, Perkins Loans, and Stafford Loans. Private loans that offer interest subsidies are typically reserved for borrowers with excellent credit scores.

Interest subsidies can save borrowers a significant amount of money over the life of their loan, so it is important to consider this factor when choosing a loan type.

Various types of loans

There are various types of loans available, each with its own interest rate and terms. Some loans, such as government-backed loans, may offer interest subsidies. This means that the government will pay a portion of the interest on the loan. Other loans, such as private loans, do not offer this subsidy.

To find out if a particular loan type offers an interest subsidy, you will need to contact the lender or look at the terms of the loan. Some lenders may advertise that their loans offer an interest subsidy, so this is a good place to start your research.

If you are considering taking out a loan, it is important to compare the different types of loans available to ensure that you get the best deal possible. Make sure to consider the interest rate, terms, and whether or not an interest subsidy is offered.

Difference between an interest subsidy and an interest rate

An interest subsidy is a type of financial assistance that reduces the amount of interest you have to pay on a loan. An interest rate, on the other hand, is the percentage of a loan that you pay in interest.

Generally, loans with interest subsidies have lower interest rates than loans without subsidies. This is because the subsidy reduces the amount of money that you have to pay in interest.

However, there are some loans where the interest rate is not reduced by the subsidy. For these loans, you will still have to pay the full amount of interest that is due.

Who is eligible for an interest subsidy?

There are two types of Stafford Loans: subsidized and unsubsidized. The main difference between the two loan types is that the federal government pays the interest on subsidized Stafford Loans while the borrower is in college, during the grace period, and during deferment periods. For unsubsidized Stafford Loans, the borrower is responsible for paying all of the interest that accrues on the loan.

To be eligible for a subsidized Stafford Loan, you must demonstrate financial need as determined by your school’s cost of attendance and other aid you’re receiving. Interest subsidy eligibility is determined at your school’s discretion, but generally speaking, if you have exceptional financial need, you may be eligible for a subsidized Stafford Loan.

If you are not eligible for a subsidized Stafford Loan or if you need to borrow more than the maximum amount of subsidized Stafford Loans available to you, you may borrow an unsubsidized Stafford Loan. Unsubsidized Stafford Loans are not based on financial need; however, you are still responsible for paying all of the interest that accrues on your loan.

If you have any questions about which type of Stafford Loan is right for you, please contact your financial aid office.

How to apply for an interest subsidy

There are two main types of loans that offer interest subsidies: direct subsidized loans and Perkins Loans.

Direct Subsidized Loans are available to undergraduate students with financial need. The interest on a Direct Subsidized Loan is subsidized, or paid, by the federal government while you’re in school at least half-time, for the first six months after you leave school (referred to as a grace period*), and during a deferment (a postponement of loan payments).

Perkins Loans are low-interest loans for undergraduate and graduate students with exceptional financial need. The federal government pays the interest on a Perkins Loan while you’re in school and during your grace period. If you have a Perkins Loan and are unable to make your payments, you may be eligible for deferment or forbearance.

Conclusion

In conclusion,students can avail of the interest subsidy benefit on their education loan by opting for the type of loan that offers this benefit. The options include federal loans, state loans, and private loans. The interest subsidy benefit is not available for all types of loans, so students should check with their financial aid office to see if they are eligible.