Which Job in the Finance Career Would Be Best For Someone Who Has Knowledge?

Contents

- What are the different types of finance jobs?

- What is the best way to get started in a finance career?

- What are the most important skills for a finance career?

- What are the most popular finance jobs?

- What are the highest paying finance jobs?

- What are the most in-demand finance jobs?

- What are the most challenging finance jobs?

- What are the most rewarding finance jobs?

- What are the best finance jobs for the future?

- Which job in the finance career would be best for someone who has knowledge?

There are many finance jobs available for those with the right qualifications. But which job is best for someone with finance knowledge?

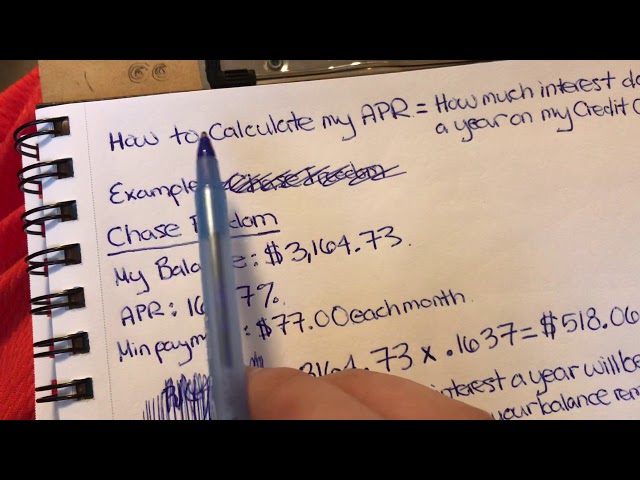

Checkout this video:

What are the different types of finance jobs?

There are different types of finance jobs, depending on one’s area of expertise and interest. Some finance jobs focus on helping individuals manage their money, while other finance jobs focus on large-scale investment and administration. Here is a list of some common finance jobs:

-Banking: Bankers offer financial products and services to both individuals and businesses. Products offered by bankers include savings accounts, checking accounts, loans, and credit cards.

-Investment Banking: Investment bankers help companies raise money by issuing and selling securities. They also help companies buy other companies through mergers and acquisitions.

-Asset Management: Asset managers help individuals and institutions invest their money. They choose investments based on the goals of the investor and manage the portfolios to ensure that the investments remain profitable.

-Real Estate: Real estate professionals help individuals and businesses buy, sell, or lease property. They may also manage properties for a fee.

What is the best way to get started in a finance career?

There are many different finance careers available to someone with the right skills and knowledge. The best way to get started in a finance career will depend on your goals, qualifications, and preferences.

Some finance careers may be better suited for someone with knowledge of the financial markets, while others may be better suited for someone with strong mathematical skills. Here are some of the most common finance careers:

-Investment banking: Investment bankers advise companies on issuing new securities, help them raise capital, and manage their financial affairs. Investment bankers typically have a bachelor’s degree in business or economics.

-Commercial banking: Commercial bankers provide loans and other financial services to businesses. Commercial bankers typically have a bachelor’s degree in business or economics.

-Asset management: Asset managers invest money on behalf of clients, such as pension funds or other institutions. Asset managers typically have a bachelor’s degree in business or economics.

-Financial planning: Financial planners help individuals plan for their financial future, including retirement and estate planning. Financial planners typically have a bachelor’s degree in business or economics.

What are the most important skills for a finance career?

In order to have a successful finance career, there are several important skills that you will need to possess. These include:

-Analytical skills: You will need to be able to analyse financial data and make sound decisions based on your findings.

-Communication skills: You will need to be able to communicate clearly and concisely, both in written and oral form.

-Interpersonal skills: You will need to be able to build strong relationships with clients, colleagues and other stakeholders.

-Organisational skills: You will need to be able to effectively manage your time and resources.

-Problem-solving skills: You will need to be able to identify and resolve problems quickly and efficiently.

What are the most popular finance jobs?

There are many different finance jobs available, and it can be difficult to decide which one is right for you. If you have knowledge in this area, there are a few popular finance jobs that might be a good fit.

Investment banking is one of the most popular finance jobs. If you have knowledge in this area, you could work as an investment banker and help companies raise money.

Another popular finance job is financial planning. If you have knowledge in this area, you could help people plan their finances and make sure they are on track to meet their goals.

A third popular finance job is insurance. If you have knowledge in this area, you could help people choose the right insurance policies for their needs.

There are many other finance jobs available, but these are three of the most popular. If you have knowledge in this area, these jobs might be a good fit for you.

What are the highest paying finance jobs?

There are many different types of jobs in the finance industry, from investment banking to financial planning. But which job in the finance career would be best for someone who has knowledge?

The highest paying finance jobs tend to be in investment banking and hedge fund management. Investment bankers typically work for banks or large financial institutions and help companies raise capital by issuing and selling securities. Hedge fund managers manage investment portfolios for wealthy individuals or institutions and often make high salaries.

Other well-paying finance jobs include positions in corporate finance, venture capital, and commercial banking. Corporate finance jobs involve working for a company to help them manage their finances, while venture capitalists invest in new businesses. Commercial bankers work for banks and provide loans to businesses and individuals.

While there are many different types of finance jobs, the best job for someone with knowledge will depend on their skills and interests. However, jobs in investment banking and hedge fund management tend to be the highest paying jobs in the finance industry.

What are the most in-demand finance jobs?

In order to answer the question of which job in finance is best for someone with your skill set, you first need to understand what employers are looking for in new hires. The most in-demand finance jobs vary depending on the current state of the economy, but there are some positions that are always in high demand. Here are a few of the most popular finance jobs:

Financial Analyst

A financial analyst is responsible for analyzing financial data and making recommendations about investment opportunities and strategies. Financial analysts typically have a bachelor’s degree in business, economics, or accounting.

Investment Banker

An investment banker is responsible for helping companies raise capital by issuing and selling securities. Investment bankers typically have a bachelor’s degree in business or economics.

Financial Planner

A financial planner helps individuals or businesses create a plan to meet their financial goals. Financial planners typically have a bachelor’s degree in business, economics, or accounting. They may also have certification from the Certified Financial Planner Board of Standards.

Portfolio Manager

A portfolio manager is responsible for selecting investments and managing a portfolio of assets. Portfolio managers typically have a bachelor’s degree in business, economics, or accounting. They may also have certification from the Certified Financial Analyst Institute.

What are the most challenging finance jobs?

There are a few finance jobs that are notorious for being challenging. Here are a few of the most challenging finance jobs, along with a brief description of what each entails:

1. Financial Analyst

A financial analyst is responsible for analyzing an organization’s financial statements and providing insights to management. This job is challenging because it requires strong analytical skills and the ability to effectively communicate complex concepts.

2. Investment Banker

An investment banker is responsible for providing financial advice to clients, raising capital for companies, and helping to promote securities. This job is challenging because it requires in-depth knowledge of financial markets and regulations.

3. Portfolio Manager

A portfolio manager is responsible for overseeing a portfolio of investments and making decisions about when to buy or sell securities. This job is challenging because it requires the ability to make sound investment decisions and the ability to manage risk.

What are the most rewarding finance jobs?

There are many different finance jobs out there, and it can be difficult to know which one is right for you. If you have knowledge in the finance field, you may want to consider a career in financial planning or analysis. These two jobs are some of the most rewarding in the finance industry, and they offer great opportunities for growth and development.

What are the best finance jobs for the future?

The finance industry is always changing, and new jobs are constantly emerging. If you’re interested in a career in finance, it’s important to stay up-to-date on the latest trends. Here are some of the best finance jobs for the future:

1. Financial Analyst

As a financial analyst, you’ll provide insights and recommendations to businesses and individuals to help them make better financial decisions. You’ll need to be proficient in financial analysis and have a strong understanding of the latest economic trends.

2. Portfolio Manager

As a portfolio manager, you’ll be responsible for overseeing a portfolio of investments and ensuring that it meets the goals of your clients. You’ll need to have strong investment knowledge and be able to make quick decisions in volatile markets.

3. Wealth Manager

As a wealth manager, you’ll provide advice and guidance to individuals on how to best manage their finances. You’ll need to have strong interpersonal skills and be able to understand your clients’ needs.

4. Financial Planner

As a financial planner, you’ll help individuals and families create long-term financial plans that meet their unique goals. You’ll need to be able to identify different financial planning strategies and have a comprehensive understanding of tax laws.

Which job in the finance career would be best for someone who has knowledge?

In the finance sector, there are a few different roles that someone with knowledge could take on. The best job for someone with knowledge in finance would be as a financial analyst. A financial analyst is responsible for researching and analyzing financial data to help make investment decisions. In this role, they would use their knowledge to help make recommendations to clients or their employer.